The Fed didn’t announce a stimulus tapering coming out of its meeting today, but the market sure acted like it did and even Fed Chairman Jerome Powell indicates the time for talking about it is here.

Stock indices quickly fell to session lows when the Fed issued projections showing much better chances of a rate hike next year. It also raised its inflation growth estimate for this year pretty sharply. These moves led to thoughts among analysts that a taper of the Fed’s $120 billion a month bond-buying program might start by late this year or early next, though the Fed is sticking by it for now.

We can think of this meeting as the “talking about talking about” tapering meeting, Powell said in his press conference after the meeting, suggesting it’s time to retire that term that he himself created. However, he didn’t give any timing on when the Fed would give advance notice of any timing of a decision to slow down those bond purchases.

Seven members of the Federal Open Market Committee (FOMC) now expect at least one rate hike next year, up from four who did at the Fed’s March meeting. Also, 13 FOMC members expect rates to rise in 2023, up from seven in March. The meeting basically seems to indicate we can expect a rate hike possibly by late 2023, rather than the 2024 timing projected after the March meeting. Rates have been basically zero since March 2020 when the pandemic hit.

The U.S. dollar and Treasury yields both rose nicely after the news, with the 10-year yield jumping rapidly to near 1.56% from lows around 1.48% earlier in the day. That’s a major move for yields in a single day. Financial stocks also appeared to get a charge out of the more hawkish tone from the Fed, with major banks like JP Morgan (NYSE: JPM) and Goldman Sachs (NYSE: GS) getting a boost.

Fed’s Change Of Pace Throws Market A Curveball

Basically, this looks like a change of pace from the Fed, and clearly the market reacted as if it were a surprise. People hadn’t expected the Fed to change its tone from March, and any change of tone from the Fed tends to get a reaction in the market. The Fed’s hotter than expected inflation projection of 3.4% for 2021, up from the previous 2.4%, might play into some of the market’s initial weakness.

While the takeaway might be that we’re heading into a slightly less free money environment sooner than some had expected, remember this is nothing to go too crazy over. It’s unclear if the Fed will really change course until we get a handle on employment and some of the government subsidies start to dry up. Last week’s Job Openings and Labor Turnover Survey (JOLTS) showed an historically high level of job openings. It’s hard to imagine the Fed getting too hawkish while all those jobs are left to be filled.

The Fed’s actual press release didn’t change all that much from March. It did say the country is making progress on vaccinations, easing the crisis. There was no change in its asset purchase language, and it’s aiming for inflation above 2% for some time. Even though it raised its inflation projection, it continues to say inflation is “transitory.”

In his press conference following today’s meeting, Powell referred to supply and labor bottlenecks coming out of the “unprecedented” reopening of the economy. However, he said the Fed sees inflation falling to more normal levels of just above 2% in 2023.

“We expect to maintain an accommodative stance” until employment and inflation objectives are achieved, Powell said. He added, though, that inflation could turn out to be “higher and more persistent” than the Fed expects. However, since inflation long ran under 2%, the Fed now sees above-2% inflation as a goal so that the average over time will be near 2%.

Powell acknowledged prices have risen pretty steeply in some categories lately, but mainly in areas directly related to coming out of the pandemic. Eventually, they’ll move back down, but he can’t predict when.

“The prices driving inflation are in areas directly related to the pandemic and the reopening of the economy, like lumber,” Powell said. “Prices like that have moved up really quickly because of shortages and bottlenecks and should stop going up and start going down.” Lumber has already gone down recently, he added.

“Prices for used cars…represent a perfect storm of very strong demand and limited supply,” Powell said. “We do think it makes sense that these will stop and reverse. When will we see it? We’re not sure. The timing of that is pretty uncertain.” He talked about how important it is to “anchor” inflation expectations.

In the good news department, the Fed raised its projection for 2021 gross domestic product growth to 7% from the previous 6.5%, and still sees unemployment at a low 4.5% for 2021.

Back in March the Fed had projected 2021 gross domestic product growth of 6.5%, and an unemployment rate of 4.5%. It also had expected personal consumption expenditure (PCE) prices to rise 2.4% overall and 2.2% for the core reading that strips out energy and food prices. PCE is an inflation reading the Fed has said it monitors closely.

