Is the downside correction over? Not so fast, as GBP/USD has yet to make a convincing pullback that would allow for further gains. Markets are in a risk-off mood due to several factors. The escalating conflict between Israel and Palestinian faction Hamas is the latest factor to dampen the mood, joining the ransomware attack that has paralyzed gasoline supplies to the US northeast.

However, the latest concern is of inflation rearing its ugly head in the US. While disappointing Nonfarm Payrolls showed the world’s largest economy is cooling down, fears quickly reemerged. Are these concerns exaggerated? America publishes Consumer Price Index data for April later in the day, and core prices are set to top the 2% level. The calendar is pointing to a jump from 1.6% to 2.3% YoY. Read more…

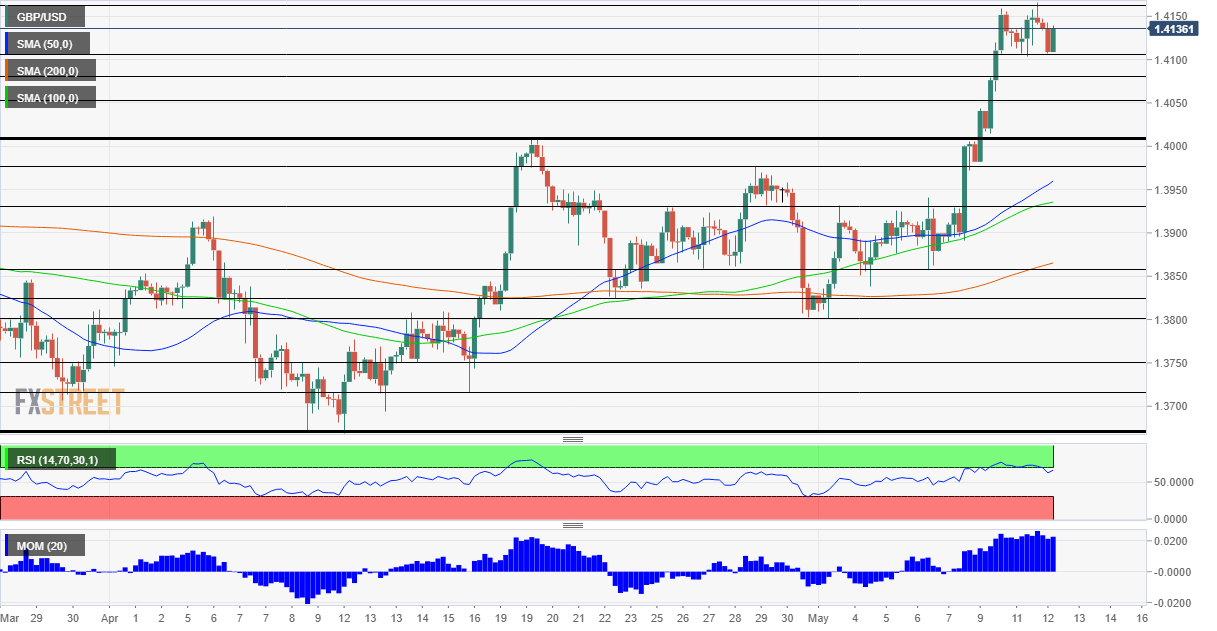

Cable ticked higher after better than expected UK March GDP (2.1% vs 1.3% f/c) but remains within Tuesday’s range, signaling that strong rally of past three days is paused. Signals are mixed as positive momentum on daily chart is rising and moving averages in bullish setup are heading north, with Monday’s massive bullish candle underpinning the action, but overbought stochastic and long upper shadows of Mon/Tue daily candles warn that bulls are running out of steam.

Bullish continuation scenario requires extended consolidation above important support at 1.41 before bulls resume towards targets at 1.4181 (Feb 25 high) and 1.4238 (2021 peak). Read more…

GBP/USD has been retreating from the highs amid a worsening market mood. Is the downside correction over? Not so fast, as GBP/USD has yet to make a convincing pullback that would allow for further gains. As FXStreet’s Analyst Yohay Elam notes, sterling is hobbled by overbought conditions – US inflation data is critical to the dollar’s next moves.

“America publishes Consumer Price Index data for April later in the day, and core prices are set to top the 2% level. The calendar is pointing to a jump from 1.6% to 2.3% YoY. The greenback’s recovery and the damp mood in markets are showing that unless Core CPI leaps considerably beyond estimates, the dollar could snap back in a ‘buy the rumor, sell the fact’ response.” Read more…

-637564178163746468.png)