- Wall Street’s rally on upbeat US data puts pressure on the greenback.

- US Treasury yields ticked lower, but the yield on the 10-y note holds around 1.70%.

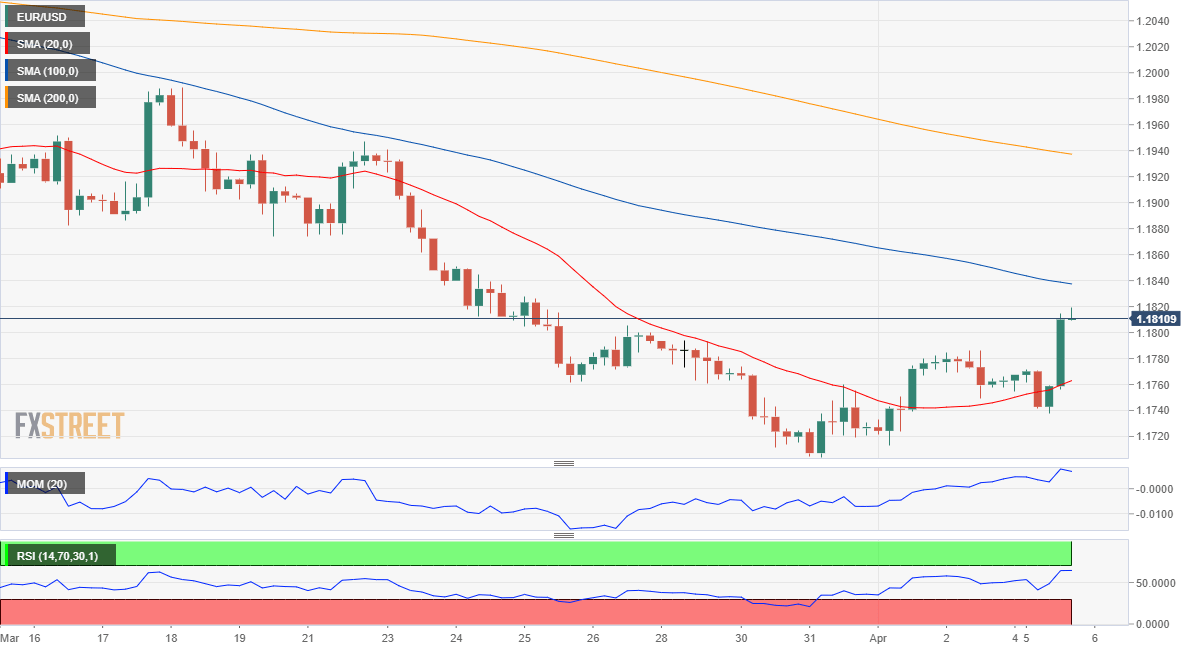

- EUR/USD recovered the 1.1800 threshold, but its bullish momentum is limited.

The EUR/USD pair is up this Monday, reaching an intraday high of 1.1819 as Wall Street soared. The impressive US Nonfarm Payroll report released last Friday boosted hopes for a soon-to-come economic bounce in the US, passing unnoticed on Good Friday. The DJIA and the S&P reached record highs, with the three US major indexes adding over 1.0% each. Meanwhile, US Treasury yields ticked modestly lower, with that on the 10-year note at around 1.70%.

The EU macroeconomic calendar had nothing to offer, but the US published the March ISM Services PMI, which surged to an all-time high of 63.7, largely surpassing the 58.5 expected. The country also published the February Factory Orders, which fell by 0.8%, worse than the -0.5% expected.

On Tuesday, the EU will publish April Sentix Investor Confidence, foreseen at 6.7 from 5 previously. The US calendar will publish minor figures, the April IBD/TIPP Economic Optimism and February JOLTS Job Openings.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair trades near the daily high as the day comes to an end, but the near-term picture falls short of indicating the rally would continue. In the 4-hour chart, the pair advances above a mildly bullish 20 SMA, but a bearish 100 SMA provides dynamic resistance around 1.1840. Technical indicators neared overbought readings but are currently in retreat mode, indicating decreasing buying interest. The pair can extend gains on a break above 1.1840.

Support levels: 1.1705 1.1665 1.1620

Resistance levels: 1.1840 1.1890 1.1935

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.