Football is not coming home, it is going to Rome – England’s dreams of winning the Euro 2020 football tournament have been shattered after an exhausting final in which Italy won. British traders have woken up tired, but forex never sleeps and sterling is on the move – to the downside.

“Freedom Day” may be less free than earlier anticipated. While the UK is set to lift a substantial set of restrictions on July 19, the persistent spread of COVID-19 cases has prompted ministers to suggest that wearing masks indoors and other rules will stay intact. Hints of a slower return to normal mean a weaker recovery. Read more…

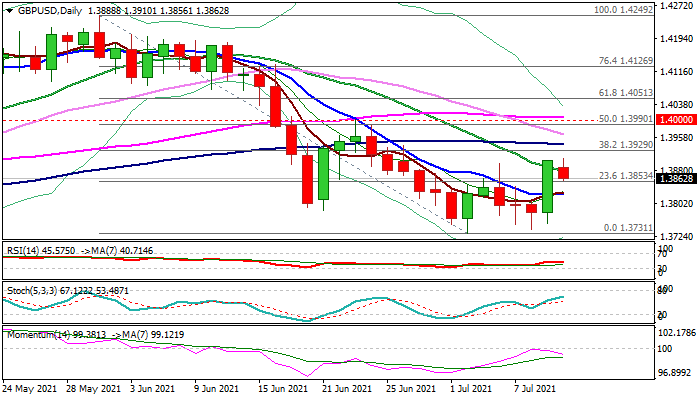

During the early hours of this week’s trading, the GBP/USD currency exchange rate bounced off the resistance of a zone that surround the 1.3900 level. By the middle of Monday’s trading, the rate was expected to look for support near the 1.3850 level.

Near the 1.3850 level, the rate could find support in the weekly simple pivot point at 1.3853 and the last week’s significant zone near 1.3840. If these levels would be passed, the pair could reach the combined support of the 55, 100 and 200-hour simple moving averages near 1.3820. Read more…

Cable is consolidating under a new two-week high (1.3904), posted after Friday’s 0.9% rally, as sterling accelerated higher on fresh risk mode, inspired by global equity gains. Pound’s sentiment improves on expectations that the government would remove nearly all coronavirus restrictions on July 19, while weaker dollar adds to a positive near-term outlook.

Fresh bulls need to clear important barriers at 1.3929/59 (Fibo 38.2% of 1.4249/1.3731 fall/daily cloud base) to generate a stronger reversal signal, which would require a break of the key 1.40 resistance zone for confirmation. Read more…