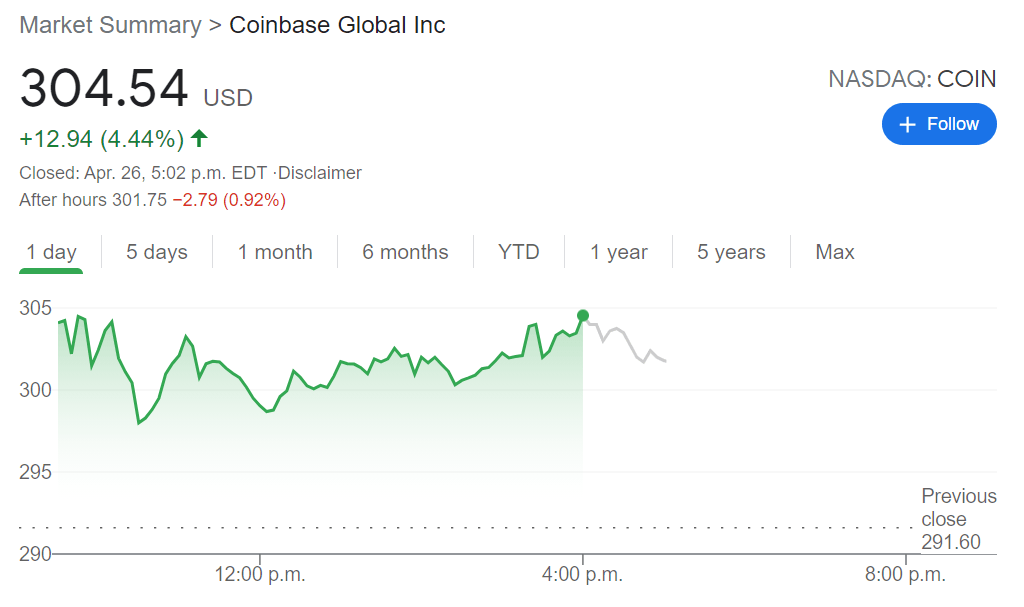

- NASDAQ:COIN surges by 4.44% on Monday amidst another green day for the broader markets.

- Coinbase retraces as Bitcoin and other cryptos start another bullish run.

- Coinbase announces its first earnings call as a publicly traded company on May 13th.

NASDAQ:COIN has had an eventful first couple of weeks on Wall Street to say the least, going from one of the most anticipated debuts in recent memory, to subsequently dropping in price by 30%. On Monday, the broader markets kicked earnings season off with a bang and Coinbase gained 4.44% to close the day at $304.54. To say that Coinbase has been volatile is an understatement as shares already have a twelve day price range of $282.07 to $429.54 as investors continue to struggle with the lofty valuations.

Stay up to speed with hot stocks’ news!

Thus far Coinbase has largely been affected by the fluctuating price of cryptocurrencies, specifically the benchmark cryptos Bitcoin and Ethereum. Over the weekend, the correction that was triggered by last week’s proposal of an increase to the capital gains taxation rate by President Biden, tapered off and the crypto market re-emerged on another bullish run. While Coinbase may have just hit its first support point after being steadily sold off since its direct listing, it is clear that the price of Coinbase shares and the price of Bitcoin will continue to go hand in hand for the foreseeable future.

Coinbase has officially announced that it will be reporting its first quarterly earnings after the closing bell on May 13th. Much has been made about Coinbase’s performance so far as a publicly traded company, but this has not seemed to deter Ark Invest’s Cathie Wood from loading up on the stock. Ark Invest sold some of its highest conviction holdings in Square (NYSE:SQ) and Tesla (NASDAQ:TSLA) to fund the Coinbase investments, so it will be interesting to see how it performs in the long run.