After a negative start to a fresh week on Monday, gold price is back in the green zone, advancing towards two-week highs of $1818 ahead of the critical US inflation release. Though gold bulls may face an uphill battle, as the US dollar rebounds across the board amid a cautious market mood. Concerns over the rapid spread of the Delta covid strain on both sides of the Atlantic seem to dent investors’ risk appetite.

Gold traders remain cautious as well heading into the US CPI data, which may shed more light on the Fed’s timeline for monetary policy normalization. Fed Chair Jerome Powell’s testimony before Congress on Wednesday and Thursday on the monetary policy and inflation outlook will also hold the key for gold’s next direction. Meanwhile, markets ignored upbeat Chinese exports data, which suggested a strong global economic recovery.

Read: Powell Preview: Three reasons to expect the Fed Chair to down the dollar

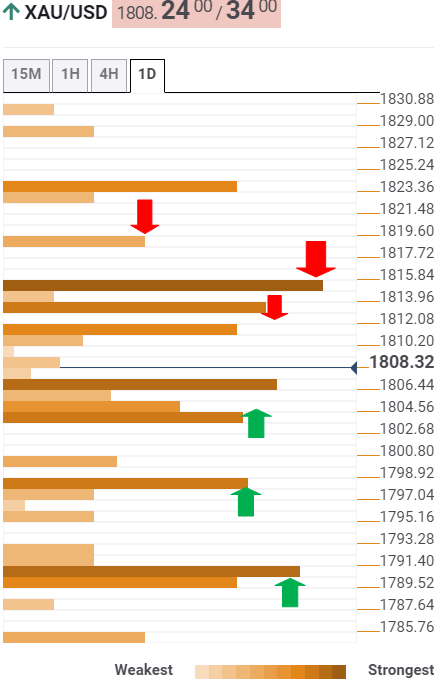

The Technical Confluences Detector shows that gold price is retreating towards powerful support at $1803, which is the convergence of the Fibonacci 61.8% one-day and SMA5 one-day.

The next support awaits at the intersection of the SMA50 four-hour and the Fibonacci 61.8% one-week at $1798.

Further south, the last line of defense for gold bulls appears at $1791, where the Fibonacci 23.6% one-month, SMA10 one-day and pivot-point one-week S1 coincide.

Alternatively, a firm break above a dense cluster of healthy resistance levels around $1812 could expose a fierce hurdle at $1815.

That level is the confluence of the pivot point one-day R1 and Fibonacci 38.2% one-month.

Buyers will then aim for the previous week’s high of $1818.

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.