The March meeting’s so-called “dot plot” of rate projections showed only four Fed officials predicting a rate hike in 2021 and seven seeing one before the end of 2022. The majority saw rates staying at the current level near zero through the end of next year.

There’s a growing consensus among many analysts that any announcement about a possible tapering of stimulus could come by late summer or early fall. CME Fed funds futures rapidly rolled higher after today’s Fed meeting and now show a 17% chance of a rate hike this year, up sharply from 7% earlier today.

Mixed Data Put Fed On Tightrope

Over the last few weeks, the Fed and investors had received a kind of mixed set of data points that probably made the central bank’s job even more confusing. The recent producer and consumer price reports for May showed inflation steepening to levels last seen decades ago. At the same time, monthly jobs growth in April and May didn’t really come close to analysts’ projections, and housing and retail sales have both taken a dip after surging earlier this year.

In a way, this might have opened up a path for the Fed to keep policy looser longer, so to speak. If all the data points flashed green the last month or two, fears of overheating might have put more pressure on the central bank to talk about tapering. In fact, it almost seemed that way back in mid-May when a couple of Fed officials sounded a bit hawkish after inflation ticked higher.

Since then, the light’s been flashing more yellow than green, if you will, and the bond market–which sometimes can be a barometer of where the Fed might be headed–had really calmed down. Going into today’s meeting, the 10-year Treasury yield was just below 1.5% after topping 1.75% in late March. Higher yields can sometimes indicate growing anticipation in the market about possible Fed tightening.

Stocks Climbed “Wall Of Inflation Worry” To Recent Highs

Major stock indices recently reached new highs for the first time in a month or more, and the so-called “growth” sectors like Technology and Communication Services that wilted under higher yields back in February and March have shown signs of revival. Some key Tech names like Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA) marched higher into Fed week, while Financial stocks like JP Morgan Chase (NYSE: JPM) and Morgan Stanley (NYSE: MS) have stumbled a bit. Bank stocks tend to do better when rates are rising, but higher rates can sometimes pressure growth stocks.

The Fed, meanwhile, has stood by its assertion that inflation is “transitory.” Officials there continue to cite short-term supply bottlenecks caused by sharp increases in demand as the economy reopens following the pandemic. The supply shortages, they say, will fade as the year continues. This led one Wall Street analyst to write, after seeing a recent data point showing inflation at a 29-year high, “The Fed had better be right about bottlenecks.”

Worries that the Fed might be wrong could be keeping a lid on stocks, which haven’t really gained much traction despite the recent record highs. No one would likely want to see a situation where the Fed skates behind the puck too long on inflation and prices get out of hand. That hasn’t happened, really, since the 1970s, and when it did back then the result was massive rate hikes designed to bring down crippling inflation, sending the economy and stock market into a long tailspin.

Few analysts expect anything like that again, but it does haunt memories of those who experienced the ugly “stagflation” of that era.

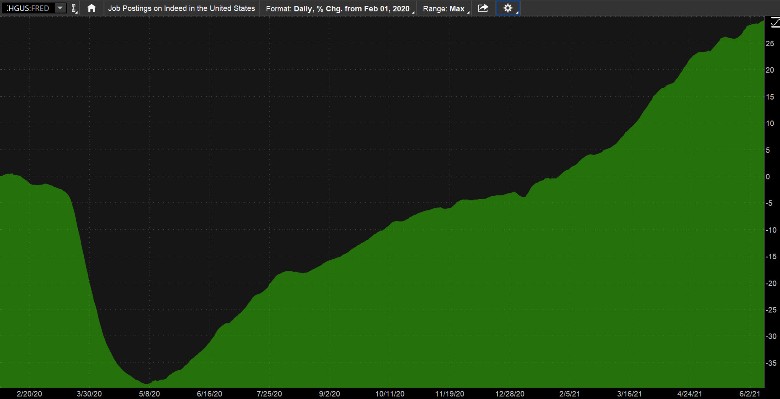

CHART OF THE DAY: Chart source: The thinkorswim(R) platform. TALENT WANTED. Before the pandemic hit, the St. Louis Fed began tracking job postings from career site Indeed on its FRED database. After a big lockdown dip in 2020, postings began to surge and that surge seems to be accelerating. Could wage pressures add another element to the transitory inflation debate? Chart source: The thinkorswim(R) platform. FRED(R) is a registered trademark of the Federal Reserve Bank of St. Louis. The Federal Reserve Bank of St. Louis does not sponsor or endorse and is not affiliated with TD Ameritrade. For illustrative purposes only.

