Is it coming home? That is the question on most Brits’ minds ahead of England’s football semifinal against Denmark later in the day. The match may distract some forex traders away from GBP/USD. UK consumer spending may also get a boost – economists expect Brits to down some 50,000 pints of beer per minute around the game.

Yet not only Manchester City midfielder Raheem Sterling is set to shine but also pound sterling – at least against the dollar. The greenback advanced on Tuesday despite a substantial drop in the ISM Services Purchasing Managers’ Index. Signs of a cooldown in the world’s largest economy – and the consequent fall in Treasury yields – failed to stop the dollar. Can this last? On Wednesday, the tables may turn against the dollar. Read more…

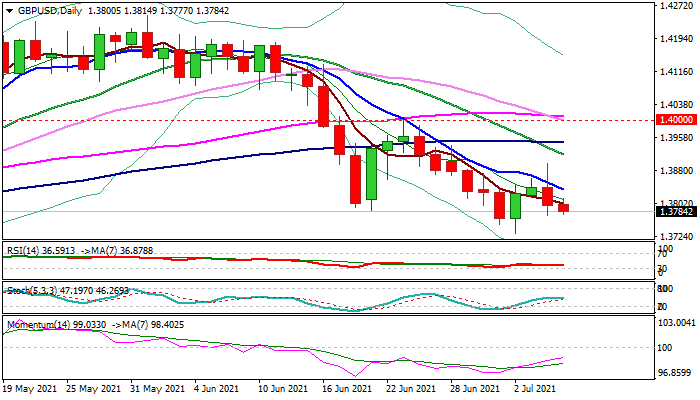

Cable stands at the back foot, weighed by Tuesday’s bearish daily candle with long upper shadow, formed after strong upside rejection on a false break of descending 10DMA and subsequent weakness. The action generated an initial signal of a bearish continuation pattern on a daily chart, which looks for more evidence to be confirmed.

Fresh bears need a daily close below 1.3770 pivots (Tuesday’s low/Fibo 76.4% of 1.3731/1.3897 recovery leg) to signal an end of the corrective phase. Read more…

The GBP/USD pair quickly reversed an early European session dip and climbed back above the 1.3800 mark, back closer to daily tops in the last hour.

The pair attracted some dip-buying near the 1.3775 region on Wednesday and for now, seems to have stalled the previous day’s sharp retracement slide from the vicinity of the 1.3900 mark. The UK Prime Minister Boris Johnson set out plans for the final step of lifting lockdown in the UK, which, in turn, was seen as a key factor that extended some support to the British pound. Apart from this, a subdued US dollar price action provided a modest lift to the GBP/USD pair. Read more…