This week in what’s trending, tech once again forges ahead of the pack as big moves – and the simple fact of our everyday reliance on technology – begets big opportunities. As such, every stock trending in the midweek falls into the tech space, from basic hardware to computing to end-user applications. Let’s see why these giants of industry (and pandemic profits) are circulating in investors’ portfolios.

Q.ai runs daily factor models to get the most up-to-date reading on stocks and ETFs. Our deep-learning algorithms use Artificial Intelligence (AI) technology to provide an in-depth, intelligence-based look at a company – so you don’t have to do the digging yourself.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

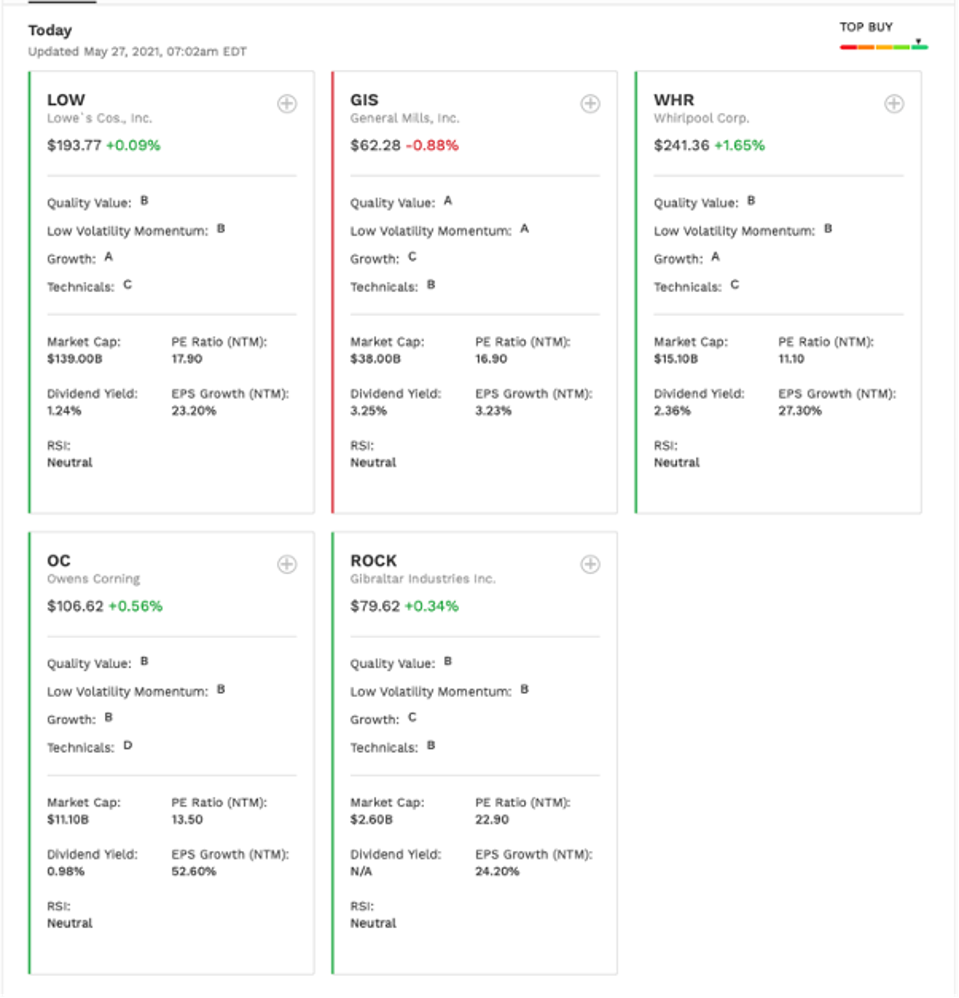

Netflix, Inc (NFLX)

Netflix, Inc

NFLX

ticked up 0.2% on Wednesday to $502.36 per share, ending the day with 2.46 million trades. The stock has been trending upward in the past week, as noted by the 10-day price average of $495, though it remains down 7% YTD.

MORE FOR YOU

Forbes AI Investor

In the last three fiscal years, Netflix has seen impressive revenue growth of 67%, bringing total cash flow from $15.8 billion to almost $25 billion. In the same period, operating income has soared over 248% to $4.585 billion, compared to $1.6 billion three years ago, with per-share earnings similarly skyrocketing 208% from $2.68 to $6.08.

