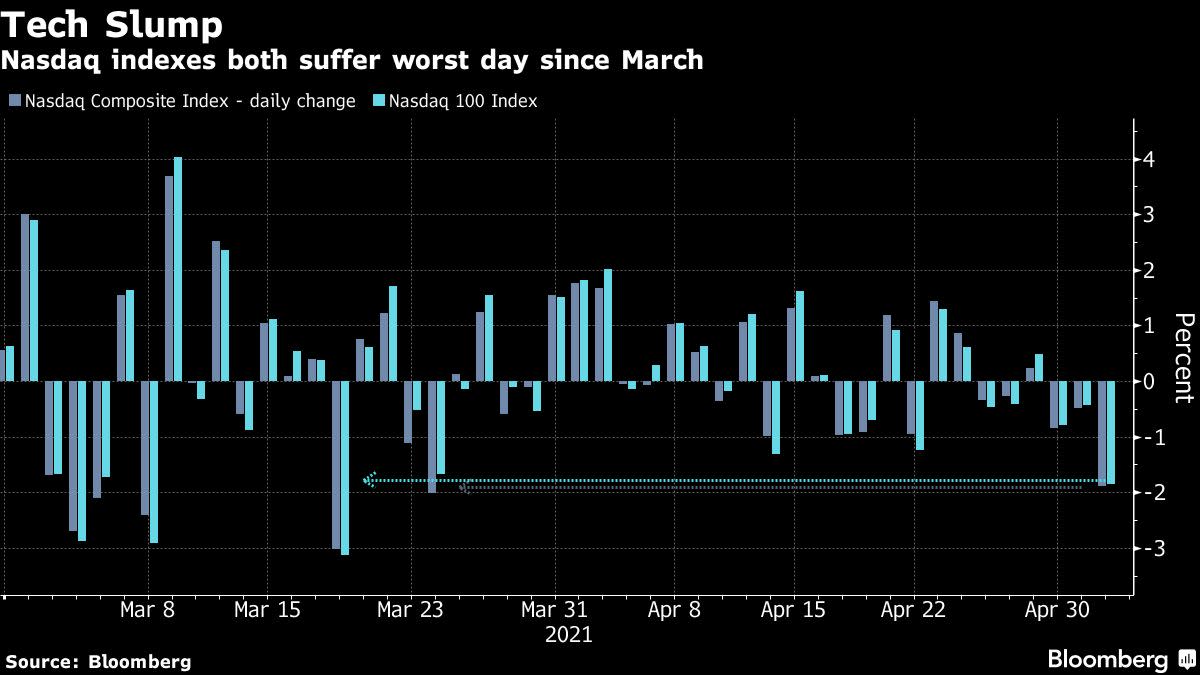

(Bloomberg) — U.S. equity futures wavered and Asian stocks were set for a volatile open Wednesday after a selloff in technology shares, amid comments from Treasury Secretary Janet Yellen on interest rates that rattled markets. The dollar rose.Nasdaq 100 contracts retreated after weakness in megacaps such as Apple Inc., Tesla Inc. and Amazon.com Inc. dragged the index lower. The S&P 500 pared losses with gains in the commodity, financial and industrial sectors. Australian and Hong Kong futures declined. Holidays in major markets including Japan, China and South Korea will limit trade in Asian hours.Yellen said rates will likely rise as government spending ramps up and the economy responds with faster growth, comments that economists regarded as self evident. In a subsequent interview, the former Federal Reserve Chair said she wasn’t predicting or recommending rate hikes.Commodities rallied to the highest in almost a decade as a rebound in the world’s largest economies stokes demand for metals, food and energy. Treasuries were little changed.The debate on whether government spending could lead to excessive inflation comes as stock valuations hover near the highest levels in two decades. Investors have been reluctant to push rallies much further despite some blowout corporate earnings. While the Fed has assured markets that interest rates will remain at current lows throughout the recovery, strengthening economic data have raised concerns that policy makers may move to tighten sooner than anticipated.Read: Nasdaq 100’s Worst Day Since March Sparked by Inflation Fears“Yellen’s comments did not specify a timeframe for rises and she clarified her comments by saying that she was not recommending FOMC rate hikes,” said Kim Mundy, currency strategist at the Commonwealth Bank of Australia. “We still expect the FOMC will be very patient as economic data improves.”The latest numbers showed the U.S. trade deficit widening to a new record in March. Meanwhile, a senior White House economic aide demurred on the question of whether President Joe Biden will nominate Fed Chair Jerome Powell for a second four-year term, saying the decision on selecting the next central bank chief will come after a thorough process.Here are some key events to watch this week:U.S. ADP employment change is due WednesdayChicago Fed President Charles Evans gives a virtual speech at an event hosted by Bard College on Wednesday. Cleveland Fed President Loretta Mester gives a virtual speech to the Boston Economic ClubBank of England rate decision ThursdayThe April U.S. employment report is released on FridayThese are some of the main moves in markets:StocksS&P 500 futures fell less than 0.1% as of 6:11 a.m. in Hong Kong. The S&P 500 lost 0.7%Nasdaq 100 contracts dipped 0.2% after the index fell 1.9%Australia’s S&P/ASX 200 Index futures dropped 0.4%Hang Seng Index futures declined 1.1% earlierCurrenciesThe Japanese yen traded at 109.30 per dollarThe offshore yuan was at 6.4840 per dollarThe Bloomberg Dollar Spot Index rose 0.3%The euro traded at $1.2013BondsThe yield on 10-year Treasuries was steady at 1.59%CommoditiesWest Texas Intermediate crude rose 0.8% to $66.23 a barrelGold was at $1,778.07 an ounceFor more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2021 Bloomberg L.P.