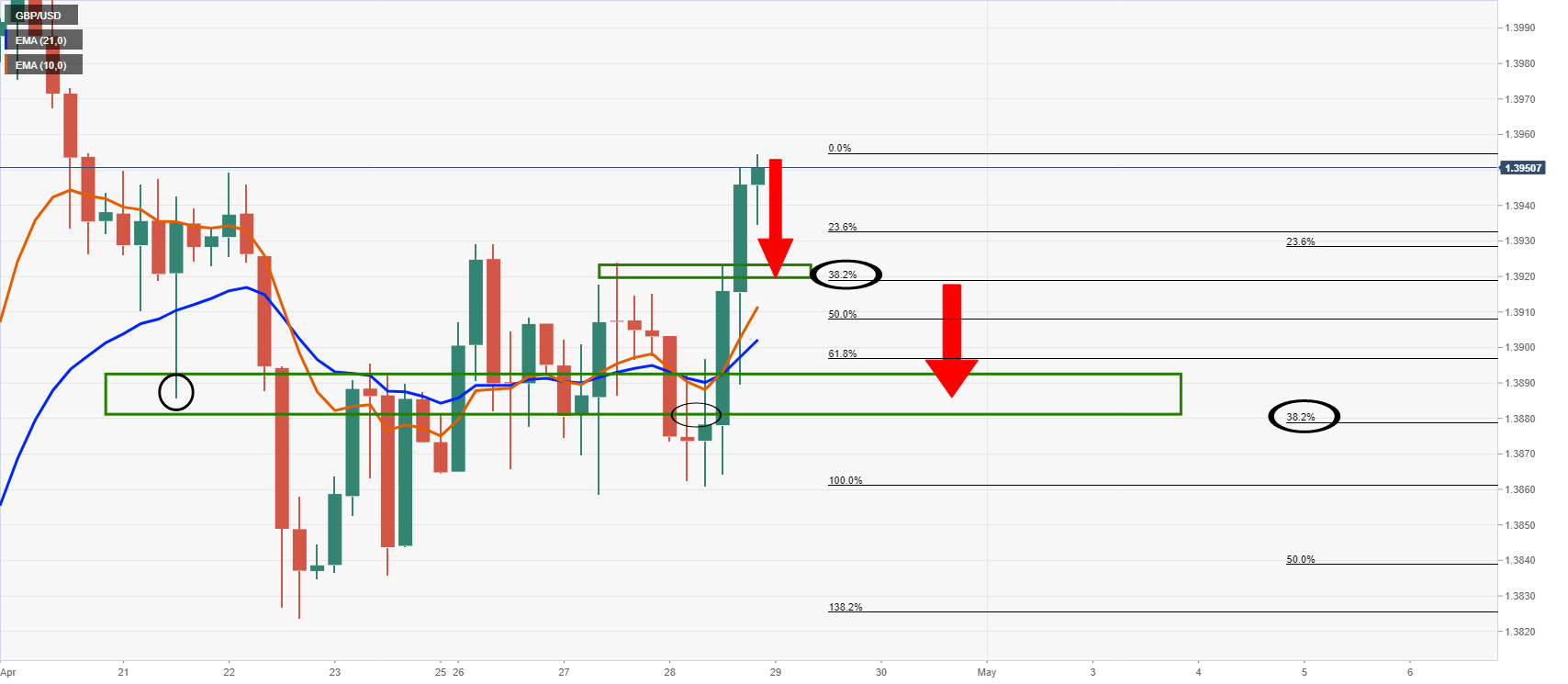

As per the prior analysis, GBP/USD Price Analysis: Bulls await a discount in probable daily continuation, the price has indeed moved lower but the upside prospects are in jeopardy considering the 4-hour resistance structure.

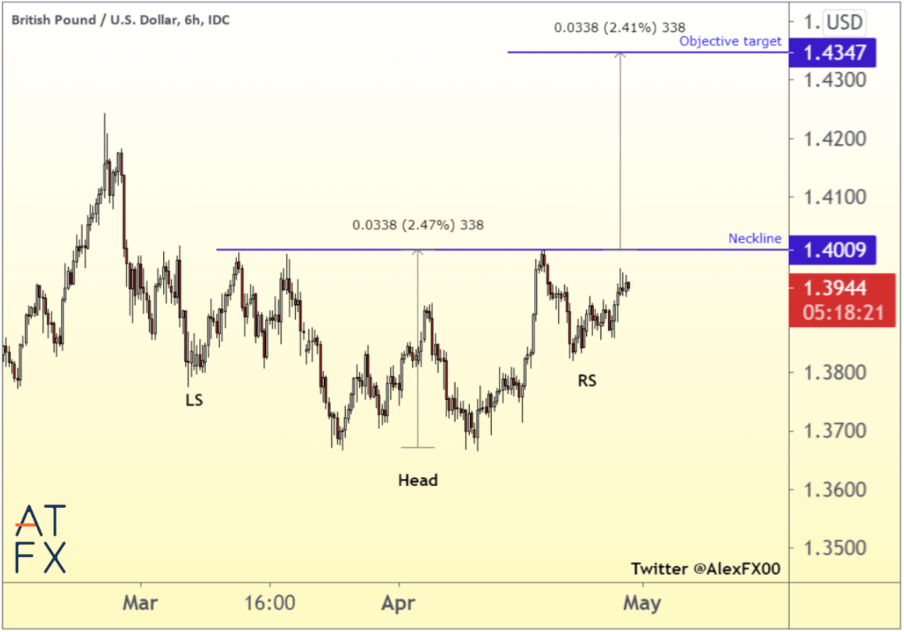

Since March 1, the GBP/USD has been trading sideways. At one point, it looked like the price was heading towards 1.33. Yet, the price has stabilised, and from a technical point of view, the price might be in the process of carving out an inverse head and shoulders pattern, with a target of 1.4353. The fundamental outlook is also favourable.

The British economy was one of the hardest hit by the pandemic, given its services orientation. Its weakness could now be its strength as the UK economy is set to reopen faster than most other countries, given that at least 50% of the total UK population has received at least one vaccine shot. The US is lagging at 42%. The Bank of England’s quantitative easing program is also due to end by the end of the year. I don’t think the BoE will turn hawkish anytime soon, but just letting QE expire could be bullish enough.