- GBP/JPY seeking a continuation of the bullish momentum.

- Bulls stepping in at a critical support zone.

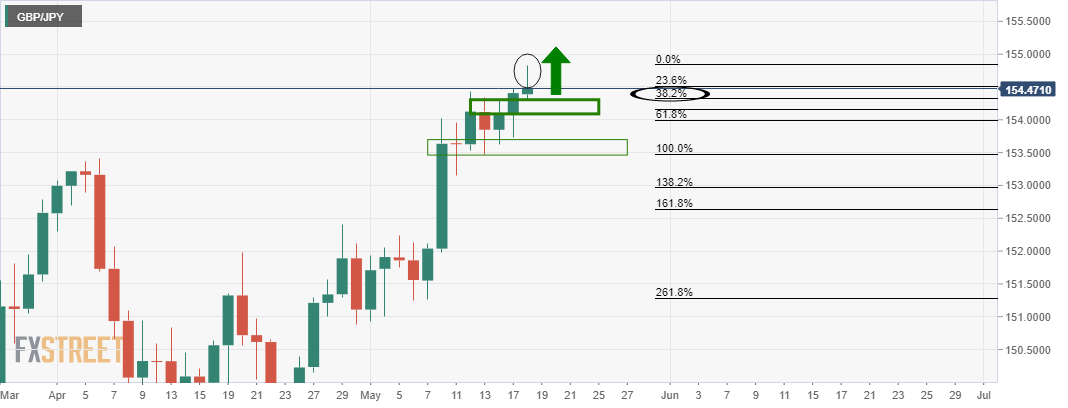

GBP/JPY has printed a fresh cycle high on Tuesday and the bulls are seeking a continuation from the 4-hour confluence of supporting factors.

The following illustrates the bullish bias in a top-down scenario which goes onto analyse the 15-min time frame and market structure.

While the market is bullish, there are prospects of a correction prior to the next leg higher.

The support correlates with a 38.2% Fibonacci retracement.

With that being said, the wick is compelling.

If the market closes higher, then there will be prospects for the wick to be filled in on the lower time frames for the sessions ahead.

As can be seen, there has already been a 38.2% Fibo retracement of the 4-hour bullish impulse which has a confluence of the 10 EMA and prior highs.

A move higher from here would be going towards the highs to fill in the daily wick.

From a lower time frame, bulls will be looking for a bullish environment, such as a bullish 10 /20 EMA crossover, and for a break of the current resistance structure.

On a retest of the structure that would be expected to act as support, bulls will look to engage within the bullish environment and higher probabilities of an upside continuation.