- NYSE:CCIV gained 0.1% on Friday as the broader markets continued to rally into the weekend.

- The Lucid Air sedan shines at the Amelia Concours auto show.

- CCIV shares volatility has reduced as the shares have steadily appreciated.

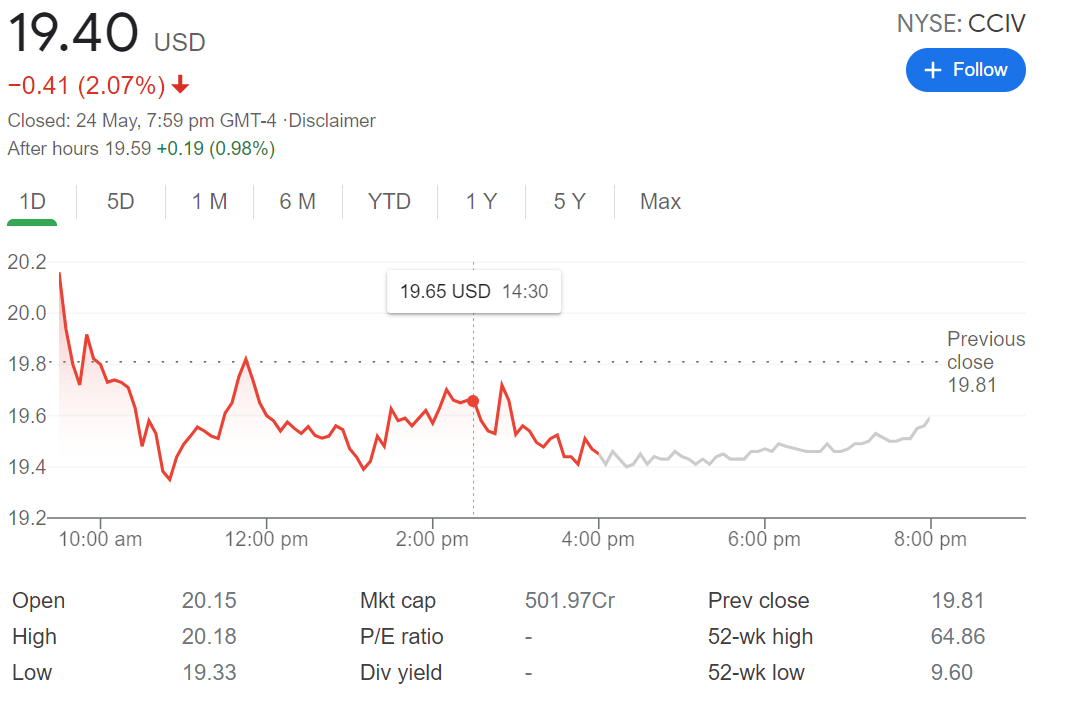

Update May 25: CCIIV shares (NYSE: CCIV) ditched the broader market rally and fell 2% on Monday before recovering 1% in post-market hours to recapture $19.50. Wall Street indices advanced, helped by a tech rally and conciliatory comments by the Fed official on concerns over rising inflation. The losses appear limited for the company amid upbeat fundamental factors. The stock price surged to two-week highs of $20.37 last Friday, as a potential merger with Lucid Motors remains on track for a speedy conclusion.

NYSE:CCIV seems to have all of the momentum right now as its chief rival Tesla (NASDAQ:TSLA) continues to trip over its own feet in the eyes of the markets. On Friday, CCIV continued its upward trajectory, although the stock traded mostly sideways, closing the trading session at $19.81. CCIV bulls tried to will the stock back to the 200-day moving average price of $20.03, but shares met some resistance before falling back below the $20 price barrier. CCIV is still trending toward a bullish breakout, although investors should temper expectations as the market for SPAC IPOs is still ice cold.

Stay up to speed with hot stocks’ news!

The flagship Lucid Air sedan is on display this weekend at the famous Amelia Concours auto show in Florida, and the initial reviews are extremely positive. The annual auto show has over 240 classic cars on display, but the Lucid Air has been stealing the show with its luxury design and cutting edge technology. The auto show comes a week ahead of Lucid’s planned User Experience Event on May 26, which should give fans a firsthand virtual look at the new vehicle.

Electric vehicle industry leader Tesla continues to fall out of favor with investors, and shares are trading nearly 15% below both the 50-day and 200-day moving averages. CEO Elon Musk has not made many friends lately, as he has been at odds with current Lucid CEO Peter Rawlinson, as well as members of the crypto community after backtracking on Tesla’s acceptance of Bitcoin. All of this has prompted investors to shift their focus to stocks like CCIV, as Tesla’s credibility continues to crumble.

Previous Updates

Update May 24: NYSE:CCIV started the week with the wrong foot, edging 2.07% lower to settle at $ 19.40. Equities were up on Monday, moving inversely to government bond yields which ended the day with modest losses. CCIV is having a hard time to rally beyond the 20.00 threshold, but so far holds on to its latest gains. The share seems to be losing its positive momentum near-term, but there are no other signs of an upcoming slide.

Previous Update: CCIV shares continue to steadily push higher after bouncing from support last week at around $18. The shares are currently flat in Monday’s session as sector leader Tesla steals the show, rallying over 1%. CCIV shares are trading $19.80 for a small loss of 0.25% on Monday.