- NYSE:PLTR drops again on Tuesday, down over 3%.

- Palantir CEO Alex Karp receives a $1 billion payday for 2020.

- Palantir has seen heavy insider selling over the last quarter.

Update May 4 PM: PLTR shares are suffering a steep fall on Tuesday in a broader risk-off environment. The stock has been under pressure as news emerged of the CEO’s massive share award since taking PLTR public. A number of PLTR insiders have also been permitted to sell their shares after the expiry of a lockup period and this is what they have been doing. Cathie Wood or ARK continues to make large block purchases in April.

Update May 4: Palantir Technologies Inc (NYSE: PLTR) is facing a sixth consecutive day of declines, as after-hours data is pointing to another loss of 0.18% after shares of the Denver-based tech company fell by 3.17% on Monday. While daily losses have been relatively modest in comparison to the equity’s swings, the accumulated effect is significant. Critical support awaits at $21.78, which was the closing trough in April. Will bargain-seeker jump in and prevent another day of falls?

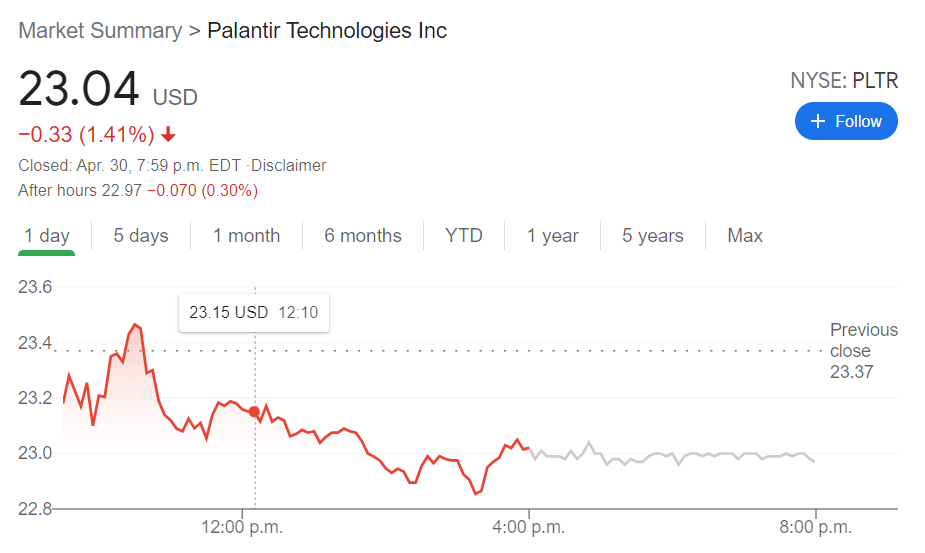

NYSE:PLTR has proven to be a frustrating stock to own for investors when it is not the target of a coordinated Reddit short squeeze. Palantir has spent the last two months consolidating around the $23.00 price level, and on Friday the stock extended its losses as it fell a further 1.41% to close out the trading week at $23.04. Shares have plateaued and this is evidenced by the 50-day and 200-day moving average being nearly equal at $23.63 and $23.31 respectively. Despite remaining popular amongst retail investors, Palantir has not been able to make any upward movement back towards its all-time high price of $45.00.

Stay up to speed with hot stocks’ news!

Palantir’s management is back in the headlines just weeks after several high-ranking executives sold off millions of dollars in stock after the IPO lockup period had expired. This time, it was reported that CEO Alex Karp received $1 billion for bringing the company public last year as well as other incentivized accomplishments. The breakdown of the $1 billion includes $797.9 million in options and $296.4 million worth of stock. This is quite the raise for Karp who only netted a salary of $12.1 million the year before.

Palantir is just the latest tech company to announce that it will be reporting its quarterly earnings to shareholders on May 11th. All eyes will be on how Palantir performed this quarter, after a somewhat disappointing Double Click Demo Day that showed off its Foundry platform to potential clients around the world. Wall Street will also be paying attention to see if Palantir has been able to successfully create more commercial clients, as one of the biggest knocks against the company is its reliance on the U.S. Government.