The Leading Index could give investors another Q1 2024 snapshot of the Japanese economy. According to the preliminary report, the Leading Index declined by 0.7% to 111.4 in March. Softer-than-expected numbers could reduce bets on a June BoJ rate hike and buyer demand for the Yen.

Beyond the numbers, investors should consider policy chatter from Beijing and the Bank of Japan. Bank of Japan Governor Kazuo Ueda is on the calendar to speak on Monday.

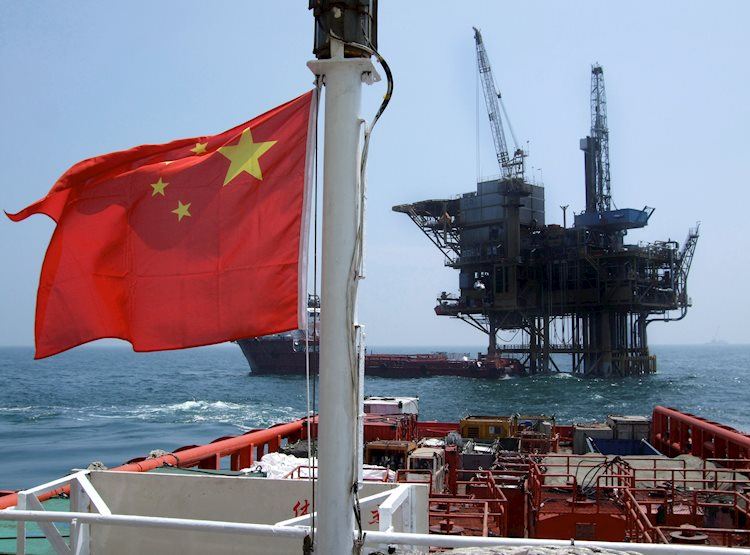

Commodities: Crude Oil, Gold, and Iron Ore

On Friday, gold spot (XAU/USD) gained 0.20% to close the session at $2,333.83. Furthermore, WTI crude oil rallied 1.11%, ending the Friday session at $77.72.

On the Singapore Futures Exchange, iron ore prices were down 0.14% on Monday. Additionally, iron ore spot gained 0.28% on Friday.

The USD/JPY and the Nikkei

The USD/JPY extended its winning streak to three sessions, advancing 0.05% on Friday to end the session at 156.959. A weaker Japanese Yen could drive buyer demand for Nikkei-listed export stocks. However, Bank of Japan chatter or intervention threats from the Japanese government need monitoring.

The Futures Markets

On Monday, the ASX 200 and the Nikkei Index were up 47 and 200 points, respectively.