- GBP/USD witnessed some selling on Friday and snapped five days of the winning streak.

- Break below an ascending trend-line should pave the way for further near-term weakness.

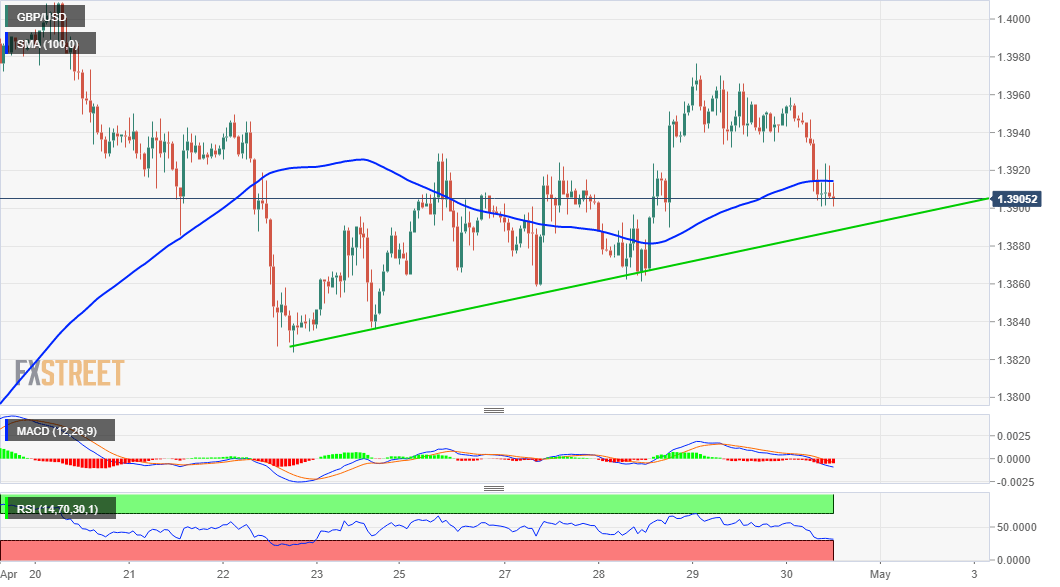

The GBP/USD pair witnessed some selling on the last trading day of the week and extended the previous day’s retracement slide from the 1.3975 region, or over one-week tops. This marked the first day of a negative move in the previous six sessions and dragged the pair below the 1.3900 mark during the early North American session.

The US dollar built on the overnight modest bounce from the lowest level since February 26 and gained traction for the second consecutive session. A modest pullback in the equity markets was seen as a key factor that benefitted the safe-haven greenback, which, in turn, exerted some downward pressure on the GBP/USD pair.

From a technical perspective, the GBP/USD pair has now dropped back closer to a one-week-old ascending trend-line. The mentioned support is pegged near the 1.3885 region, which if broken decisively might prompt some technical selling. The pair might then accelerate the fall towards weekly lows, around the 1.3860-55 region.

Some follow-through selling has the potential to drag the GBP/USD pair further towards the 1.3825-20 intermediate support en-route the 1.3800 mark. The next relevant support is pegged near the 1.3740-35 area, which if broken will set the stage for the resumption of the recent downfall from near three-year lows.

On the flip side, the 1.3960 region now seems to act as immediate strong resistance, above which bulls are likely to make a fresh attempt to conquer the key 1.4000 psychological mark. The subsequent move up has the potential to push the GBP/USD pair towards the 1.4080 intermediate hurdle en-route the 1.4100 mark.