- EUR/USD loses further momentum and approaches 1.1800.

- German final CPI rose 0.4% MoM, 2.3% YoY in June.

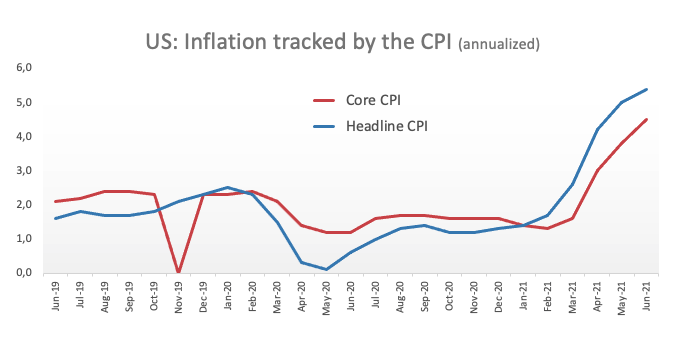

- US headline CPI rose 5.4% YoY, Core CPI gained 4.5% in June.

The selling pressure around the European currency picks up extra pace and now forces EUR/USD to recede to the vicinity of the 1.1800 yardstick.

EUR/USD sees its weekly drop accelerated on turnaround Tuesday following the now better mood surrounding the dollar.

Indeed, the buck stays well bid after US inflation figures tracked by the headline CPI rose 5.4% on a year to June, while the Core CPI gained 4.5% both prints coming in above estimates. Additional US data saw the NFIB Index improving to 102.5 in June (from 99.6).

In the domestic docket, German final inflation figures saw the CPI rising 0.4% MoM in June and 2.3% from a year earlier.

EUR/USD has managed well to bounce off recent lows in the 1.1780 region, just above the key 2020-2021 support line. Price action around spot, in the meantime, is expected to exclusively follow dollar dynamics, particularly as investors continue to adjust to the latest FOMC gathering, when the Committee opened the door to tapering the QE programme sooner than anticipated. In addition, support for the European currency in the form of auspicious results from fundamentals in the bloc now appears somewhat mitigated considering recent data, although the investors’ morale remains high amidst the persistent optimism surrounding a strong rebound in the economic activity in the second half of the year.

Key events in the euro area this week: EMU Industrial Production (Wednesday) – EMU Final June CPI (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the Delta variant of the coronavirus and pace of the vaccination campaign. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities in the wake of the pandemic.

So far, spot is losing 0.37% at 1.1815 and a breakdown of 1.1781 (monthly low Jul.7) would target 1.1762 (78.6% Fibo of the November-January rally) and route to 1.1704 (2021 low Mar.31). On the other hand, the next up barrier emerges at 1.1895 (weekly high Jul.6) followed by 1.1975 (weekly high Jun.25) and finally 1.2001 (200-day SMA).