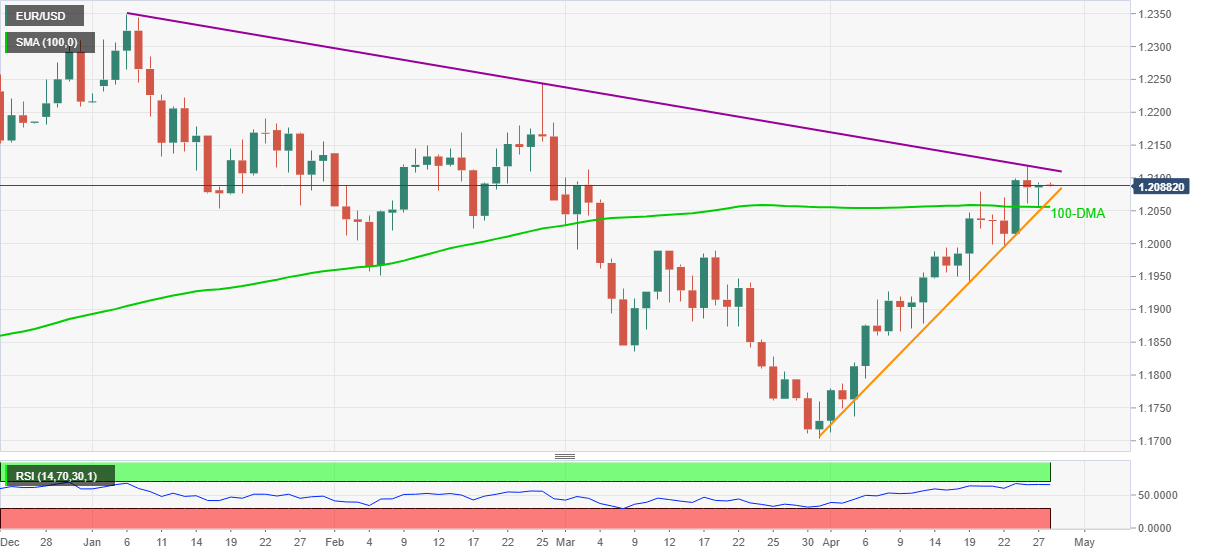

- EUR/USD bulls catch a breather following a clear recovery from the key SMA.

- Overbought RSI may trigger pullback from multi-day-old resistance line.

- Monthly support line adds to the downside filters.

EUR/USD wobbles in a choppy range around 1.2090, firmer after the previous day’s recovery moves, amid the Asian session on Wednesday.

While cautious sentiment ahead of the US Federal Reserve’s (Fed) interest rate decision test the bulls, nearly overbought RSI conditions also contribute to the odds suggesting the pair’s U-turn from a downward sloping trend line from January 06.

It should, however, be noted that an ascending support line from March 31, near 1.2065 will test the short-term EUR/USD declines ahead of the key 100-day SMA level near 1.2055.

Alternatively, an upside clearance of the stated resistance line close to 1.2115 should successfully cross the monthly top of 1.2116 before directing the run-up towards the 1.2200 thresholds.

Overall, EUR/USD remains on the upward trajectory but it all depends upon today’s Fed decision.

Read:

Trend: Bullish