- Australian NAB’s Business Confidence improved to 17 in Q1 from 14 previously.

- The sour tone of equities weighed on the pair in the last trading session of the day.

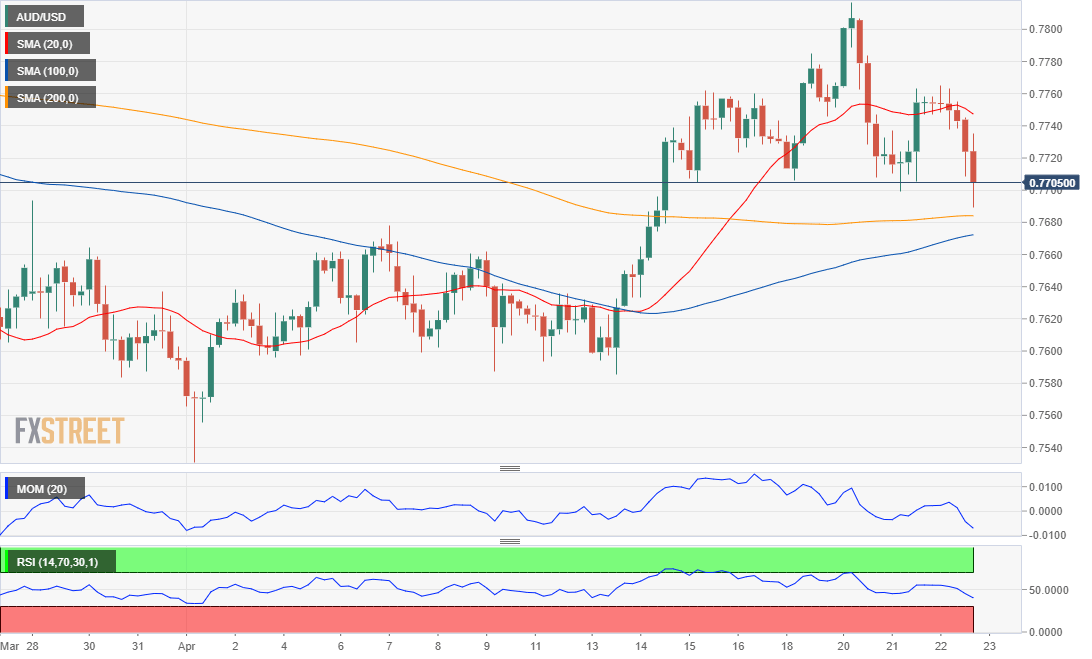

- AUD/USD trades around 0.7700, but bears have taken the lead.

The Australian dollar was unable to retain gains against its American rival, with the pair finishing the day just above the 0.7700 level. AUD/USD started the day advancing amid gains in equities markets, reflecting investors optimism and upbeat Australian data. The National Australian Bank Business Confidence improved to 17 in Q1 from 14 previously, much better than the 7 expected.

The pair took a turn to the worse during US trading hours, following reports of US President JOE Biden’s plan to hike capital gains tax. Wall Street plunged with the news, with the three major indexes posting sharp losses for the day. This Friday, Australia will publish the preliminary estimates of April Commonwealth Bank PMIs.

AUD/USD Short-Term Technical Outlook

The AUD/USD pair fell to 0.7690 before recovering some ground, currently trading around 0.7705. The 4-hour chart shows that the pair has extended its decline below a now bearish 20 SMA and approaches directionless longer moving averages. Technical indicators remain at daily lows within negative levels, with the RSI still heading south at around 41, indicating increased selling interest.

Support levels: 0.7690 0.7640 0.7605

Resistance levels: 0.7730 0.7770 0.7820

View Live Chart for the AUD/USD

Image by 3D Animation Production Company from Pixabay