- NYSE:GME rallied for a fourth consecutive day, settling at $ 209.43.

- GameStop had a failed gamma squeeze event, but Redditors refused to show paper hands.

- AMC plummets on Friday as it is revealed to be a decoy for GameStop.

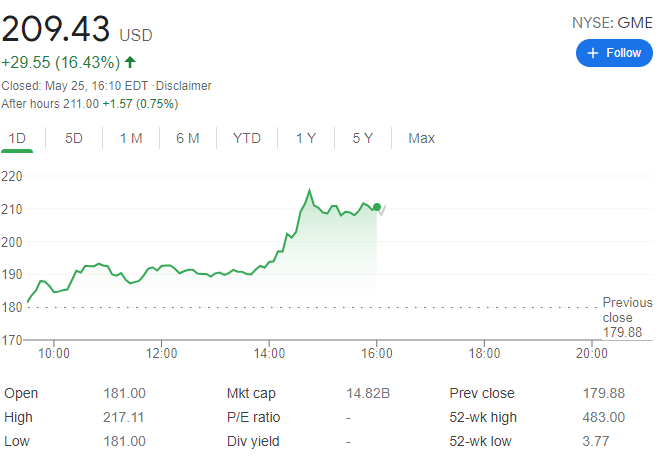

Update: GameStop Corp (NYSE: GME) has finished the day at $ 209.43, advancing for a fourth consecutive session as expected, despite the poor performance of Wall Street. The share added a whopping 16.34% and the break above the 200 threshold will likely boost bullish interest. It peaked at $ 217.11 intraday its highest since mid-March when the Reddit frenzy resulted in a sell-off. Technically speaking, the bullish trend remains firmly in place and there’s room for an extension toward $325 in the near-term.

GME did not quite have the Friday that Redditors were hoping for, but the Reddit discussion boards are still optimistic that the short squeeze is coming. To close the week, GameStop added 3.7% and finished the trading session at $176.69, although shares were down nearly 2% after hours at the time of writing. Despite the volatility this past week, GameStop managed to stay above its 50-day moving average price of $164.36, which may prove to be a support level moving forward.

Stay up to speed with hot stocks’ news!

According to Reddit boards, Friday’s gamma squeeze event may have been mitigated by hedge funds as the battle wages on. A gamma squeeze happens when excessive bullish call buying sets off a series of larger and larger call orders, which leads to the price of the underlying stock skyrocketing. While Friday’s event may have been a failed attempt, Redditors are still optimistic that another short squeeze is coming, and that GameStop will remain the primary battleground between so-called apes and hedge fund managers.

The ongoing short squeeze event originally revolved around AMC (NYSE:AMC), as the hashtag #AMCSqueeze was trending on social media for the past week. Evidently AMC only served as a decoy to the ultimate plan of the GameStop gamma squeeze that was supposed to go down on Friday. AMC plummeted on Friday as Redditors turned their attention back to GameStop. The ongoing saga has already cost short-sellers of GameStop and AMC over $1 billion this week, and if you believe what you read on the discussion boards, the best is still yet to come.

Previous updates

Update: GME shares are trading nearly 3% higher in early Monday, trading at $182. The shares have been struggling for direction lately and have some resistance around current levels. GME shares have not traded above $189 since early April

Update: GameStop Corp (NYSE: GME) is set to extend its gains, rising for the fourth consecutive day on Tuesday after closing just above $180 on Monday. Apart from the psychological victory of ending the day above a round number, another small upside move would send shares to the highest since late March – the second meme stock frenzy. The critical level to watch is $180.60, which is the current May peak. Any close above that point would put GME at a pole position to attack $200. Retail traders have been accumulating equity of the Grapevine, Texas-based company.