Chinese automaker GAC Group said on April 12 that it had broken through several obstacles regarding the durability and safety of “all-solid-state” batteries, and expected its future rollout of the technology to offer drivers a range of over 620 miles per charge by 2026.

GAC, which made the announcement at its annual Tech Day, is among the few Chinese automakers to have offered specific plans in the race to market for next-generation advanced electric vehicle batteries. Toyota’s long-time partner has opted for a solid electrolyte system that sets it apart from the Japanese giant, by far the world’s leading holder of solid-state battery patents, according to Nikkei’s study.

Why it matters: The development is the latest example of liquid-state lithium-ion pack leader China ramping up efforts to master the technology, as global auto giants expect solid-state batteries to give them an edge over competitors in the EV transition.

Global auto majors and battery makers have been adopting three highly promising solid electrolytes in place of a liquid one, a key element that allows the movement of lithium-ions between cathode and anode during charge and discharge cycles. Japanese and Chinese manufacturers primarily focus on sulfides and oxides, respectively, while Western makers are betting on both candidates and paying additional attention to polymers, according to market intelligence provider TrendForce.

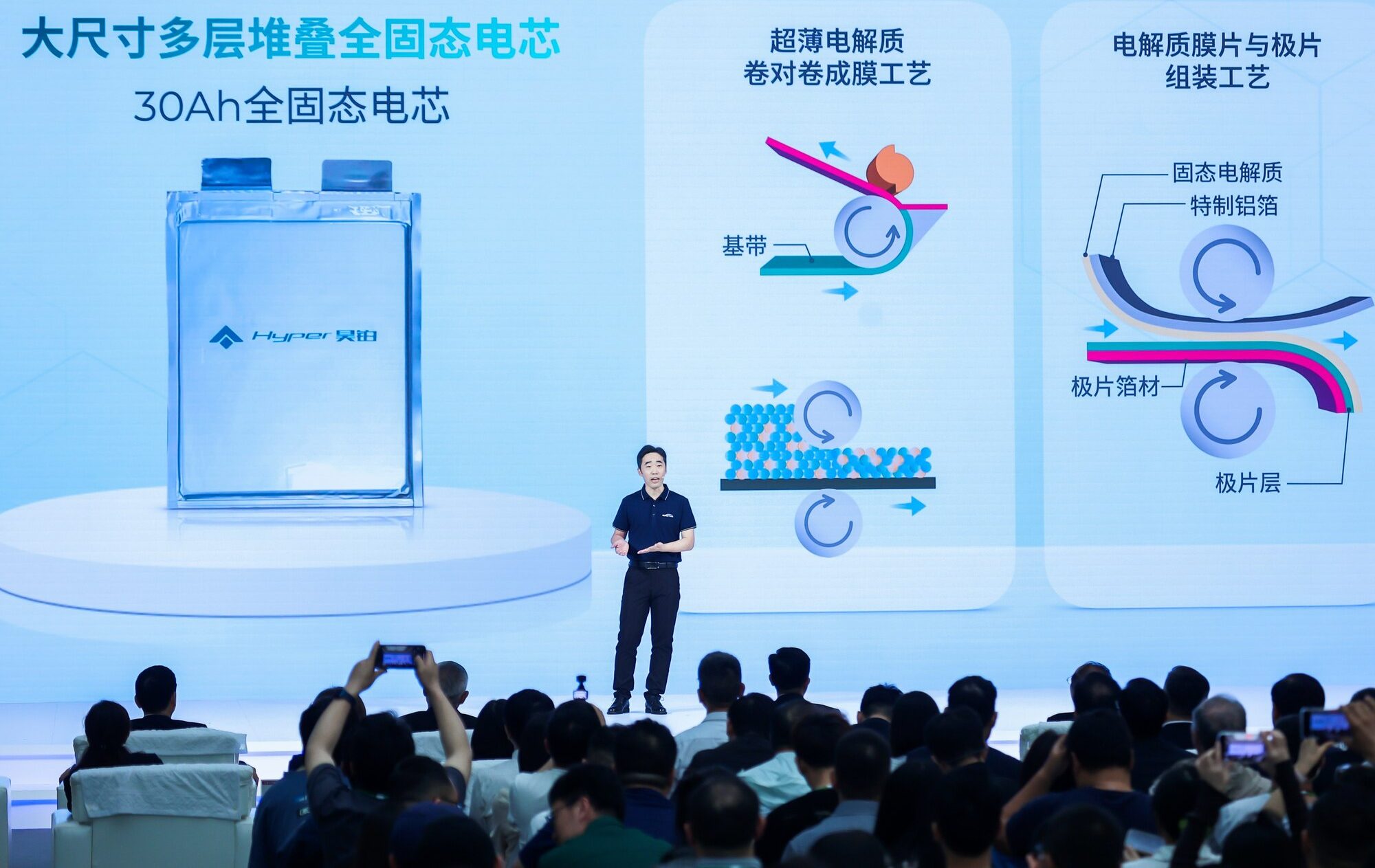

GAC showcased an all solid-state battery prototype at its 2024 Tech Day in the southern Chinese city of Guangzhou on Friday, April 12, 2024. Credit: GAC Group

Details: GAC claims its batteries offer better safety compared with not only liquid-based batteries but also solid-state alternatives, while achieving an energy density of 400 watt-hours per kilogram (Wh/kg), a roughly 60% rise compared with CATL’s highly advanced Qilin battery. It features a hybrid solid-state electrolyte based on both oxides and sulfides, among other materials.

The automaker said it developed a thin interphase film over the solid electrolyte surface, formed by a highly dense composite material in a special design that enhances structural durability and battery mechanics. This largely protects the battery from metal filaments known as “dendrites,” which may penetrate the solid electrolyte and eventually short the battery cell, allowing it to maintain thermal stability at 200°C above operating temperature.

