SOPA Images/LightRocket via Getty Images

The stock price of Abiomed (NASDAQ: ABMD), a medical devices company best known for Impella, the world’s smallest heart pump, looks attractive at current levels of $280, despite it being up 2x from the levels of $132 it was at on March 23, 2020, when broader markets made a bottom due to the spread of Covid-19. This marks a significant outperformance compared to the S&P which has moved 85% since its March 2020 lows, with the resumption of economic activities as lockdowns are gradually lifted and vaccination programs have been initiated in multiple countries. This outperformance of Abiomed can be attributed to higher demand for Impella 5.5, and the company’s better than estimated results over the recent quarters. Impella helps pump blood out of the heart and pumping it into the aorta, bypassing the left ventricle. The device has gained popularity over the last few years, and this has led to strong sales growth for Abiomed.

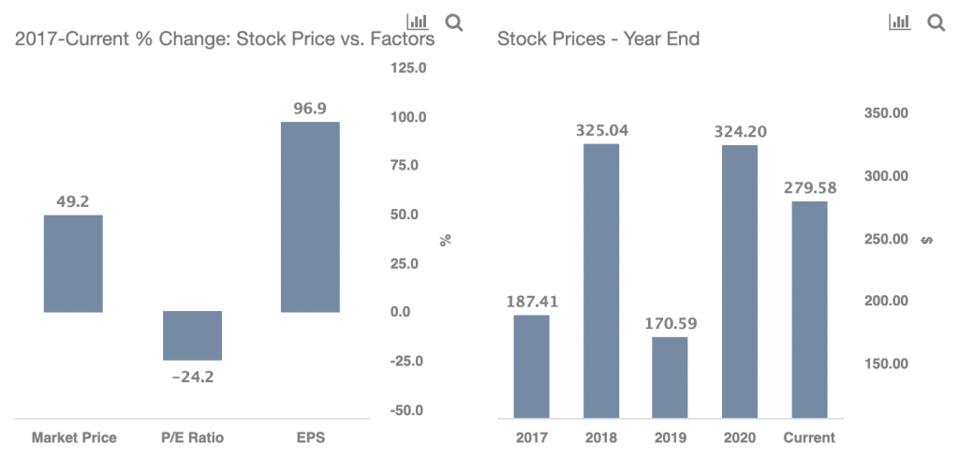

ABMD stock is also up 49% from the levels of around $190 seen toward the end of 2017. The 49% rise over the last three years or so appears to be low, given the robust fundamentals of the company. Abiomed’s total revenue grew a solid 43% to $847 million in fiscal 2021 (fiscal ends in March), compared to $594 million in fiscal 2018. Also, the company saw an expansion of 770 bps for its net margins to 26.6% in 2021, compared to 18.9% in 2018, resulting in a 101% growth in net income. The company’s total shares saw a growth of 2% over this period, and on a per share basis, earnings grew a solid 97% to $5.00 in 2021, as compared to $2.54 in 2018. Despite the robust performance over the recent years, Abiomed’s P/E multiple has contracted from a large 128x in 2018 to 56x currently. While these numbers optically appear to be high, high multiples are common for fast growing companies. Our dashboard, ‘What Factors Drove 49% Change In Abiomed Stock between 2018 and now?‘, has the underlying numbers.

So what’s the likely trigger and timing for upside?

Trefis

For Abiomed, the revenue growth over the recent years has been driven by market share gains for Impella. Looking at geography-wise breakup of revenue, the U.S. accounts for over 80% of the company’s total sales. Although the company posted an overall revenue growth of 1% in fiscal 2021, the U.S. sales actually declined 2%, which was more than offset by growth in Europe, Japan, and other international markets.

We know that the fiscal 2021 sales were impacted by the Covid-19 pandemic, resulting in deferment of elective surgeries. But now that the economies are opening up gradually with large scale vaccination programs underway in several countries, the overall volume of procedures is expected to rise, boding well for the demand for Impella, both in the U.S. as well as in other geographies.

MORE FOR YOU

Abiomed has over one thousand patents worldwide for Impella that will help maintain its pricing. Note that Impella can cost over 25 times compared to intra-aortic balloon pump. While both the products help pump blood, the studies have shown that Impella heart pump has fewer adverse effects as well as fewer repeated hospital re-admissions, compared to IABP.

Abiomed does not have debt on its books, while its cash and investments balance is around $850 million. Overall, Abiomed will likely continue to see strong sales growth over the coming years, boding well for its stock. Now that the stock has corrected over 20% from its highs of over $350 seen last month, it offers a good entry point for long-term investors, in our view. That said, any further recovery in the economy and its timing hinge on the broader containment of the coronavirus spread. Our dashboard Trends In U.S. Covid-19 Cases And Vaccination provides an overview of how the pandemic has been spreading in the U.S. and contrasts with trends in Israel.

While ABMD stock may see higher levels, 2020 has created many pricing discontinuities which can offer attractive trading opportunities. For example, you’ll be surprised how counter-intuitive the stock valuation is for TJX vs Abiomed.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

/https://specials-images.forbesimg.com/imageserve/60adf6fe6a0aee6e2bb5b640/0x0.jpg)