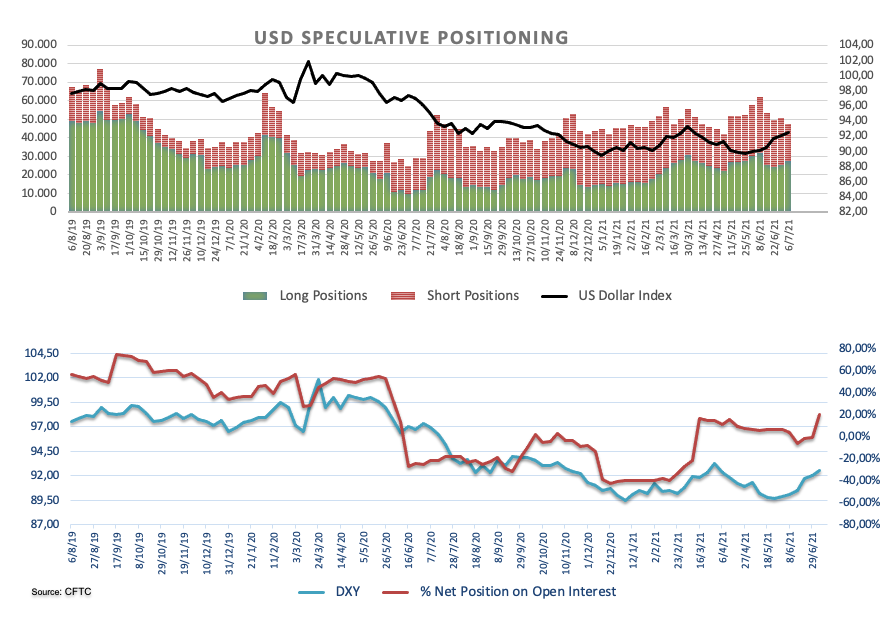

These are the main highlights of the CFTC Positioning Report for the week ended on July 6th:

- Speculators added gross longs to their dollar positions for the third week in a row, taking the net position to the highest level since early June 2020. The upside in the US Dollar Index (DXY) was propped up by increased volatility and rising inflows into the safe haven universe. Of note is that the percentage of net longs on open interest climbed above the 20%, levels last seen in June 2020. Back to that period, DXY experienced quite a selloff from the 97.60 zone to the 92.60/92.00 range recorded in September 2020.

- Net shorts in EUR receded to nearly 3-month lows. The drop in EUR/USD still tracked the investors’ assessment of the shift in the Fed’s stance as well as the improved mood in the safe haven space.

- The speculative community reduced its net shorts in the Japanese yen on the back declining US yields and supportive inflows in response to the pick-up in cases of the Delta variant of the coronavirus across the globe. Still among the safe havens, CHF net longs dropped to 3-week lows.

- Net longs in the sterling climbed to 3-week highs despite the erratic performance of cable. Doubts regarding the growth prospects for the UK economy remained on the rise in response to the quick spread of the Delta variant in the country. In addition, investors stayed vigilant following the latest cautious stance from the BoE.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.