Despite this impressive feat of growth, Netflix shows room to advance in the months to come, with forward revenue expected to grow 3.3% over the next year. Currently, Netflix is trading over 48x earnings, suggesting a company with massive potential ahead – or trending into overvaluation territory.

Netflix is one of the great growth stories of the past decade. From closing out at $26.01 at the start of 2011 to over $500 today, the streaming media giant has increased its stock price almost 20 times over in a matter of ten years. And our AI rates Netflix as an overall positive prospect: A in Growth, B in Low Volatility Momentum and Quality Value, and D in Technicals.

Microsoft Corporation (MSFT)

Microsoft Corporation

MSFT

trending down 0.09% on Wednesday to $251.49 per share, with additional losses Thursday bringing the stock down even further – although it still managed to outperform its competitors. The company experienced total volume of 17.77 million on Wednesday, with the price outperforming the 10-day average of $247 and leaving the stock up 13% YTD.

Forbes AI Investor

Microsoft has long been a big name in tech, though during the pandemic it furthered its shift to a hybrid SaaS (software as a service) model in addition to its hardware offerings. The company has seen huge, consistent growth in recent years, partly due to grabbing increasing market share from the booming cloud computing market.

Over the past three fiscal years, Microsoft’s revenue has grown almost 45%, bringing it from $110.4 billion three years ago to $143 billion in the last year. Operating income has almost doubled that growth, totaling 83% from $35 billion to nearly $53 billion. This has seen per-share earnings boom 244.5%, driving a rise from $2.13 to $5.76 in a 36-month period.

All told, return on equity has over doubled to 40% in the last three fiscal years, with the company expecting to see 8.5% revenue growth in the next 12 months. Currently, Microsoft is trading with a forward 12-month P/E of 31x.

The tech company is well-rated by our AI overall, with A’s in Low Volatility Momentum and Quality Value, B in Growth, and C in Technicals.

NVIDIA Corporation (NVDA)

NVIDIA Corporation

NVDA

notched up 0.33% on Wednesday, closing out the day at $628 even with 9.26 million trades on the books. The company has made great strides in the latter half of May, with Wednesday sitting well above the 10-day price average of $587, bringing the company up 20.26% YTD.

After closing Wednesday, NVIDIA posted powerful quarterly earnings, with data center sales alone up 79% to $2.05 billion. NVIDIA topped off their report with a fiscal Q2 forecast more than half a billion over Wall Street estimates, largely driven by a projected $400 million in cryptocurrency chip revenue.

Forbes AI Investor

And yet, NDVIDIA share prices fell Thursday as investors used to consistent performance from the company were unimpressed with their earnings. Just in the last three years, NVIDIA’s revenue has grown 64.4%, from $11.7 billion to $16.7 billion. Operating income rose nearly 50% in the same period, up to $4.7 billion from $3.8 billion, with per-share earnings jumping 27.6% to $6.90.

Currently, NVIDIA is trading at forward earnings of 38.7x. Over the next twelve months, the tech giant is expected to see revenue growth of almost 2.5%.

And though NVIDIA is trading at fairly high forward earnings, Q.ai’s deep-learning algorithms sees value in what the company brings to the table for investors. As such, NVIDIA is rated A in Technicals and Growth, B in Low Volatility Momentum, and C in Quality Value.

