- NYSE:CCIV kept advancing on Tuesday amid merge progress.

- Lucid CEO, under pressure from Elon Musk, responds.

- Lucid Air vehicles are making appearances around the world as the company ramps up its marketing.

Update May 19: Churchill Capital Corp IV (NYSE: CCIV) has been paring some of the gains made on Tuesday, and traded below $19 in early trading on Wednesday. Shares of the blank-check company that is SPAC-merging with Lucid Motors have been under broad pressure since the event was announced. While the news of the upcoming new ticker – LCID – have been cheered, uncertainty about the firm’s prospects and broad markets selling is adding to the pressure. Critical support is at $17.25, and resistance is at $19.38.

Stay up to speed with hot stocks’ news!

NYSE:CCIV investors have finally received some good news after going months without any updates from Lucid, as the company inches closer to merging with CCIV. On Friday, CCIV reversed its trend and gained 4.00% to close the trading day at $17.94. Shares are still trading below the 50-day and 200-day moving averages, but investors are relieved to see that the SPAC stock finally found support before it fell below its initial PIPE price of $15. With some recent announcements, CCIV may be looking to do a bullish reversal heading towards a Q3 merger date.

Lucid Motors CEO Peter Rawlinson fired back at former boss Elon Musk, who recently made some public jabs towards the former Tesla (NASDAQ:TSLA) employee. Musk said that Rawlinson was never a Chief Engineer at Tesla and downplayed his roles in the development of the Model S and Model X vehicles. Rawlinson responded by claiming he still had his business cards from Tesla, and that it would seem like a great deal of effort to have fraudulent cards made up if that was not his actual position.

Lucid Motors is officially making its way into Canada, announcing that it is opening a showroom in the high end Pacific Centre Mall in Vancouver. Lucid is bringing with it some high-end technology as consumers will have a chance to engage in a virtual reality experience where they can see other Lucid models in action. Lucid will also have its vehicles on display at the upcoming Amelia Concours auto show in Florida.

Previous updates

Update May 19: After witnessing a stellar 6% rally on Tuesday, NYSE:CCIV eased half a percent in post-market trading, still finishing with sizeable gains above the $19 mark. The stock finally recaptured $19 to clinch weekly highs. CCIV shares rose for the fourth straight session on Tuesday, gaining additional impetus from the announcement that the SPAC will be listed under a LCID ticker on Nasdaq after its likely merger with Lucid Motors. Investors also looking forward to Lucid’s vehicles display at the upcoming Amelia Concours auto show in Florida.

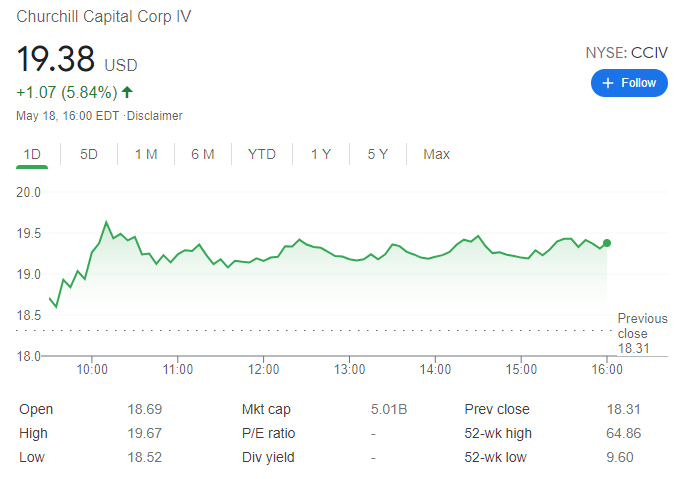

Update: Churchill Capital Corp IV (NYSE:CCIV) has closed Tuesday at $19.38, adding 5.84% to its latest rally. Despite the sour tone of Wall Street, speculative interest continued to bet on a successful merge. Hopes surged after Lucid Motors made some interesting tweets, first reporting that $LCID coming to Nasdaq following the planned merger with CCIV. Although there was no specific date for the merge, the tweet confirmed progress toward it. Also, the company anticipated it will appear at the Amelia Island Concours d’Elegance this week, which is among the top automotive events in the world.

Update: Churchill Capital Corp IV (NYSE:CCIV) has been experiencing the third day of recovery, moving up toward $19 on Tuesday. Shares of the company that is set to SPAC-merge with Lucid Motors hit a low point of $17.25 on Thursday but has been recovering since then. Some resistance is at $19.28, which was capped an attempt to recover on May 7. Broader stock markets are looking for a new direction.

Update May 18: CCIV shares continued to rally on Monday, bouncing from a strong support zone around $17.62. The shares ended at $18.31, up 2%. Lucid Motors CEO Peter Rawlinson had a fitting reply to former boss Elon Musk, who made a dig at him at a public forum and questioned his role in Tesla. The stock hit a daily high of $18.70 before retracing to settle the day slightly lower.