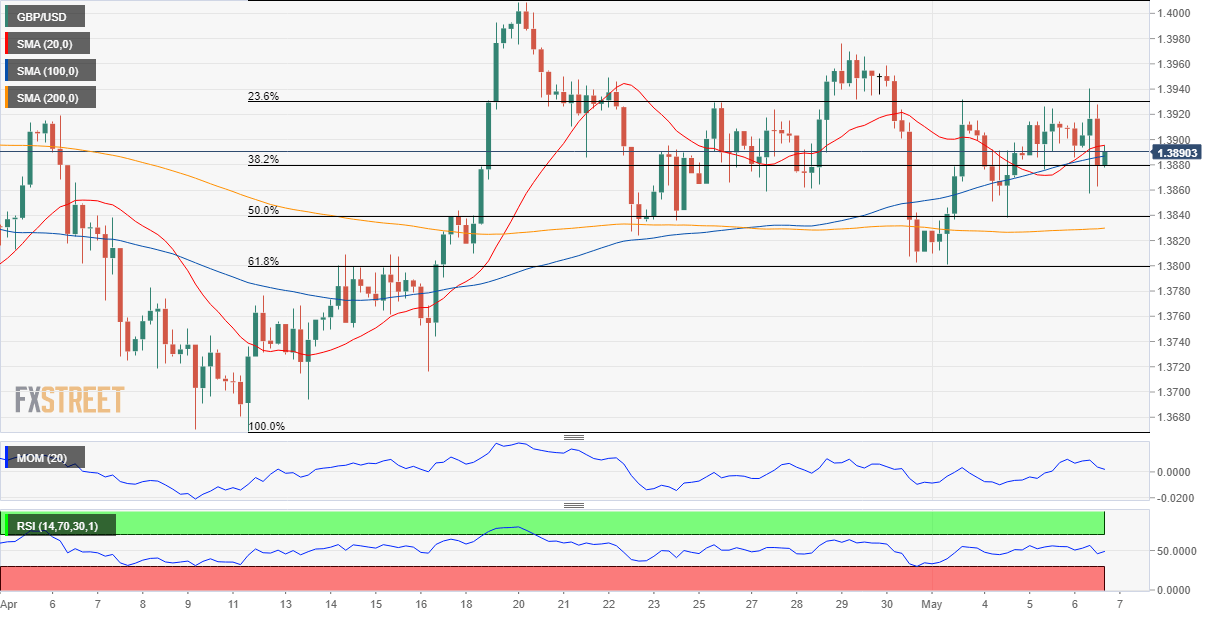

GBP/USD stays firm around 1.3900 after a wild Thursday that summed up trading on a negative side. In doing so, the cable pair benefits from the latest Brexit-positive news while waiting for the fresh clues ahead of the US Nonfarm Payrolls (NFP) and recent election results. The Bank of England’s (BOE) revised up the UK’s growth forecasts for 2021 while expecting a pullback in GDP during 2022. The “Old Lady” also sees 2021 inflation averaging 2.5% during the previous day’s announcements.

The GBP/USD pair ends Thursday pretty much unchanged, trading a handful of pips below the 1.3900 figure. The pair seesawed between gains and losses as the Bank of England announced its latest decision on monetary policy. The central bank left the benchmark interest rate unchanged at 0.10% and kept the Asset Purchase Facility steady at GBP895 billion as widely expected. The BOE also slowed the pace of weekly bond-buying and expects purchases to end around late 2021. Finally, policymakers upwardly revised growth and inflation forecasts, as they now expect the GDP to reach 7.25% in 2021 and 5.75% in 2022 and see 2021 inflation averaging 2.5%.