Supposedly, inflation is no longer as much of a concern for investors as stocks staged a furious rally despite inflation coming in at its hottest level since August 2008. The consumer price index for May accelerated by 5% from a year ago, which exceeded the consensus estimate of 4.7%. However, many economists say that this number may be skewed by used-car sales. Bond yields also rose. Yet, the S&P 500 hit its first intraday record since May, while both the Dow and Nasdaq

NDAQ

skyrocketed as well. The Dow Jones

DOW

rose 275 points, the S&P 500 climbed 0.6%, and the Nasdaq gained another 0.7%. If you’re looking for a way to play this market, the deep learning algorithms at Q.ai have crunched the data to give you a set of Top Shorts. Our Artificial Intelligence (“AI”) systems assessed each firm on parameters of Technicals, Growth, Low Volatility Momentum, and Quality Value to find the best short plays.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

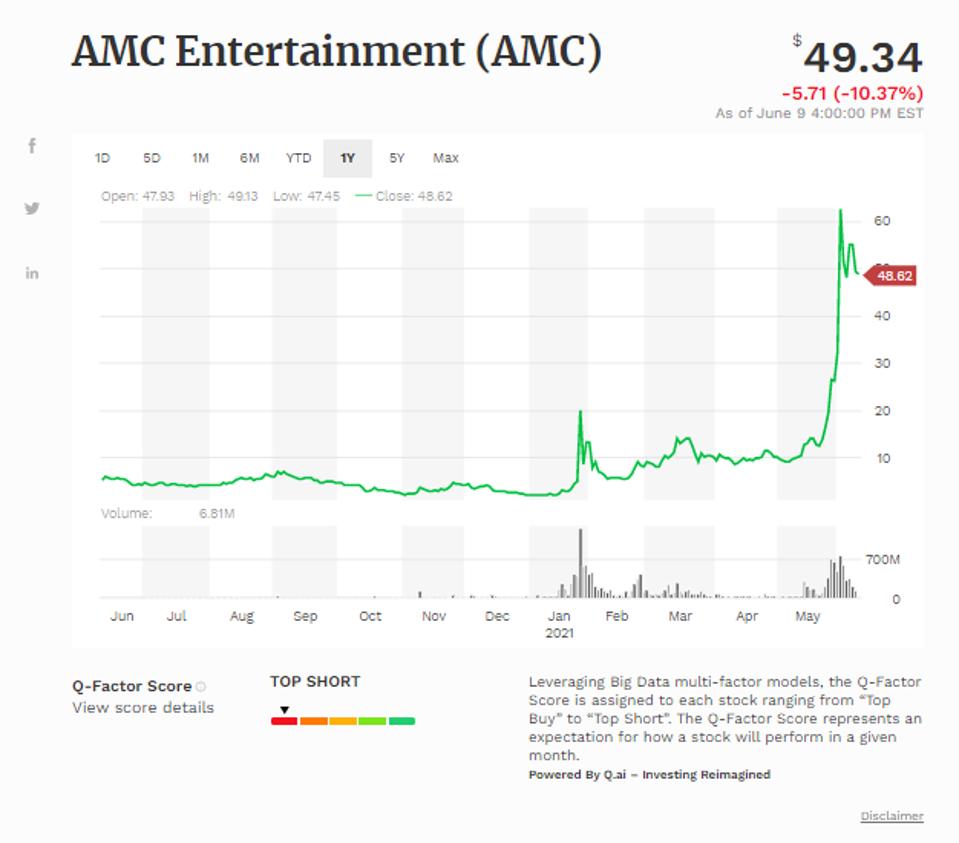

Amc Entertainment Holdings (AMC)

One of the top darlings of the Reddit trade, Amc Entertainment Holdings

AMC

is our first Top Short of the day. The company owns movie theatres across the U.S. and internationally through itself and its subsidiaries. Before we get the WSB army against us, our AI systems rated AMC B in Technicals, F in Growth, F in Low Volatility Momentum, and F in Quality Value. The stock closed down 10.37% to $49.34 on volume of 150,361,300 vs its 10-day price average of $42.54 and its 22-day price average of $26.21, and is up 2354.73% for the year. EPS grew by -60.18% in the last fiscal year. Revenue was $1242.4M in the last fiscal year compared to $5460.8M three years ago, Operating Income was $(1565.3)M in the last fiscal year compared to $309.3M three years ago, EPS was $(39.15) in the last fiscal year compared to $0.41 three years ago, and ROE was 6.27% three years ago. Forward 12M Revenue is also expected to grow by 37.89% over the next 12 months.

