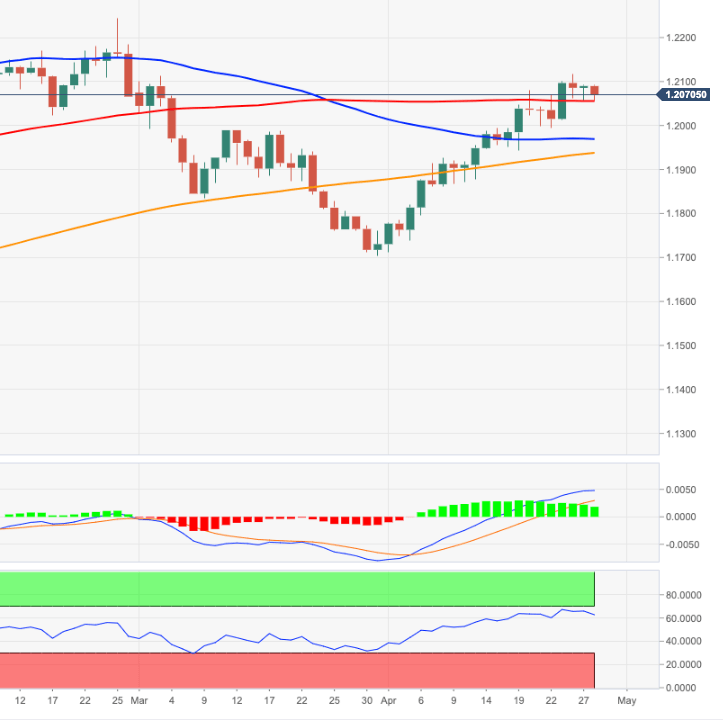

- EUR/USD stays choppy in the upper end of the recent range.

- So far, sellers met a tough barrier around the mid-1.2000s.

EUR/USD alternates gains with losses below the 1.2100 mark ahead of the FOMC event so far on Wednesday.

In the near-term, a surpass of Monday’s monthly peaks in the 1.2115/20 band carries the potential to accelerate the upside to the February’s top at 1.2243. On the downside, near-term support is located around 1.2050.

Above the 200-day SMA (1.1930) the outlook for EUR/USD is predicted to remain bullish.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.