- The RBA left its monetary policy unchanged as widely anticipated.

- Broad dollar’s weakness helped the pair post a modest intraday advance.

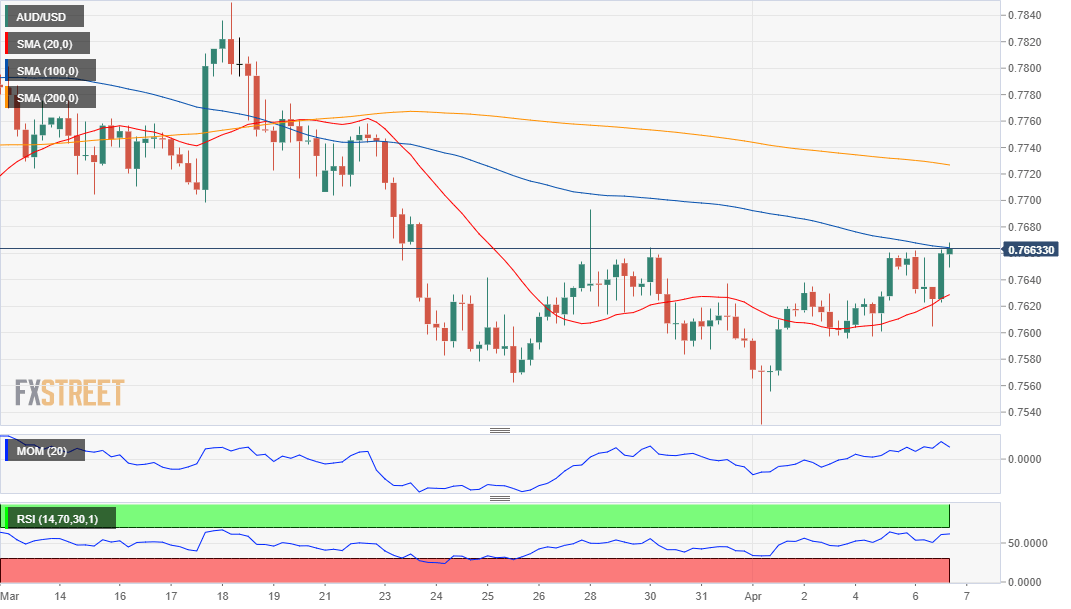

- AUD/USD gains bullish traction, still needs to move above 0.7700.

The AUD/USD pair finishes Tuesday with modest gains trading in the 0.7660, price zone. The Reserve Bank of Australia announced its latest monetary policy decision earlier in the day, but as widely anticipated, they maintained the official cash rate at a record low of 0.10%. Policymakers also maintained its target of 10 basis points for yield on a 3-year Australian government bond, alongside their bond-buying program. The statement was generally optimistic, as it reiterated that the economic recovery is well under way, although the broad clarified that they do not expect employment and inflation goals will be met until 2024 at the earliest.

This Wednesday, Australia will release the March AIG Performance of Construction Index and the March Commonwealth Bank Services PMI, foreseen at 56.2.

AUD/USD Short-Term Technical Outlook

From a technical point of view, the AUD/USD pair is neutral-to-bullish. The 4-hour chart shows that the pair is just below a mildly bearish 100 SMA while above a bullish 20 SMA. Technical indicators hold within positive levels but lack directional strength. Given the broad greenback’s weakness, the risk is skewed to the upside, although the pair would need to extend its advance beyond 0.7700 to become more attractive to bulls.

Support levels: 0.7620 0.7575 0.7530

Resistance levels: 0.7700 0.7735 0.7770

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.