MORE FROM FORBESAMC Entertainment (AMC)

Forbes AI Investor

MORE FOR YOU

Beyond Meat Inc (BYND)

Beyond Meat Inc is our second Top Short today. Beyond Meat has become the face of the plant-based food revolution, and has become a major producer of plant-based meat substitutes such as beef, meatballs, ground meat, and pork sausage links and patties. Our AI systems rated the company C in Technicals, F in Growth, D in Low Volatility Momentum, and D in Quality Value. The stock closed down 1.67% to $150.15 on volume of 2,555,891 vs its 10-day price average of $144.36 and its 22-day price average of $124.26, and is up 19.57% for the year. Revenue grew by 2.73% in the last fiscal year and grew by 375.21% over the last three fiscal years, and EPS grew by -72.45% over the last three fiscal years. Revenue was $406.78M in the last fiscal year compared to $87.93M three years ago, Operating Income was $(31.52)M in the last fiscal year compared to $(26.47)M three years ago, EPS was $(0.85) in the last fiscal year compared to $(4.75) three years ago, and ROE was (14.04%) in the last year compared to (45.95%) three years ago. Forward 12M Revenue is also expected to grow by 8.27% over the next 12 months.

MORE FROM FORBESBeyond Meat (BYND)

Forbes AI Investor

Huntington Bancshares (HBAN)

Huntington Bancshares is our third Top Short today. Huntington Bancshares is a Columbus, OH-based bank holding company that provides commercial and consumer banking services, mortgage banking services, automobile financing, recreational vehicle and marine financing, equipment leasing, investment management, trust services, brokerage services, insurance programs, and other financial products and services. Our AI systems rated the company C in Technicals, F in Growth, D in Low Volatility Momentum, and D in Quality Value. The stock closed down 1.45% to $14.99 on volume of 22,044,190 vs its 10-day price average of $15.63 and its 22-day price average of $15.63, and is up 19.35% for the year. Revenue grew by 18.92% in the last fiscal year and grew by 4.58% over the last three fiscal years, Operating Income grew by 56.94% in the last fiscal year, and EPS grew by 65.51% in the last fiscal year. Revenue was $3763.0M in the last fiscal year compared to $4279.0M three years ago, Operating Income was $1045.0M in the last fiscal year compared to $1744.0M three years ago, EPS was $0.69 in the last fiscal year compared to $1.2 three years ago, and ROE was 6.59% in the last year compared to 12.71% three years ago. Forward 12M Revenue is expected to grow by 5.54% over the next 12 months, and the stock is trading with a Forward 12M P/E of 11.81.

MORE FROM FORBESHuntington Bank (HBAN)

Forbes AI Investor

Nikola Corp (NKLA)

Nikola Corp is our next Top Short. While the company is technically still conceptual, Nikola is a speculative play on the EV boom. It has presented many zero-emission vehicle concepts since 2016, and is still working on its flagship truck project. Our AI systems rated the company C in Technicals, D in Growth, F in Low Volatility Momentum, and F in Quality Value. The stock closed down 5.71% to $17.49 on volume of 14,182,390 vs its 10-day price average of $16.48 and its 22-day price average of $14.24, and is up 8.77% for the year. Revenue was $0.1M in the last fiscal year compared to $0.17M three years ago, Operating Income was $(368.32)M in the last fiscal year compared to $(70.49)M three years ago, EPS was $(1.18) in the last fiscal year compared to $(0.28) three years ago, ROE was (63.09%) in the last year. Forward 12M Revenue is also expected to grow by 115.94% over the next 12 months.

Stock Charts

Xl Fleet Corp (XL)

Xl Fleet Corp is our final Top Short today. Xl Fleet Corp was founded by MIT alumni and green energy veterans to provide simple, sustainable electrification solutions to the commercial fleet market. Our AI systems rated the company C in Technicals, F in Low Volatility Momentum, and F in Quality Value. The stock closed down 1.96% to $9.01 on volume of 8,400,032 vs its 10-day price average of $7.8 and its 22-day price average of $7.0, and is down 55.11% for the year. Revenue grew by 107.24% over the last three fiscal years, while EPS grew by -111.06% in the last fiscal year and grew by -106.3% over the last three fiscal years. Revenue was $20.34M in the last fiscal year, compared to $9.54M three years ago, Operating Income was $(15.29)M in the last fiscal year compared to $(12.7)M three years ago, EPS was $(0.72) in the last fiscal year compared to $(1.26) three years ago, and ROE was (69.19%) in the last year. Forward 12M Revenue is also expected to grow by 49.81% over the next 12 months

Forbes AI Investor

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.

/https://specials-images.forbesimg.com/imageserve/60c2308fc28a7bef459a929b/0x0.jpg)