Shares of FuelCell Energy Inc. slumped toward a four-month low, after Wells Fargo analyst Praneeth Satish started coverage of the fuel cell technology company with the equivalent of a sell rating, citing relative concerns regarding commercialization and valuation.

At the same time, Satish initiated FuelCell rivals Bloom Energy Corp.

BE,

+1.53%

with the equivalent or a buy rating and was neutral on Ballard Power Systems Inc.

BLDP,

-4.39%

FuelCell’s stock

FCEL,

-5.10%

dropped 5.5% in afternoon trading, putting it on track for the lowest close since Dec. 17, 2020. The stock has tumbled 39.6% this month, and has lost more than two-thirds of its value (down 69%) since closing at a 4 1/2-year high of $27.96 on Feb. 9.

Satish set an underweight rating for FuelCell’s stock, and a price target of $9.

He said with the hydrogen economy in the “early stages of development,” FuelCell has a number of growth opportunities, including stationary power, distributed hydrogen, long-duration hydrogen storage and carbon capture.

“However, the company is behind other fuel cell peers in terms of commercialization, and we struggle to see a path for [FuelCell] to grow into its current valuation,” Satish wrote in a note to clients.

He said a “significant portion” of FuelCell’s future projected cash flows are tied to projects that are still under development, such as carbon capture and separation and solid oxide platforms, which adds to commercialization risk.

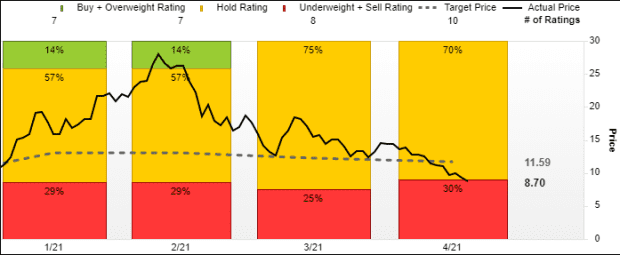

Satish is now one of three of the 10 analysts surveyed by FactSet who rate FuelCell the equivalent of sell. The other seven analysts rate the company the equivalent of hold. The analyst price targets range from a low of $4 to a high of $17.20, with an average of $11.59.

FactSet

Meanwhile, Satish initiated Bloom Energy with an overweight rating and $43 stock price target, which is nearly double current prices.

“[Bloom Energy] has an established market presence and visible growth trajectory in the fuel-cell stationary power business with multiple avenues for future growth if the company’s hydrogen initiatives achieve commercial success,” Satish wrote.

With a “successful track record” of cost cutting, he projects continued improvement in gross margin and expects the company to generate positive cash from operating activities in 2021. In comparison, FuelCell projects to report positive Ebitda (earnings before interest, taxes, depreciation and amortization) by fiscal 2022.

Bloom Energy shares rose 0.7% in afternoon trading, to bounce off a Monday’s four-month closing low.

For Ballard Power, Satish initiated coverage with an equal weight rating and stock price target of $26, which is 35% above current prices.

“[Ballard Power] has a leading market presence in the fuel cell bus market with the potential for additional growth assuming wide-scale adoption of hydrogen fuel cells in the other end-user markets, including heavy- and medium-duty trucks, rail and marine,” Satish wrote.

Ballard’s stock dropped 4.5% on Tuesday, putting it on track for the lowest close since Dec. 14.

He didn’t give Ballard’s stock a bullish rating, however, because current valuations suggest much of the potential growth from hydrogen commercialization has already been priced into the stock.

Over the past 12 months, shares of FuelCell were still up 440.4%, Bloom Energy have rallied 229.6% and Ballard Power have climbed 91.3%, while the S&P 500 index

SPX,

-0.74%

has advanced 46.4%.