LightRocket via Getty Images

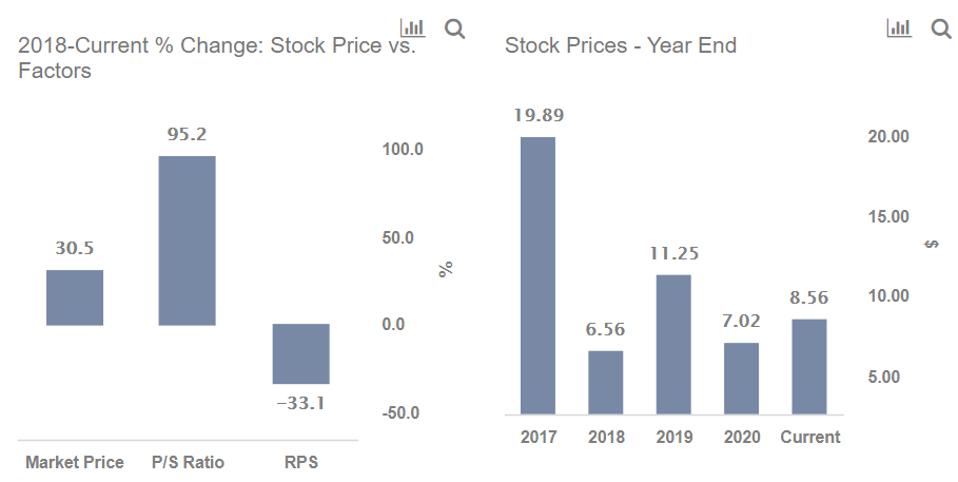

Despite rising almost 2x from its lows in March 2020, at the current price near $8 per share, we believe Coty stock (NYSE: COTY) has further upside potential. Coty, a cosmetics manufacturer, saw its stock rise from $4.50 to over $8 off its recent bottom, a little more than the S&P which increased by more than 80% from its lows. Further, the stock is actually down around 25% from the level it was at before the pandemic. We believe that Coty stock could regain its recent high of around $10, rising more than 15% from its current level, driven by expectations of strong demand recovery and promising Q3 2021 earnings. Our dashboard What Factors Drove 30% Change In Coty Stock Between 2018 And Now? has the underlying numbers behind our thinking.

Trefis

The stock price rise since 2018-end came despite a 31% drop in revenue from $6.84 billion in FY 2018 to $4.72 billion in FY 2020. Combined with a marginal 3% rise in the outstanding share count, RPS (revenue-per-share) dropped from $9.32 in 2018 to $6.23 in 2020.

Coty’s P/S (price-to-sales) multiple rose from 0.7x in 2018 to 1.1x by 2020 end, and has since risen to 1.4x riding the rally in the broader markets. However, we believe that the company’s P/S ratio has the potential to rise further in the near term on expectations of continuing demand growth and a favorable shareholder return policy, thus driving the stock price higher.

Where Is The Stock Headed?

The global spread of coronavirus and the resulting lockdowns in early 2020 saw work from home becoming the new norm. This significantly hurt demand for makeup and fragrance products, thus hampering demand for Coty’s products across these segments. However, with the economy opening up and people stepping out more and more now, demand for these products has started rising again. This is evident from Coty’s Q3 2021 earnings, where revenue came in at $1.03 billion, down marginally from $1.06 billion in Q3 2020. However, with significantly lower operating expenses and the absence of asset impairment charges ($40 million in Q3 2020), operating loss came in at a mere $1.4 million, compared to $300 million for the same period last year. This led to EPS rising to -$0.02 from -$0.36.

MORE FOR YOU

Further, demand growth for cosmetic products is expected to continue in the medium term, driving demand for Coty’s products even higher. We believe the company will see strong revenue and margin growth, and these factors will raise investor expectations further, driving up the company’s P/S multiple. We believe that Coty’s stock can rise more than 15% from current levels, to regain its recent highs above $10.

While Coty stock may be undervalued, it is helpful to know how its peers stack up. Coty Stock Comparison With Peers summarizes how Coty compares against peers on metrics that matter. You can find more such useful comparisons on Peer Comparisons.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

/https://specials-images.forbesimg.com/imageserve/5f61af48c75173dcf388f91c/0x0.jpg)