- NYSE:NIO fell by 0.29% on Wednesday during a whipsaw session amidst a key Fed announcement.

- Nio CEO William Li anticipates 90% of new vehicle purchases in China by 2030 will be new energy vehicles.

- American automaker General Motors announces it is upping its spending in the electric vehicle sector.

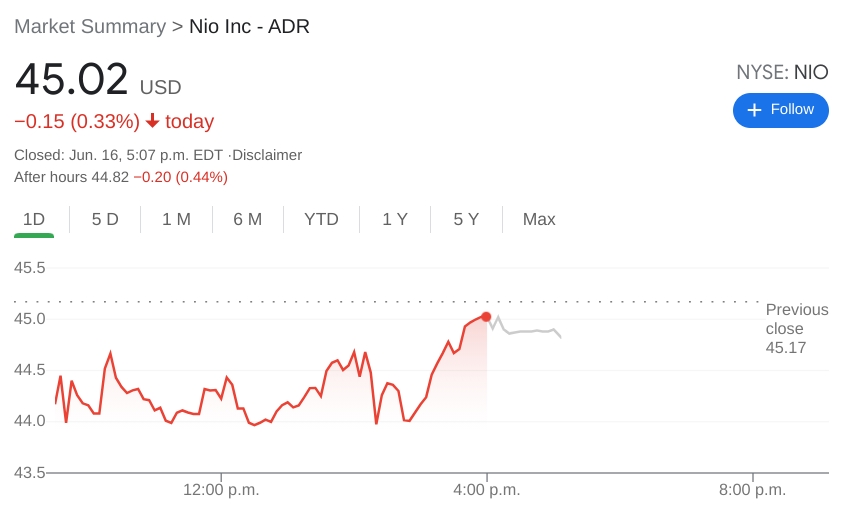

NYSE:NIO showed some excellent relative strength during a roller coaster session on Wednesday that saw shares dip as low as $43.77 during intraday trading. Shares of Nio closed the day at $45.02, after ending lower by 0.29% at the closing bell. Nio broke through its prior resistance level but it seems as though this was a fake breakout as shares immediately bounced back down. It is encouraging for investors that Nio found a higher support level on the way down though, so the bullish trend is intact as the stock continues to make higher highs and higher lows.

Stay up to speed with hot stocks’ news!

Chinese electric vehicle heavyweights weighed in on the future of the domestic industry which included Nio CEO WIlliam Li and BYD founder Wang Chuanfu. Li gave a bullish forecast as he said he believes that 90% of new vehicle purchases by 2030 will be new energy vehicles, so either hybrid or fully electric. Chuanfu was not as bullish, but he still believes that there will be at the very minimum a 70% penetration of the market by 2030.

Stateside, General Motors (NYSE:GM) announced on Wednesday that it was upping its spending on its electric and autonomous vehicle models. The iconic automaker is increasing spending to $35 billion through 2025, which represents a 30% rise from its current budget. Companies like GM and Ford (NYSE:F) are trying to play catch up to Nio and Tesla (NASDAQ:TSLA), and it’s clear that no amount is too much to get involved in the electric vehicle race.