- EUR/USD retreats from new monthly highs near 1.2270.

- German Business Climate surprised to the upside in May.

- US Consumer Confidence next of relevance in the docket.

The buying pressure around the European currency stays well and sound and pushes EUR/USD to fresh 4-month peaks in the 1.2265/70 band on Tuesday.

EUR/USD posts gains for the second straight session on Tuesday, extends the optimism seen at beginning of the week and at the same time breaks above the multi-session consolidative theme in place during most of last week.

The increasing selling bias in the greenback emerges as the exclusive driver behind the pair’s moderate upside, as investors look somewhat more convinced about the Fed’s commitment to keep the mega accommodative stance for the time being (thanks to recent Minutes, Powell and further Fedspeak).

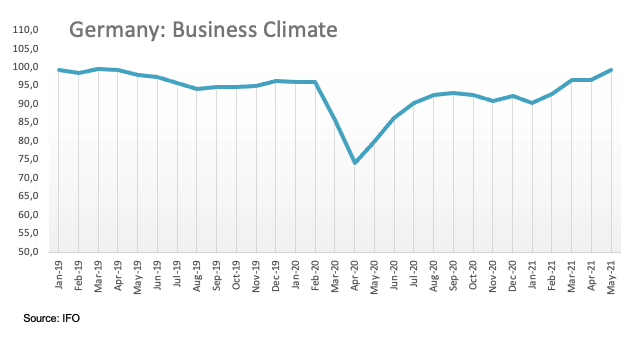

In the calendar, the German Business Climate tracked by the IFO survey came in above estimates at 99.2 for the current month, while the German economy contracted 1.8% QoQ in Q1 and 3.4% from a year earlier, according to the latest GDP figures.

Across the pond, the House Price Index tracked by the FHFA rose 1.4% MoM in March, and the S&P/Case-Shiller Index went up 13.3% on a year to March. Later, the Conference Board will release its Consumer Confidence gauge for the current month along with New Home Sales and the testimony by FOMC’s R.Quarles.

EUR/USD briefly surpassed the key hurdle around 1.2250 to clinch new 4-month highs near 1.2270 on Tuesday. The move remains largely underpinned by risk appetite and the persistent sell-off in the greenback amidst rising optimism on the recovery in the euro area, which appears in turn supported by the firmer pace of the vaccine rollout. In addition, the improvement of key fundamentals pari passu with the surging morale in the bloc also props up the upbeat mood surrounding the pair.

Key events in the euro area this week: German GfK Consumer Climate (Thursday) – Final May Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections.

So far, spot is gaining 0.33% at 1.2253 and faces the next hurdle at 1.2266 (monthly high May 25) followed by 1.2300 (round level) and finally 1.2349 (2021 high Jan.6). On the flip side, a break below 1.2051 (weekly low May 13) would target 1.1985 (monthly low May 5) en route to 1.1966 (200-day SMA).