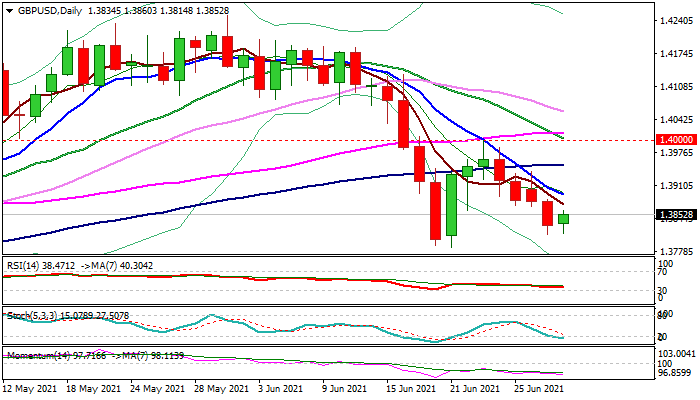

The GBP/USD passed the support of the 1.3860 level and declined to the support of the lower trend line of the channel down pattern. The trend line provided the pair with enough support for a recovery to the 1.3860 level.

The 1.3860 marks managed to provide enough resistance for the pair to decline. By the middle of Wednesday’s trading, the GBP/USD had reached the 1.3820 marks, which appeared to be providing support. If the rate recovers from the 1.3820 level, it would eventually face the resistance of the 1.3860 marks and the 55-hour simple moving average, which would approach from above. Read more…

Cable bounced on Wednesday after retesting 1.3814 (one-week low posted on Tuesday), as traders took some profits from a four-day drop. Near-term bears face headwinds from strong bids at 1.3800 zones (1.13814 (Today/Tue lows / 1.3791/86 – lows of June 18/21) but the overall picture remains bearish on daily chart.

Limited correction is seen likely before bears re-take control, as negative momentum continues to rise and daily moving averages are in bearish configuration. Falling 10DMA offers solid resistance at 1.3891, ahead of 100DMA / daily cloud base (1.3950) which should cap upticks and protect 1.40 breakpoint (psychological barrier, reinforced by falling 20DMA / recent recovery spike high). Read more…

It has been a brilliant night for Sterling – Footballer Raheem Sterling, not the currency. England beat Germany 2:0 in a high-stakes match, thrilling Brits that were glued to their TV sets. However, pound sterling bulls glued to their screens could find little solace in the pair’s performance.

The British currency has been suffering from several worries. First, the rapid spread of the Delta coronavirus variant is weighing on sentiment. While the UK will likely ease restrictions on July 19 as planned, concerns about a harsh winter are rising. That dampens the prospects for the economy moving forward. Read more…