At the time of writing, XAU/USD is flat in Asia following a mixed day overnight. The price is consolidated at $1,836 following a choppy trading day and steep correction where the dip was an attractive discount for the bulls.

Asia’s sharp equity declines at the start of the week were mirrored as the Europeans came online which transpired into a sour day on Wall Street as well.

The US dollar was mixed against the G10 and gold took advantage of bouts of weakness.

On the eve of the US Consumer Price Index, investors bet that rising inflation could erode the greenback away and the US dollar hit a 2-1/2-month low early in the New York session.

However, the greenback then firmed around those levels on Tuesday afternoon.

Overall, markets believe the Federal Reserve will keep its commitment to low rates and hefty asset purchases which is a supportive factor for the precious metal in the longer run.

In US bond markets, the inflationary concerns amidst the commodities boom pushed yields higher.

The 2-year government bond yields added 1bp from 0.15% to 0.16%, and the 10-year government bond yields rose 3bps from 1.60% to 1.63%.

As for the key data ahead, the market expects that April CPI will rise 0.2%, ”which will push the year-ended pace to 3.6% on base effects,” analysts at Westpac explained.

Elsewhere, the April monthly budget statement deficit is on tap and we will also hear from the Federal reserve’s Vice Chair Clarida who will talk on the US economic outlook.

