There have been reports going around the past couple of days that the Chinese government is cracking down on commodities speculation.

They blame speculators (like futures traders) for the soaring prices in key commodities.

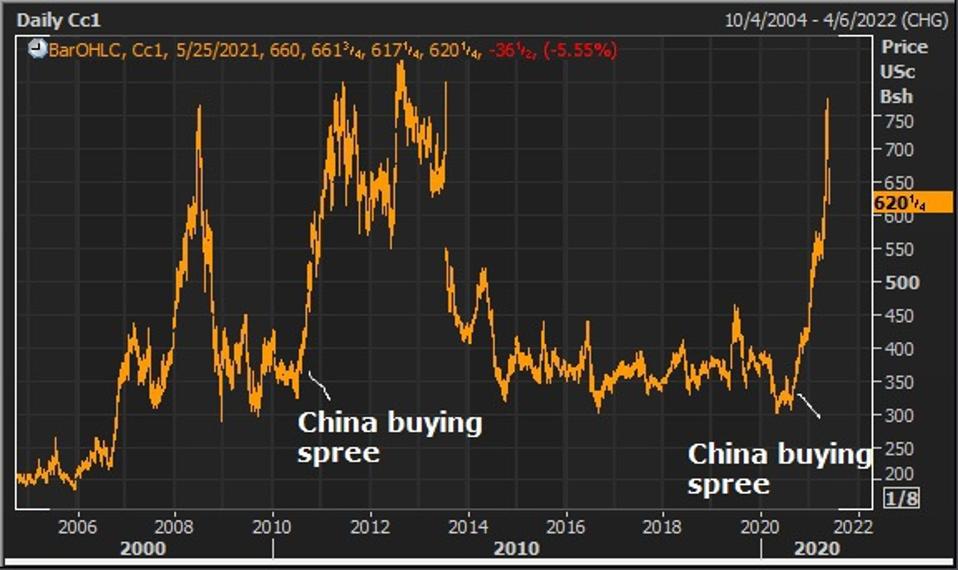

But it’s the Chinese government that has a record of driving up global commodities prices in the wake of a global crisis, stockpiling and hoarding to take advantage of beaten-down prices.

We talked about this back in February.

Both the Chinese government and Chinese companies imported record volumes of crude oil, copper, iron ore and coal in 2020. They also imported a record amount of corn, wheat and soybeans.

This is all a replay of the post-financial crisis playbook, as you can see in the chart of corn prices …

BillionairesPortfolio.com

Coming out of the financial crisis, the Chinese economy looked fairly unscathed. The developed market world was suffering, but China’s economy was still putting up double-digit growth.

This commodities binge looked like a power play. Buy up the world’s most valuable resources at a discount, drive prices higher and further hamper the already struggling major economies of the world. It appeared to be working, as many of the world’s influencers were convinced that this period represented a passing of the torch of economic leadership–from the developed world, to China. But it soon became clear that if China’s consumers were suffering (the U.S./developed world) then China would also suffer. Thus, with weak global growth, China’s growth and power play ultimately waned.

So, is this time different?

Like a decade ago, China’s economy is in a position of relative strength over the developed market world. And like a decade ago, China has stockpiled key global commodities at bargain prices. And like a decade ago, this power play has resulted in soaring commodities prices.

MORE FOR YOU

The difference? This time, China’s consumers (namely the U.S.) are awash with money, with a U.S. central bank and U.S. government that is willing to continue underwriting consumption, even at higher and higher prices. This U.S. debt-financed consumption (which includes buying back commodities we once sold to China for cheaper prices) looks like the recipe to get China to the global economic superpower finish line.

Get my free daily Pro Perspectives notes delivered to your inbox, here.

/https://specials-images.forbesimg.com/imageserve/60ae829a7b2195bb534ae90a/0x0.jpg)