How long can the Federal Reserve hold off before tapping the brakes on its ultra accommodative monetary policy? The biggest rise in consumer prices since 2008 has provided plenty of food for thought on that front.

Investors are on the sidelines for Wednesday, following that data shocker and with all eyes on the start of Chairman Jerome Powell’s two-day appearance on Capitol Hill. That well-timed event may see lawmakers press him on whether the central bank is letting things run too darned hot.

The stock pullback on Tuesday was hardest on the smaller companies, with the Russell 2000 index

RUT,

-1.88%

dropping 1.9%, versus 0.3% to 0.4% falls for the bigger indexes. The Russell is off to a weak start for the quarter, which lines up with a Bank of America fund managers survey showing some steam coming out of vaccine and postelection bets. Value over growth and small-cap over large are no longer en vogue it seems.

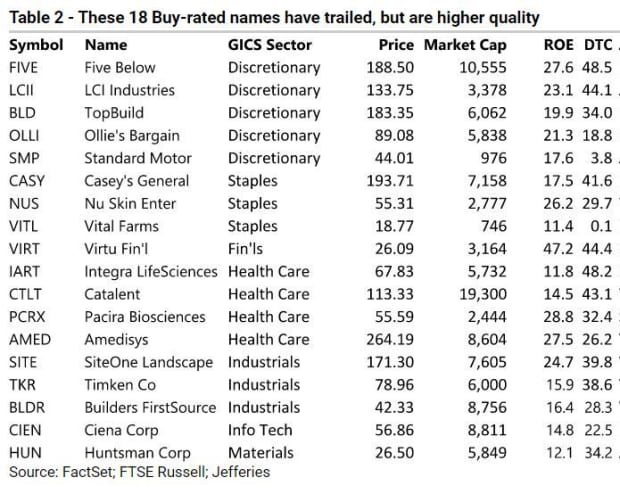

But now is not the time to throw all the babies out with the bathwater, says our call of the day, from Jefferies strategists Steven DeSanctis and Eric Lockenvitz who have 18 small-to-midcap stock ideas to share.

“Small has taken it on the chin vs. large since 3/15, but we are believers in the outperformance cycle. Earnings are better, valuations cheaper, just need macro to turn back up. Watch for big burst of outperformance,” they said in a note to clients on Wednesday.

The team believes markets are “in the midst of a multiyear outperformance cycle for small-caps, however in the ‘pause that refreshes’ period.” And as for cyclicals and value themes, “too many investors were on this side of the boat and when the waters got a bit more choppy, we have seen a rotation back toward growth, secular growth, and even the bond proxies.”

They offer three main reasons for that optimism, starting with cheaper relative valuations for smaller stocks reflected in their models and the fact “no cycle ever ended with small cheaper than large.” The second is that earnings growth estimates for smaller companies continue to rise and at a faster pace than bigger rivals. Finally, the strategists note the second-best start in history for mergers and acquisitions in the asset class. More deals means better performance, and they don’t see a let-up soon, with healthcare one sector they are watching closely.

As for their stock picks, given not all small-to-midcap asset class have performed well year to date, “we looked for buy-rated names that we determined were higher quality, better balance sheet, and cheap,” said DeSanctis and Lockenvitz.

That list includes Five Below

FIVE,

-2.08%,

LCI Industries

LCII,

-0.41%,

TopBuild

BLD,

-3.31%,

Ollie’s Bargain Outlet

OLLI,

-0.24%,

Standard Motor

SMP,

-0.18%,

Casey’s General

CASY,

-1.05%,

Nu Skin Enterprises

NUS,

-2.02%,

Vital Farms

VITL,

-2.09%,

Virtu Financial

VIRT,

-2.72%,

Integra Life Sciences

IART,

-1.55%,

Catalent

CTLT,

-0.18%,

Pacira Biosciences

PCRX,

-2.13%,

Amedisys

AMED,

-1.61%,

SiteOne Landscape

SITE,

-2.98%,

Timken

TKR,

-2.17%,

Builders FirstSource

BLDR,

-3.25%,

Ciena

CIEN,

+0.18%

and Huntsman

HUN,

-2.14%.

More bank earnings, more inflation data

Another round of inflation data is ahead with June producer prices on tap, followed by the Federal Reserve’s Beige Book review of economic conditions, along with Powell’s testimony.

More big financial names are reporting earnings, with BlackRock

BLK,

-0.86%

topping earnings estimates, while Bank of America

BAC,

-1.90%

delivered mixed results. Wells Fargo

WFC,

-2.11%,

and Citigroup

C,

-1.54%

results also are due.

Apple

AAPL,

+0.79%

is reportedly boosting iPhone production by up to 20% this year, on anticipation of heavy demand for its next upgrades. J.P. Morgan analysts added Apple to their focus list, lifting the price target to $175. Those shares were up in premarket trade.

The delta variant, vaccine resistance and Fourth of July gatherings have caused U.S. COVID-19 cases to double in the past three weeks, with infections at about 23,600 a day. And despite the country’s restrictions easing next week, masks will still be required on public transport, said London Mayor Sadiq Khan. Holland saw a 500% surge in infections after fully reopening.

European officials are set to announce aggressive laws on Wednesday to wean those nations off fossil fuels at a pace faster than anywhere else in the world.

The markets

Stock futures

ES00,

+0.10%

NQ00,

+0.38%

were higher, following a weaker close on Wall Street triggered by hotter-than-expected consumer prices. European stocks

SXXP,

-0.25%

are lower and Asian equities had a weaker session.

Opinion: If you think stocks and housing are in a bubble, check out bonds

The chart

Cathie Wood, ARK Investment Management’s chief executive and founder, reportedly told clients in a Tuesday webinar that the firm is less enthusiastic on China tech stocks following a Beijing crackdown and warned of a “valuation reset.”

That’s even as U.S.-listed China stocks bucked a Tuesday’s weak session, led by JD.com

JD,

+4.58%,

Alibaba

BABA,

+1.96%

and Didi

DIDI,

+11.29%.

Time will tell if Wood’s opinion that China tech will keep falling pans out.

Random reads

For the planet, for our health, Redditors say “seriously” stop buying these things.

Haven’t had enough soccer?

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.