- EUR/USD adds to Monday’s losses near 1.1850.

- Final German CPI came in at 0.4% MoM, 2.3% YoY in June.

- Markets now look to US inflation figures in June.

The single currency remains in the negative territory in the first half of the week, motivating EUR/USD to gyrate around the mid-1.1800s for the time being.

EUR/USD loses ground for the second session in a row on Tuesday, coming under renewed downside pressure after being rejected once again from the area of recent tops near 1.1880.

In the meantime, yields of the German 10-year Bund remain side-lined around the -0.30% level, tracking the developments in the bond markets overseas.

On Monday, ECB’s De Guindos reiterated that the recovery in the region stays firm, while he noted that inflation is expected to remain high in the next months and suggested that the central bank’s forward guidance will be discussed next week.

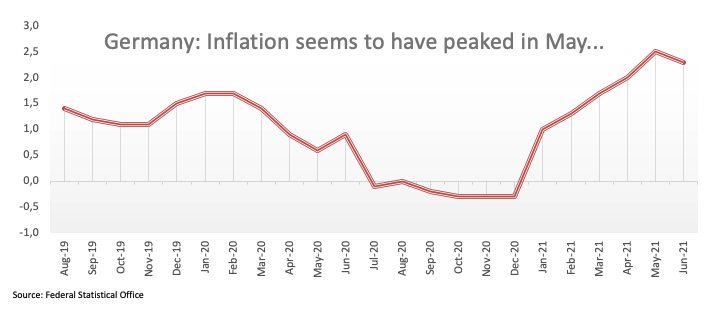

In the domestic docket, German final inflation figures saw the CPI rising 0.4% MoM in June and 2.3% from a year earlier.

In the US data space, attention will be on the June’s CPI, seconded by the NFIB Index and the API’s report.

EUR/USD has managed well to bounce off recent lows in the 1.1780 region, just above the key 2020-2021 support line. Price action around spot, in the meantime, is expected to exclusively follow dollar dynamics, particularly as investors continue to adjust to the latest FOMC gathering, when the Committee opened the door to tapering the QE programme sooner than anticipated. In addition, support for the European currency in the form of auspicious results from fundamentals in the bloc now appears somewhat mitigated considering recent data, although the investors’ morale remains high amidst the persistent optimism surrounding a strong rebound in the economic activity in the second half of the year.

Key events in the euro area this week: EMU Industrial Production (Wednesday) – EMU Final June CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the Delta variant of the coronavirus and pace of the vaccination campaign. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities in the wake of the pandemic.

So far, spot is losing 0.13% at 1.1843 and a breakdown of 1.1781 (monthly low Jul.7) would target 1.1762 (78.6% Fibo of the November-January rally) and route to 1.1704 (2021 low Mar.31). On the other hand, the next up barrier emerges at 1.1895 (weekly high Jul.6) followed by 1.1975 (weekly high Jun.25) and finally 1.2001 (200-day SMA).