- NYSE:NIO dipped by 0.85% on Monday, as cyclical sectors bounced back with the Dow gaining 1.76%.

- Electric vehicle stocks finished lower as investors see oil demand rising.

- Nio rival Tesla ramps up its technology with its first ever AI Day.

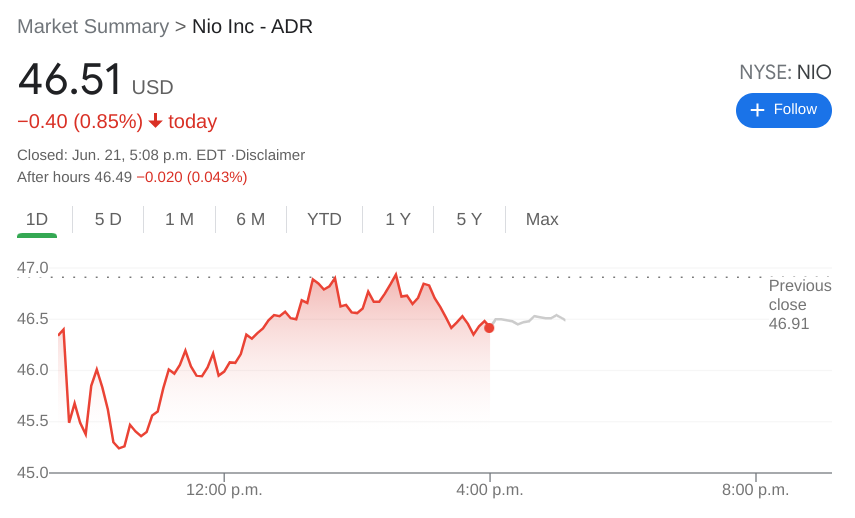

NYSE:NIO struggled to gain any traction to start the week as the electric vehicle sector stalled on Monday alongside growth sectors across the broader markets. Shares of Nio closed the trading session at $46.51, after trimming 0.85%. Nio has still managed to stay above both the 50-day and 200-day moving averages after its recent surge, although the price level of $47.13 seems to be acting as a new point of resistance. This price level acted as the start of a descending wedge formation that began on March 2nd, and continued until the recent breakout.

Stay up to speed with hot stocks’ news!

Nio wasn’t the only EV stock to struggle on Monday, as industry leader Tesla (NASDAQ:TSLA) alternated between green and red throughout the session, before finally finishing the day down 0.40%. Li Auto (NASDAQ:LI) finished the day flat, while XPeng (NYSE:XPEV) saw the most substantial loss out of the big EV companies with a 3.54% decline. Much of this was due to a sudden rotation back to cyclical sectors like banking, as well as a 4% gain from the broader energy sector as new Iranian President-elect Ebrahim Raisi noted he would not negotiate nor meet with President Biden.

Tesla did take actions to improve its upcoming technology advancements as the company announced its first ever AI Day event. This event is meant to showcase Tesla’s recent technology projects, as well as for recruiting new talent to its ever growing artificial intelligence department. It is anticipated that Full Self Driving or FSD technology will be one of the key focal points, a feature that Tesla drivers have long been waiting for.