- GBP/USD remains pressured as the US dollar rebounds on taper talks.

- Brexit concerns and UK reopening uncertainty hurts the pound.

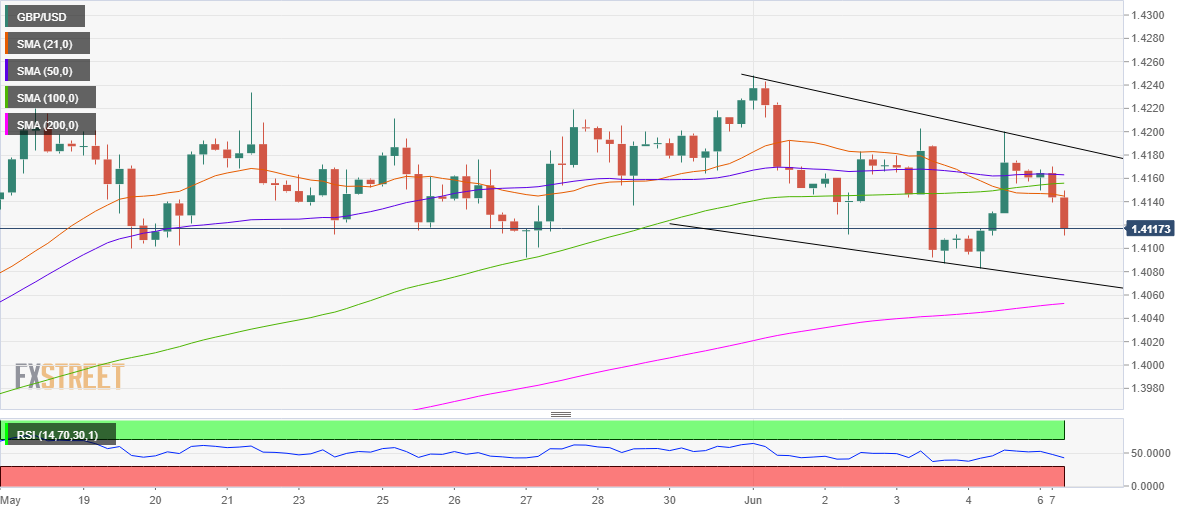

- Cable looks to test falling wedge support on the 4H chart.

GBP/USD is pressured towards the 1.4100, seeing a fresh selling wave in early Europe amid a broad US dollar rebound.

The greenback is showing some signs of life after US Secretary Janet Yellen re-ignited taper talks. Over the weekend, Yellen said that higher interest rates would be a plus for the Fed.

The USD bulls recoup downbeat US NFP-led bruises, as markets turn optimistic about a likely Fed tapering, with Treasury yields heading back towards 1.60%.

On the cable side of the story, investors remain cautious ahead of this week’s EU-UK talks on Northern Ireland (NI) protocol. Meanwhile, US President Joe Biden remains prepared to intervene in the NI issue.

Additionally, growing concerns that the UK may not reopen on June 21 due to rising cases of Indian covid strain collaborates with the additional downside in the spot.

After multiple rejections above 1.4200 in the last week, the spot edges lower while within a falling channel formation on the four-hour chart.

The pair looks to test the channel support at 1.4073 if the 1.4100 cap gives away.

The Relative Strength Index (RSI) is pointing south while below the midline, suggesting deeper declines.

On the flip side, if the GBP bulls fight back control and recapture the bearish 21-simple moving average (SMA) at 1.4145, then the buyers could regain momentum towards 1.4200.

However, the technical setup appears in favor of the bears.