GAC is also bringing out solid-state batteries with high-loading silicon anodes, adding that it has largely stopped extreme volume expansion and contraction of the anodes during electrochemical reactions, which harms solid electrolytes and often results in a poor overall battery cycle life. The latest prototype of GAC’s solid-state battery has undergone more than 100 charging cycles, retaining over 60% of its initial energy capacity, according to figures released by the company on April 12.

One of the major challenges for the large-scale use of oxide-based batteries is that their production is expensive and has fewer synergies with conventional manufacturing processes, according to an analysis published by Spanish research center CIC EnergiGUNE last May. And yet, the automaker said it can produce 30 Amp-Hour (Ah) battery cells while reducing costs in a push for volume production. GAC’s Hyper EVs are expected to travel more than 1,000 kilometers (621 miles) on a single charge in 2026, thanks to the technology.

Context: Experts say there is little agreement for now on which solid-state battery technologies will win out, and the timeline for their mass production and deployment remains uncertain. TrendForce generally projects that solid-state batteries may enter mass production between 2030 and 2035, with an energy density of 500 Wh/kg, offering a driving range two to three times greater than existing offerings.

Some early efforts at the game-changing technology are underway in other parts of the world. Toyota is aiming to market all-solid-state batteries as early as 2027, which could enable a range of 1,200 km and a charging time of just 10 minutes for its EVs, reported Reuters. Samsung SDI is looking at a similar timeline, saying last month that its plan for mass-producing such batteries in 2027 is well on track, while Nissan and BMW are aiming for 2028 and 2030, respectively.

Several Chinese auto and battery majors, including Changan and CATL, are making semi-solid-state batteries, a more gradual alternative that uses a small amount of fluid or gel electrolyte in addition to a solid-state electrolyte. SAIC said last month that its upcoming EV under the Intelligence in Motion (IM) lineup will feature a semi-solid-state battery pack, with liquid accounting for 10% of the battery’s weight. The IM L6 sedan is scheduled for launch in May.

State-owned GAC has operated a plant to produce conventional lithium iron phosphate (LFP) batteries for its Aion-branded EVs in its hone base of Guangzhou since last December, which is expected to have an annual capacity of 36 gigawatt-hours by 2025. It also invests in technologies such as autonomous driving and flying cars, planning to roll out an advanced driving system for city roads using cameras, rather than high-precision maps and lidar sensors, in 2026.