- Gold struggled to capitalize on the overnight bounce from the vicinity of the $1,765-60 support.

- The recent pullback and the lack of any follow-through buying warrants caution for bullish traders.

Gold reversed an intraday dip to the $1,774 area and is currently placed near the top end of its daily trading range, around the $1,782-83 region.

Worries that surging COVID-19 infections in some countries could derail the global economic recovery continued lending some support to the safe-haven XAU/USD. Apart from this, the emergence of some fresh selling around the US dollar further benefitted the dollar-denominated commodity. However, a modest pickup in the US Treasury bond yields kept a lid on any further gains for the non-yielding yellow metal.

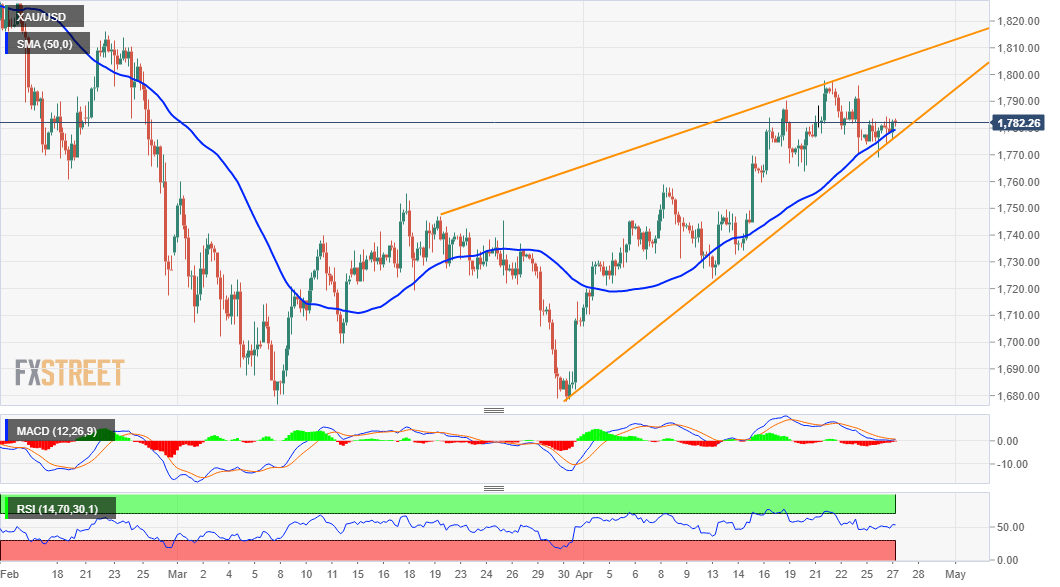

From a technical perspective, the XAU/USD stalled its recent pullback from the vicinity of the $1,800 mark, or two-month tops and found decent support ahead of the $1,765-60 region. The mentioned area marked the neckline resistance breakpoint of a bullish double-bottom formation near the $1,677-76 region. The emergence of some dip-buying near the mentioned resistance-turned-support favours bullish traders.

Meanwhile, technical indicators on hourly/daily charts are holding in the bullish territory and add credence to the constructive set-up. That said, the lack of any strong follow-through buying warrants some caution. Moreover, the recent price action between two converging trend-line now seemed to constitute the formation of a rising wedge, suggesting that the corrective bounce might have run out of steam.

This, in turn, suggests that investors have now moved on the sidelines and await fresh catalyst from the latest FOMC monetary policy decision, due on Wednesday. Hence, it will be prudent to wait for a sustained move beyond the $1,800 mark before positioning for any further appreciating move. Conversely, a convincing break below the $1,765-60 resistance-turned-support might shift the bias back in favour of bearish traders.