Market Talk

– The dollar was up on Monday morning in Asia. Risk currencies hovered above their recent lows against both the U.S. currency and the yen as fears about slowdown in the global economic recovery from COVID-19 appeared to have subsided for now.

– The outlook for U.S. inflation and the speed of the Federal Reserve’s future policy tightening are back in focus ahead of Tuesday’s consumer price data and Fed Chair Jerome Powell’s testimony.

– The Chinese yuan was a tiny bit firmer at 6.4742 per dollar after the People’s Bank of China cut banks’ reserve requirement ratio across the board in a surprise move to bolster China’s economic recovery from COVID-19.

– The euro traded at 1.1868, edging back from its three-month low of $1.1782 set on Wednesday while the Australian dollar has bounced back from Friday’s seven-month low of 0.7410, even if it traded a little soft through the Asia session at 0.7472.

– Gold was down on Monday morning in Asia. Concerns about COVID-19 outbreaks remain as countries including Australia and South Korea reintroduce restrictive measures, while U.S. inflation data and testimony from U.S. Federal Reserve Chair Jerome Powell, and are due throughout the week.

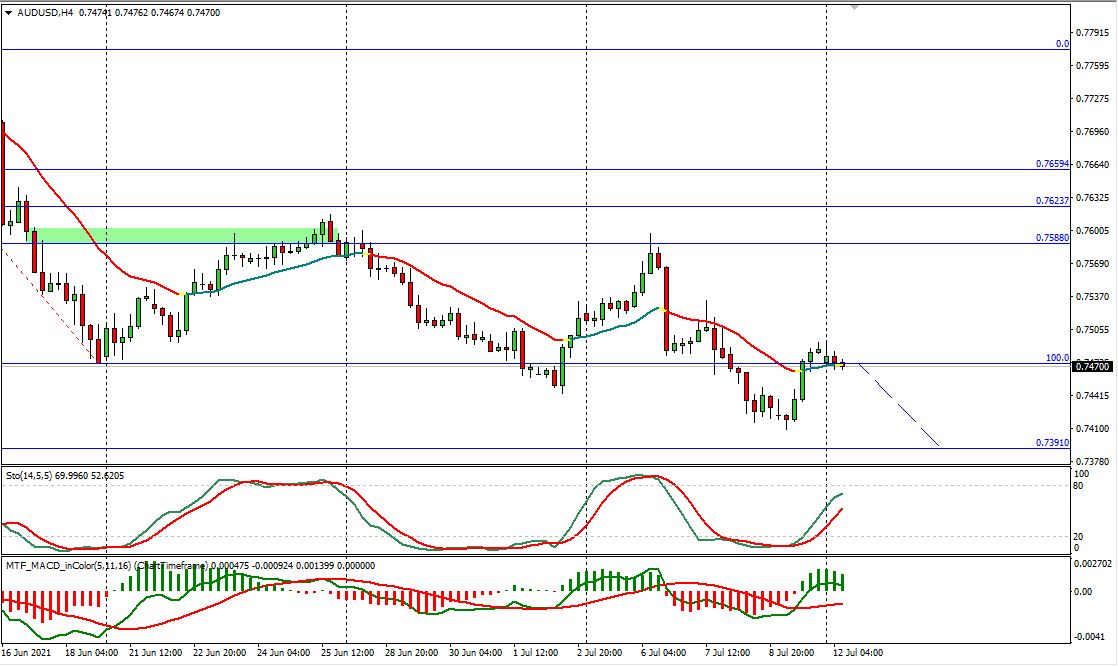

Chart Focus AUD/USD

Key Points

1. Sell AUD/USD recommendation.

2. Sell AUD/USD at 0.7480. Stop at 0.7515 and target at 0.7395.

3. COVID-19 outbreaks in various Asian countries including Australia are likely to weigh on the Aussie dollar.

4. Price was capped by a strong resistance and MACD is hinting of a bearish price trend.

Fundamental Comments

1. COVID-19 outbreaks and lockdown in Australia are both likely to weigh on the Aussie dollar.

2. COVID-19 outbreaks in various Asian countries are likely to aid the safe haven US dollar.

Technical Comments

1. Price was capped by the 20EMA as well as a previous support turned into resistance line.

2. MACD remains bearish and is hinting of a bearish price trend ahead.

Key Levels

| Support | 0.7450 | 0.7410 | 0.7370 |

| Resistance | 0.7495 | 0.7535 | 0.7565 |

Technical Overview

USD/JPY – Our view remains the same as last Friday, where we think price may have hit a temporary low at 109.52 on Thursday and a price movement towards the 20EMA at 110.30 or the previous support turned resistance point at 110.40 was likely. For today, we could see price turned down towards the low of 109.52 again after being resisted at the 20EMA. MACD remains bearish.

| Support | 110.00 | 109.55 | 109.20 |

| Resistance | 110.40 | 110.80 | 111.20 |

EUR/USD – Price may have reached a high at 1.1880 and we could see a decline back to the 20EMA at 1.1845 initially and later to 1.1780 again. Stochastic has reached the overbought zone and is likely to turn down. MACD remains bullish but is near to the zero line and we could see a bearish crossover soon, hinting of a bearish price trend. A move above 1.1900 would negate our bearish view.

| Support | 1.1845 | 1.1810 | 1.1780 |

| Resistance | 1.1885 | 1.1915 | 1.1945 |

GBP/USD – Price may have reached a Double Top if it fails to move above 1.3910. Price could decline back to 1.3740 again if that happens. Stochastic has already reached the overbought zone and is bearish crossover is likely. However, both MACD and 20EMA remain bullish and both are hinting of a bullish price trend. A move above 1.3910 is likely to lead to a test of 1.4000.

| Support | 1.3860 | 1.3820 | 1.3790 |

| Resistance | 1.3910 | 1.3955 | 1.4005 |

XAU/USD – Price reached a high of $1818.25 Thursday and this high was accompanied by a divergence warning from the MACD indicator as well as the Stochastic indicator, hinting of a possible price high. Price has since declined below $1800 and we are looking at a continuation of this decline to $1785. MACD remains bullish but is declining while 20EMA has turned bearish. Stochastic has a bearish crossover and is hinting of a bearish price trend ahead.

| Support | 1796.55 | 1784.65 | 1771.90 |

| Resistance | 1807.65 | 1818.25 | 1825.10 |

USD/CHF – We had a sell call on this pair on Friday at 0.9190. However, price only reached a high of 0.9174 and our entry order was not filled. Price had reached a low of 0.9125 on Friday with Stochastic also in the oversold zone. MACD remains bearish but there could be a bullish crossover, hinting of a bullish price trend. We are likely to see a test of the 20EMA at 0.9170 in the next 24 hours before another decline to 0.9100 again.

| Support | 0.9125 | 0.9090 | 0.9050 |

| Resistance | 0.9160 | 0.9195 | 0.9220 |