Investor appetite for equities has diminished from “extremely elevated levels” over the last two weeks, prompting questions about how much demand may still be left to push stocks higher, according to strategists at Deutsche Bank.

Equity fund inflows have slowed since surging from November through mid-March, amid concerns that momentum in the economic recovery has peaked, Deutsche strategists said in a research report on Friday. Flows into stock funds have fallen well below the $68 billion a week seen at the height of the surge, they said, though equities still have attracted a “robust” $17 billion a week over the past month.

Household and pension fund positioning in stocks are near record levels following the strong stock-market rally over the past year, with household allocations “just under the all-time high seen in early 2000 at the peak of the equity bubble,” the strategists noted. Meanwhile, some drivers of the stock market appear constrained or diminished, their analysis of “incremental potential demand” shows.

“As earnings recover, corporate buybacks should rise to a new record but are unlikely to provide a meaningful boost to equities,” partly due to the increase in stock prices, the strategists said. In another example, they said “systematic strategies have limited room to add to their equity allocation while any loss of equity momentum will see them start to sell.”

Individual investors, meanwhile, have been retreating from the stock market by some measures, according to the strategists’ research. Take call option buying, a bullish strategy where investors purchase an option to buy assets at an agreed price by a particular date.

“Retail driven call buying in single stocks had been a powerful driver of equities over the last year,” they said. “Call volumes began sliding in late January, and have continued to do so.”

Meanwhile, piles of cash are sitting on the sidelines, offering one source of potential fuel.

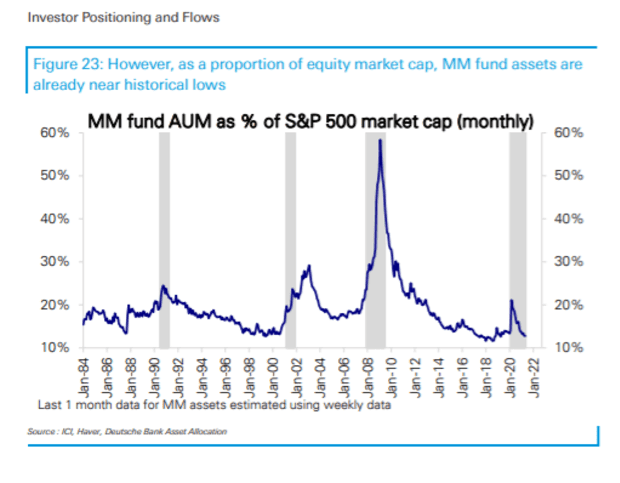

Cash in money-market funds rose by more than $1 trillion during the shock of the pandemic last year — and “has yet to be unwound,” according to the Deutsche note. But while money-market funds assets stand at an historically high level of around $4.5 trillion, those assets are near all-time lows when viewed as a proportion of equity market value, the report shows.

Esty Dwek, global market strategist at Natixis Investment Managers, expects that cash will find its way into the stock market, which she says can keep pushing higher against a backdrop of economic growth, fiscal support that is “here to stay,” and an accommodative Federal Reserve.

“Equities is still the place to be,” she said in a phone interview Monday. “We’ve been in a rebound from a very big crisis; we’re coming back to normal and the environment is still positive.”

Even if the economy is “not necessarily improving as much,” Dwek expects it will probably keep strengthening “for a number of months.” For example, earnings are set to rebound “very strongly,” she said.

Read: Fed’s Evans blames weak jobs report on ‘growing pains’ but sees strong job growth for rest of 2021

But the biggest part of the stock-market rally may be behind us after major U.S. benchmarks rose to a series of new highs this year.

“The equity market is fully valued” when viewed at the index level, said Matt Peron, director of research at Janus Henderson, in a phone interview Monday. The Dow Jones Industrial Average index

DJIA,

-0.10%

closed Monday down 0.1%, while the S&P 500

SPX,

-1.04%

fell 1% and the Nasdaq Composite

COMP,

-2.55%

slid about 2.6%.

Still, looking “under the covers,” stocks have room to run on the reflation trade, Peron said. That means stocks in sectors such as industrials, materials, energy and financial services may still benefit from the economic reopening, even as major U.S. stock indexes struggle to grind higher from their peaks, he explained.

“We’re not done with the growth impulse that we’ve had from the reopening from fiscal and monetary policy,” said Peron. “It’ll continue to propel economic growth.”