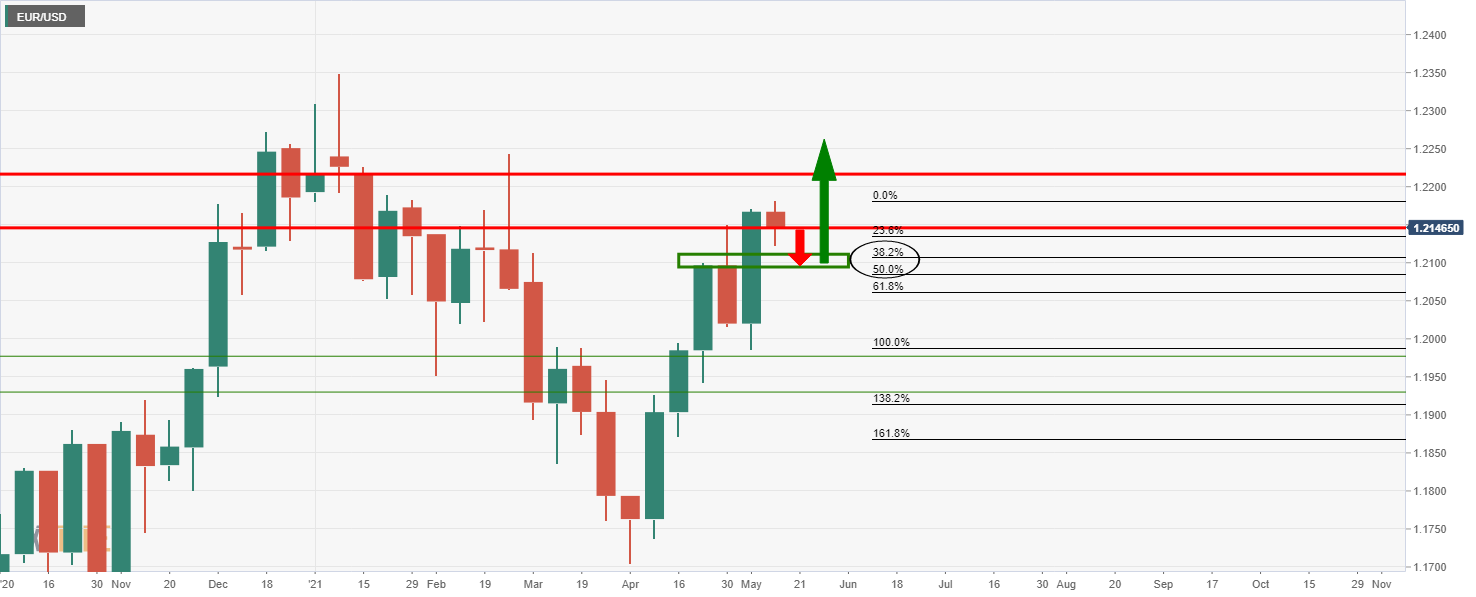

- EUR/USD bears looking for a deeper impulse to test bullish commitments at weekly support.

- Bulls taking charge and eye the daily resistance for weekly upside continuation probability.

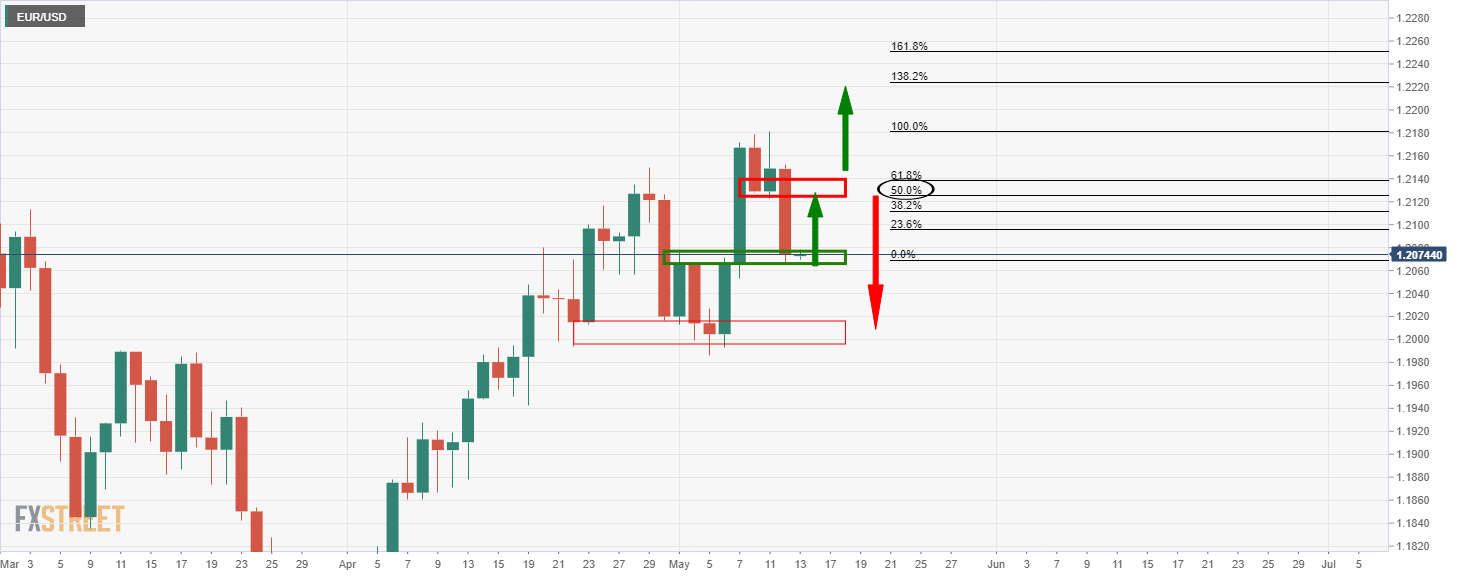

As per the prior analysis, EUR/USD Price Analysis: Bears are lurking with eyes on 61.8% Fibo target, the market has melted to the target and now the focus is on the upside should the support structure hold.

”The daily chart is showing a W-formation on the candles.

The rule of thumb is that the majority of such formations will see a restest of the prior highs of the pattern which will act as support prior to a bullish continuation.

In this case, the 61.8% Fibonacci is the key target.”

The price is now testing the bulls commitments at the prior resistance structure now turned support.

A hold here will set the stage for an upside correction to test the prior support that would be expected to act as resistance give the confluence with the 50% mean reversion.

A break of the resistance will open the pathway for a higher high.

This would fit the prior analysis of the weekly chart

”The weekly chart is showing signs of upside exhaustion and would be expected to see the price to the 38.2% or the 50% mean-reversion targets.”

Meanwhile, from a lower time frame perspective, there are prospects of a correction to the 38.2% prior to the next down leg of the hourly bearish impulse and deeper test of weekly support.