Coinbase’s hotly-anticipated initial public offering hogged the spotlight on Wednesday, eclipsing blowout results from banks, which kicked off earnings season with a bang.

Earnings from Goldman Sachs

GS,

+2.34%

and JPMorgan

JPM,

-1.87%

blew past analyst expectations on Wednesday, while peer Wells Fargo

WFC,

+5.53%

saw the biggest post-earnings gain in a decade on the back of similarly upbeat results. The trend is continuing on Thursday with Bank of America

BAC,

+1.42%

and Citigroup

C,

+1.18%

reporting stronger-than-forecast earnings.

Our call of the day is from research firm BCA Research, urging investors to favor an overweight allocation to bank stocks in their portfolios as a number of factors support continued strength in financials.

First-quarter earnings at the banking giants were boosted by large drawdowns in loss reserves, which were more than double pre-COVID-19 pandemic levels by the end of 2020. As the economic recovery from pandemic continues, banks will continue to release reserves as the need to accommodate for large potential loan losses eases, BCA said.

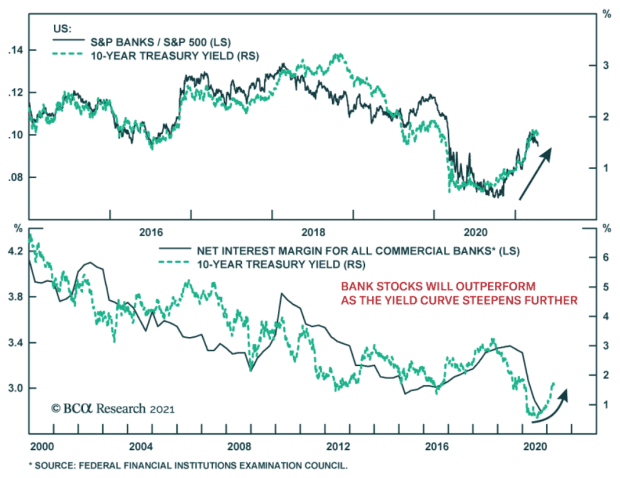

But moving forward, banks will need to focus on their ability to expand loan portfolios. Banks’ core profits come from borrowing from savers at low interest rates in the short term and lending at higher rates in the long term. The dynamics of fiscal stimulus in the U.S. have caused deposits to surge and loans to shrink, but this is expected to change once the economy reopens, BCA said.

The vaccine rollout is gathering pace, and some level of COVID-19 herd immunity by September would allow restrictions to ease, buoying consumer confidence and accelerating a recovery in the labor market, said BCA. All of this will encourage spending and another round of re-leveraging, especially since household balance sheets are largely healthy, according to the group.

In fact, this is already happening: The Federal Reserve’s Consumer Credit Survey from February showed U.S. consumer borrowing surged by $27.6 billion — 7.9% yearly — the most since November 2017.

More spending and a drawdown in savings should lift U.S. Treasury yields, according to BCA, with strong growth buoying long-term yields while short-dated bonds face more resistance from the Fed’s accommodative policy stance. This will steepen the yield curve further, BCA said, and that is another boost for bank outlook.

The buzz

ARK Invest snapped up $246 million worth of Coinbase shares after the cryptocurrency exchange went public on Wednesday, in a “watershed moment” for crypto. The fund powerhouse run by Cathie Wood sold Tesla shares worth $178 million to make room for Coinbase

COIN,

+31.31%

in three funds, including the flagship ARK Innovation ETF

ARKK,

-2.11%.

It is a blockbuster day on the U.S. economic front. A wave of data is due at 8:30 a.m. Eastern, including initial jobless claims, continuing jobless claims, retail sales for March, and the Empire State manufacturing index for this month. At 9:15 a.m., industrial production figures for March are due before the National Association of Home Builders index for April at 10 a.m.

Taiwan Semiconductor Manufacturing Co.’s

TSM,

-0.35%

profits rose 19% in the first quarter of 2021 compared with the same period a year ago. Digital trends boosted by the COVID-19 pandemic have led to a rapid increase in the demand for chips in the last year and caused a global semiconductor shortage.

Ireland’s Data Protection Commission launched an inquiry into Facebook

FB,

-2.24%

on Wednesday in response to reports that a data set containing personal information relating to around 533 million users was made public. The regulator will investigate whether the social-media giant broke European Union data protection rules.

TuSimple, a California-based autonomous trucking group, is set to go public on the Nasdaq. Tied to car maker Volkswagen

VOW,

+1.42%

and backed by logistics company UPS

UPS,

-1.79%,

TuSimple will rival self-driving projects from electric-car maker Tesla

TSLA,

-3.95%

and Waymo, a division of Alphabet

GOOGL,

-0.56%.

According to a report from Bloomberg, TuSimple raised $1.35 billion after pricing the IPO above its range.

A study by the University of Oxford found that blood clots are as prevalent with COVID-19 vaccines from drug company Pfizer

PFE,

+0.03%

and biotech Moderna

MRNA,

+6.89%

as they are from drug company AstraZeneca

AZN,

+1.77%,

a vaccine produced with the university’s help. The AstraZeneca vaccine has come under scrutiny, and its use was halted in Denmark, over blood clot concerns.

The markets

U.S. stocks

YM00,

+0.50%

NQ00,

+0.89%

are set to open higher with earnings season under way and bond yields under control. European equities are flirting with fresh records

UKX,

+0.52%

PX1,

+0.37%,

with the pan-European Stoxx 600

SXXP,

+0.41%

on track to close above the all-time high reached just last week. Asian stocks

NIK,

+0.07%

SHCOMP,

-0.52%

were more mixed.

The chart

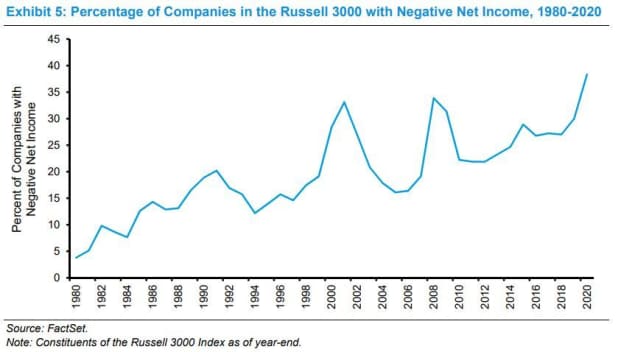

No, American corporations aren’t just bleeding money — as you might think from looking at the chart of the day, brought to our attention by the Irrelevant Investor blog. The chart, part of recent research from Morgan Stanley, reflects the rise of “intangible investments,” which aren’t included on a company’s balance sheet but rather its income statement. These “expenses,” which include assets like research and development, make companies appear unprofitable. It is an accounting thing.

Random reads

A Canadian Member of Parliament apologized after accidentally appearing naked in a virtual meeting of the House of Commons.

A missing California hiker was found after a geography enthusiast used a mystery photo to reveal his location.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.