Knowledge Is Good (Maybe) For Retail: The kids just got out of school, so let’s talk about going back to school. Specifically, back-to-school shopping season, which will be on top of us before we’re even ready (though maybe some parents can’t wait for kids to head to the classroom again). This coming school sales season has the potential to be one of the better ones in recent years, partly because after kids were stuck at home taking Zoom (ZM) classes in their pajamas, they and their parents might be in more of a mood to stock up on new clothes as the actual schools open again. College kids who never lived in their freshman dorms will likely be out shopping, too, as they prepare for on-campus life as sophomores. At the same time, the latest crop of freshmen are probably also ready to buy those mini-fridges, sports equipment, comfy “obscure sneakers,” and other essentials of campus life.

This all comes after a pretty steep drop in May retail sales reported yesterday knocked around the Consumer Discretionary sector a bit. In fact, both Consumer Staples and Consumer Discretionary are two of the worst-performing S&P sectors over the last month. This could mean many of the Walmarts (NYSE: WMT) and Targets (NYSE: TGT) of the world are likely looking ahead for a possible boost in coming weeks as incoming scholars plan to hit the books (and the clothes racks) this coming autumn.

Plenty Left In June For Fed Watchers: This month started with a huge bang when it comes to monetary policy-related items. Consumer prices, producer prices, retail sales, and now a Fed meeting. Does all this mean June is so front-loaded we can all head out to the golf course now and come back in a month when earnings season begins and we get tired of slicing into the woods? You probably know the answer. As nice as it might be to envision a vacation from the markets (and you do have permission to take one now and then, by the way), anyone who sits out the rest of June to hit the greens or the beach might miss a few key developments.

While there’s no point going down the whole list, a couple of things stand out from a possible rate perspective. They include next week’s existing and new home sales for May, which might provide more insight into whether housing is cooling off at all after almost a year of sizzling. Personal Consumption Expenditure (PCE) prices for May also come out next week, and the Fed has said it monitors this data point very closely for insight into inflation. What PCE data tell us might mean more to the Fed than the consumer and producer price reports already out.

Finals Week Ahead For Big Banks: Another Fed-related item next week involves the biggest banks in the country. The Fed’s “stress tests” for major banks are due Thursday, June 24, after the market closes. Only banks with $100 billion or more in total consolidated assets are participating this year after all banks got tested a year ago. On its website, the Fed says, “For the 2021 stress tests, the resilience of large banks is being tested against a hypothetical recession featuring a severe global downturn with substantial stress in commercial real estate and corporate debt markets.” Hmm, sounds a bit like March 2020 all over again.

Results of the tests can help determine how much latitude various banks will have from the Fed to use their money on things like buybacks and dividends. The Fed said it will lift its temporary cap on dividend payments and stock buybacks for banks that pass this year’s stress tests. A recent Barron’s analysis suggests that banks most likely to be in position to lift their dividends this year are Bank of America (NYSE: BAC), Citigroup (NYSE: C), Fifth Third (NASDAQ: FITB), JP Morgan Chase (NYSE: JPM), M&T Bank (NYSE: MTB), and Zions Bancorporation (NASDAQ: ZIONS). Banks’ stress test performance can also play into stock prices, as investors often reward big bank stocks for passing with flying colors and punish any that end up wearing a dunce cap. Financial stocks had a really nice run after last December’s strong stress test performances, though you’ve got to to be careful about equating correlation and causation.

TD Ameritrade(R) commentary for educational purposes only. Member SIPC.

Image by Sergei Tokmakov www.thecorporateattorneys.com from Pixabay

The preceding article is from one of our external contributors.

It does not represent the opinion of Benzinga and has not been edited.

(C) 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.