GBP/USD is jumping above 1.4050, as the pound cheers the UK local election outcome, as the UK PM Boris Johnson emerged stronger while Scotland’s SNP fell one seat short of an outright majority. Although the chances of a Scottish second independence referendum still remain in place, the GBP pays a little heed. Meanwhile, the US dollar remains on the back foot after the NFP blow.

Let’s see how GBP/USD is positioned technically, with the focus now on UK GDP and BOE Governor Bailey’s speech.

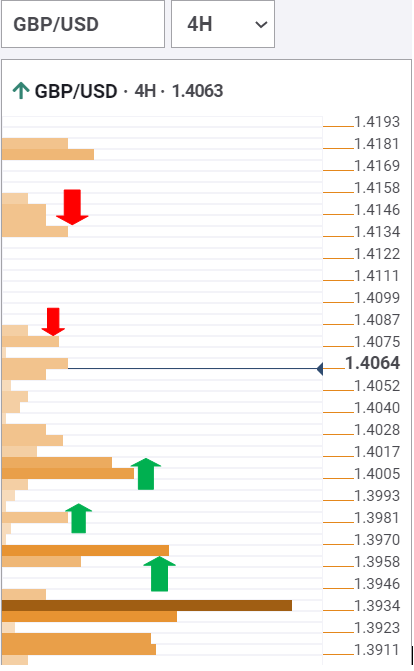

The Technical Confluences Detector shows that GBP/USD’s path of least resistance appears to the upside amid a lack of healthy resistance levels.

At the press time, the cable is flirting with 1.4060, which is the pivot point one-week R1.

The next stop for the bulls is aligned at 1.4080, where the pivot point one-day R2 converges with the Bollinger Band one-hour Upper.

A sustained break above the latter could expose the 1.4100 round number.

Further up, strong resistance awaits around 1.4140, which is the intersection of the pivot point one-week R2 and pivot point one-day R3.

Alternatively, fierce support is placed around 1.4010, the confluence of the previous day high and pivot point one-month R1.

The Fibonacci 23.6% at 1.3981 could come to the rescue of the bulls, below which the Fibonacci 38.2% one-day near 1.3965 could be tested.

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.