- Gold fell to a fresh two-week low on Thursday.

- Near-term technical outlook seems to have turned bearish.

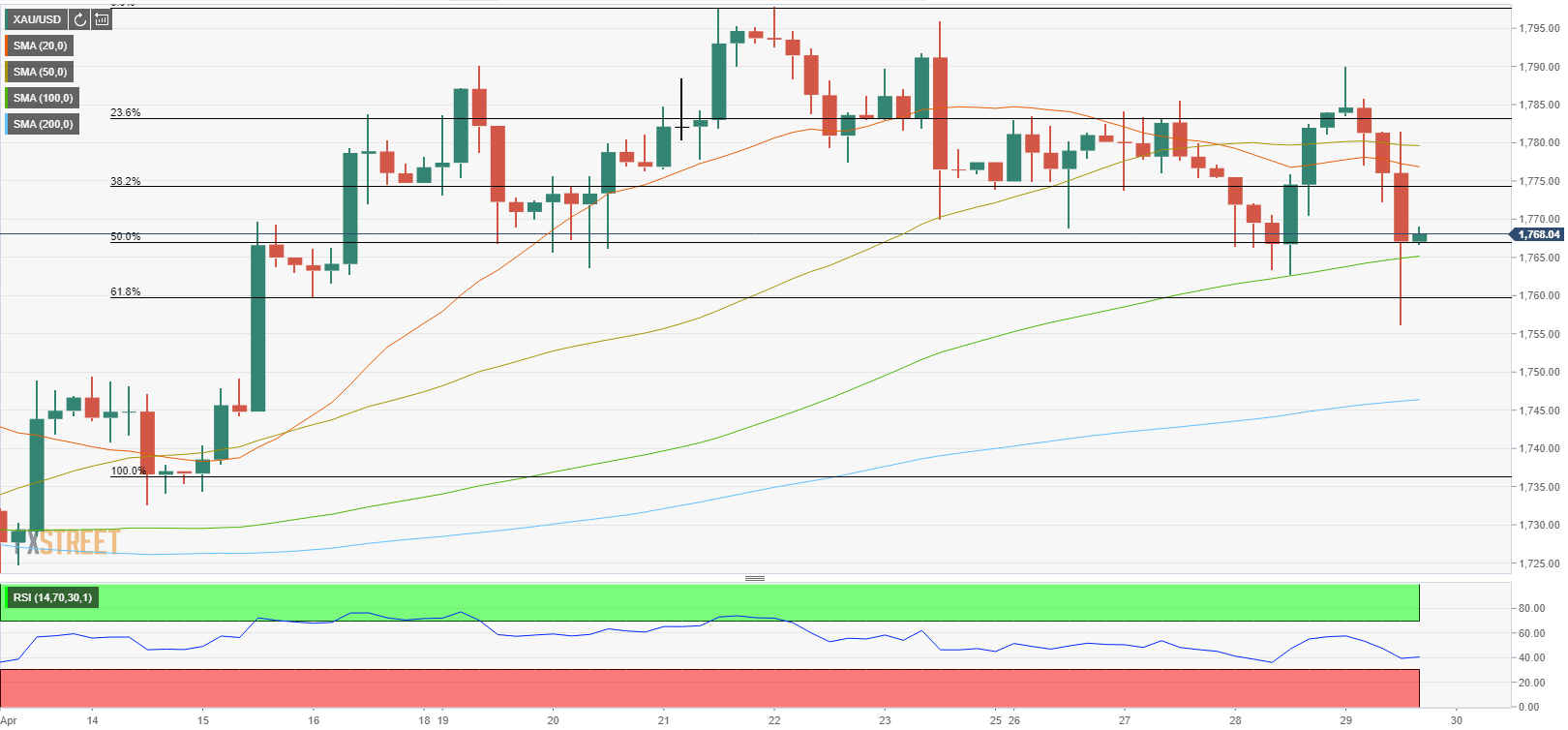

- Initial support for XAU/USD is located at $1,765 ahead of $1,760.

The XAU/USD pair came under strong bearish pressure on Thursday and dropped to its lowest level in two weeks at $1,756. Although the pair managed to erase a small portion of its daily losses, it was last seen losing 0.75% on the day at $1,768. The sharp upsurge witnessed in the 10-year US Treasury bond yields weighed heavily on gold.

The Relative Strength Index on the four-hour chart fell to 40, suggesting that buyers are struggling to retake control of the price. On the downside, the initial support is located at $1,765 (100-period SMA/Fibonacci 50% retracement of the latest uptrend). With a daily close below that level, XAU/USD could retest $1,760 (Fibonacci 61.8% retracement) ahead of $1,747 (200-period SMA).

Resistance align at $1,775 (Fibonacci 38.2% retracement), $1,780 (50-period SMA) and $1,783 (Fibonacci 23.6% retracement).