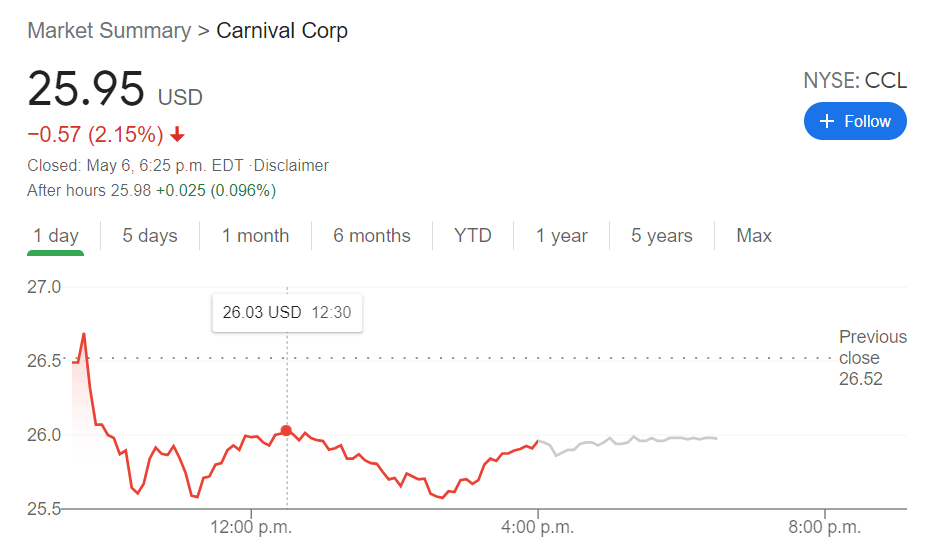

- NYSE:CCL fell by 2.15% alongside another day of choppiness for the broader markets.

- Carnival falls as a sympathy to rival Norwegian Cruise Line’s disappointing earnings.

- The CDC continues to progress towards allowing passenger cruise ships to resume sailing.

NYSE:CCL has been a very popular reopening play for investors as the allure of global travel reopening is too exciting for some to pass up. On Thursday, Carnival fell a further 2.15% to close the trading session at $25.95, as the stock continues to fall throughout the week. Carnival has now fallen below its 50-day moving average, as the downward trajectory on travel stocks continues to be affected by the ongoing growth sector correction. As popular as they may be, cruise lines are still anchored at ports around the world, so investors should not expect much for the rest of this quarter.

Stay up to speed with hot stocks’ news!

One of Carnival’s chief rivals, Norwegian Cruise Line (NYSE:NCLH) reported its Q1 earnings on Thursday, and let’s just say Wall Street was not impressed with the results. Consensus estimates had Norwegian making $10 million in revenue but the reported amount of $3.1 million sent investors off the deep end. Norwegian Cruise Line CEO Frank Del Rio was still bearish about the CDC reopening cruise sailings in the U.S. anytime soon, despite the country having one of the highest rates of COVID-19 vaccinations in the world.

The CDC continues to make progress on making a decision as to when cruise ships can reopen, but Del Rio already said that sailings in July would not happen. With August being the earliest any of the major cruise lines can begin to set sail, it could be another quarter of pain before any of these companies can turn the corner in the minds of investors.