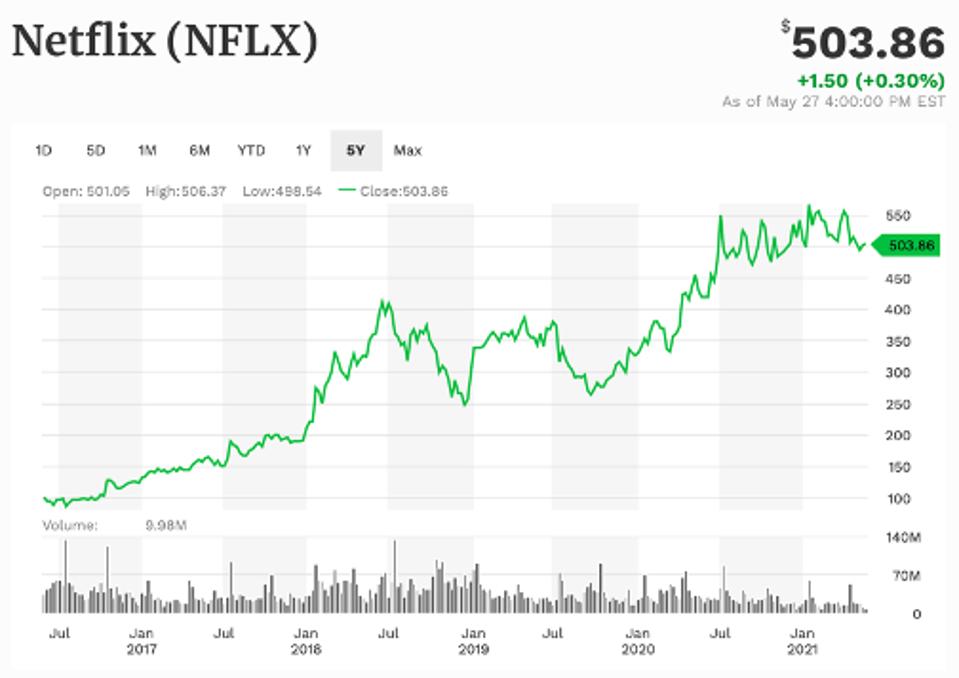

Facebook, Inc (FB)

Facebook, Inc

FB

ticked up 0.04% Wednesday, closing out the day at almost 9.7 million trades at a final price of $327.66. The stock is up 20% YTD. This despite the numerous challenges to and scrutiny of Facebook, with everything from its business model to future campaigns in question by individuals, investors, and politicians alike.

In particular, Facebook is facing a number of issues regarding its data privacy rules and antitrust lawsuits, as well as the fact that its own oversight board won’t make a ruling on the contentious Trump ban from January. And although the company is exploring new areas of revenue with Live Shopping Fridays and pay-per-view minor league sporting events, their new under-12 Instagram has been lambasted by no less than 40 state attorneys general, not to mention congressional politicians.

Forbes AI Investor

Still, Facebook is a big company that’s hard to beat from an investment standpoint. Over the last three fiscal years, the company’s revenue has grown over 69%, bringing the company to $85.97 billion from $55.8 billion.

Similarly, operating income has ballooned 53% from $24.9 billion to $32.67 billion, while per-share earnings jumped 54% to $10.09. Total return on equity has fallen from almost 28% to 25.4% in the last three fiscal years.

Going forward, Facebook is trading at 25 times earnings, while 12-month revenue is expected to grow 4%. Our AI sees Facebook as a promising prospect overall, rating the social media behemoth A in Growth, B in Low Volatility Momentum and Quality Value, and C in Technicals.

Verizon Communications, Inc (VZ)

U.S. telecom stocks are trending broadly upward this week, buoyed by optimism surrounding federal proposals to increase domestic chip production and similar R&D funds over the next five years. Verizon in particular is trending in part due to their extended Digital Out-of-Home (DOOH) advertiser portfolio, as the company intends to expand advertising relations and integrate campaign managers in planning, execution, and measurement to bolster everyone’s bottom lines.

Still, Verizon Communications, Inc.

VZ

closed down 0.21% in the midweek, ending at $56.36 with a final trade volume of 14 million. The stock remains down 4% for the year.

Forbes AI Investor

Verizon is a massive company – and due to its sheer size, any upward trend in its bottom line can be construed as positive. However, this makes it that much harder for the company to overcome losses in its balance sheet, too.

In the last fiscal year, the company’s revenue has grown 0.98% to $128.3 billion, while operating income almost matched pace at 0.93% growth to $31.4 billion. In the same period, per-share earnings rose 6% to $4.30. All told, return on equity dropped from 32.3% to 27.8% in the last three fiscal years.

Currently, Verizon is trading at 11 times earnings, with 12-month revenue expected to grow 0.8%.

That said, our AI is a little wary of Verizon, especially their technicals – although our deep-learning algorithms are fond of the stock’s overall stability. As such, Q.ai rates Verizon A in Low Volatility Momentum, B in Quality Value, C in Growth, and F in Technicals.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.

/https://specials-images.forbesimg.com/imageserve/6062149b2a0bc1d85864ecd8/0x0.jpg)