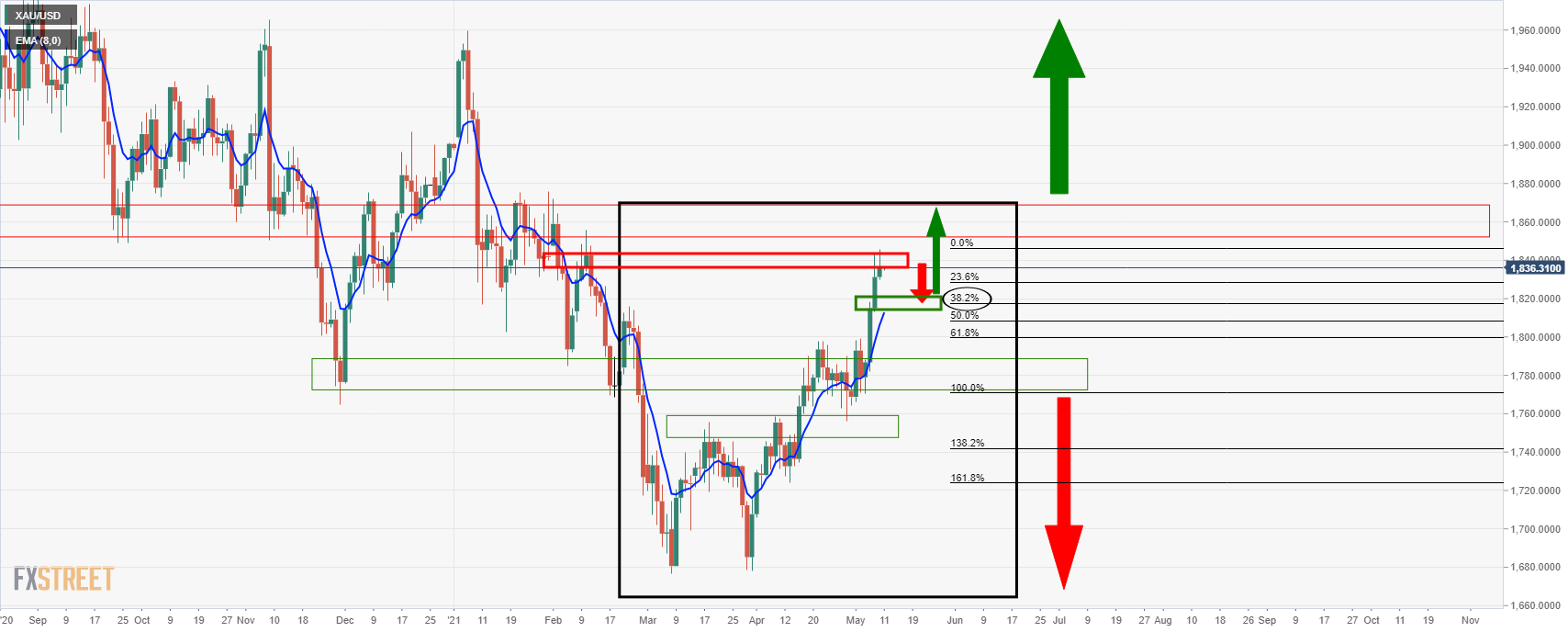

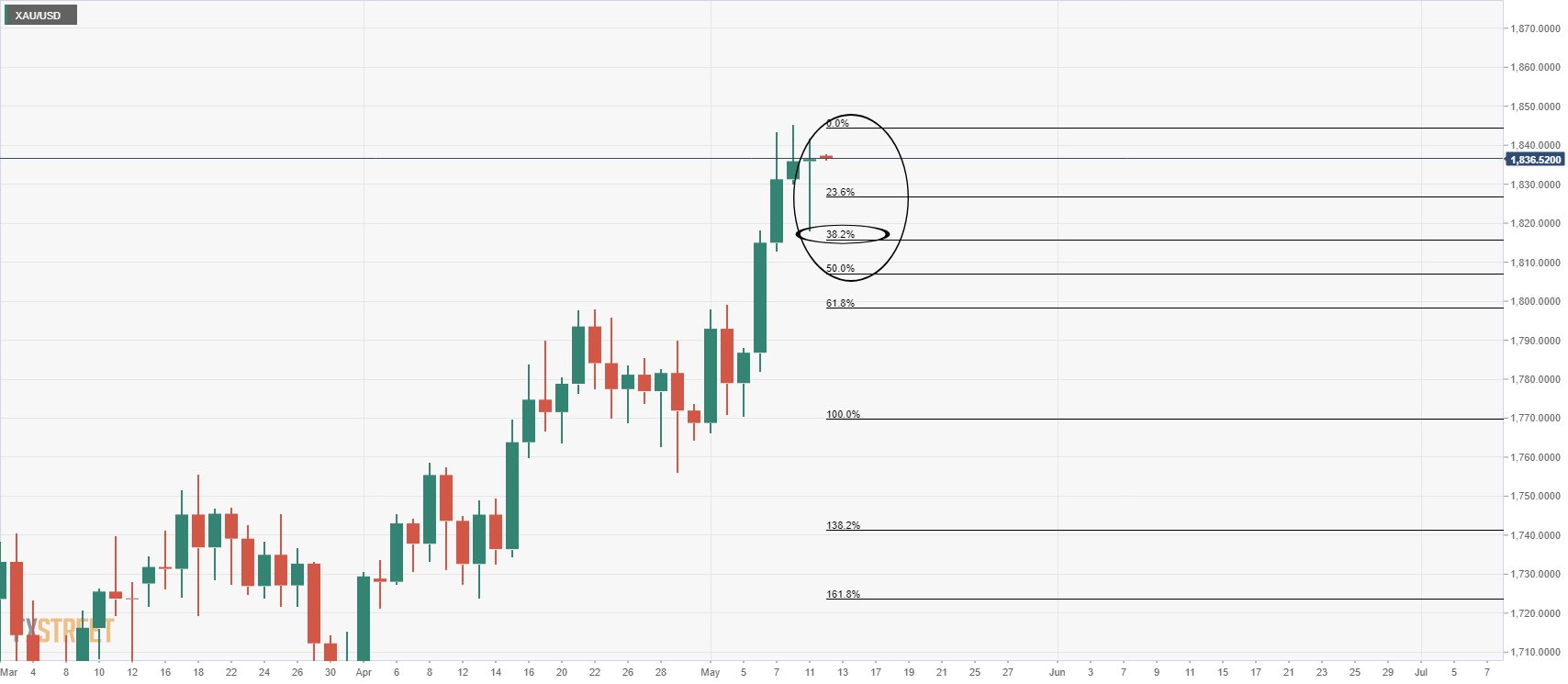

Meanwhile, as per the prior analysis, the price did indeed correct to the 38.2% Fibonacci level as follows:

As pointed out, the current bullish leg is somewhat overextended and the daily chart illustrates just that.

A correction to at least a 38.2% Fibo that meets structure on the lower time frames, such as the 4-hour chart, would have a confluence with the 8 EMA.

If bulls step in there, then it could be the making for an onwards daily bullish market to test deeper into the monthly supply zone, with 1,850 the first port of call.

As illustrated, there was a perfect touch of the level.

However, the bears may not have thrown in the towel just yet and the lower time frames can be monitored for bearish structure.

The price is in a bullish environment on the 4-hour time frame, so a continuation to the upside is a more likely scenario at this juncture.

That being said, if the support breaks, the 8 and 20 EMA bearish crossover coupled with a restest of the old support, that would be expected to then act as resistance, will tip the balance in favour of the bears.

Bears could target a 61.8% Fibonacci retracement of the daily impulse that meets the prior highs and the psychological 1,800s.