Gold price is attempting a 1% recovery so far this Monday, heading towards the $1800 mark amid a sight pullback in the US dollar across the board. The narrative that the Fed’s hawkish stance has tempered the reflation bets seems to have taken a back seat, as the US Treasury yields recover across the curve alongside a turnaround in the risk appetite. The greenback also suffers from an improved market mood, helping gold price stage a decent rebound.

However, with Fed policymakers hinting at sooner than expected rate hikes as early as next year, gold’s upside attempts appear limited. Gold price will remain at the mercy of the dollar’s price action ahead of the Fedspeak, as the data docket remains scarce.

Read: Gold Price Forecast: XAU/USD attempts a bounce amid falling yields, will it last?

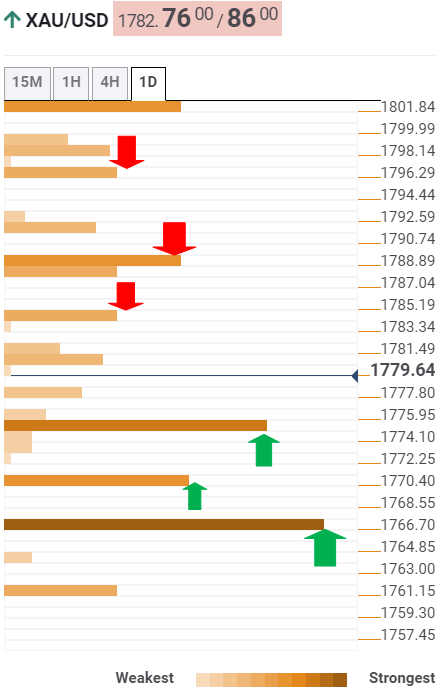

The Technical Confluences Detector shows that gold price is approaching a minor hurdle at the Fibonacci 61.8% one-day of $1785 on the road to recovery.

If the recovery picks up additional strength, then the bulls could target $1788, a confluence of the Fibonacci 23.6% one-week and pivot point one-day R1.

Recapturing the $1797 barrier is critical for gold price to extended the reversal from two-month lows of $1761.

On the flip side, strong support aligns at $1775, which is the convergence of the Fibonacci 38.2% one-day and the previous low one-hour.

The next downside target is envisioned at $1770, the intersection of the Fibonacci 23.6% one-day and SMA5 four-hour.

The previous month’s low at $1766 will be on the sellers’ radars if the above support caves in.

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.