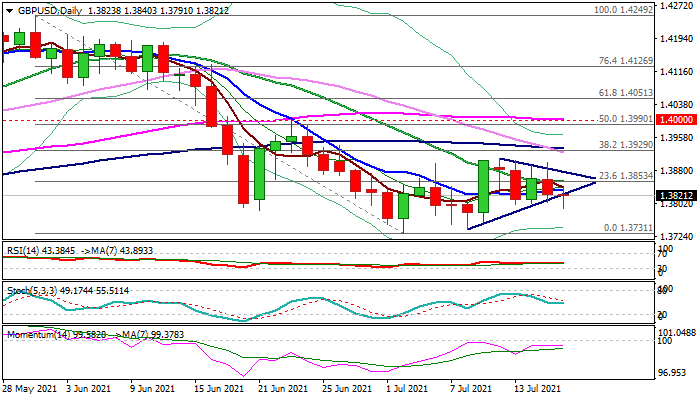

Cable probes below triangle support line in early Friday, after repeated rejections at the upper boundary of the pattern, signaled that bulls are lacking momentum, despite positive UK inflation data.

Fresh weakness is mainly driven by strength of the dollar on growing hopes that the Fed may start tightening earlier than expected.

Daily studies show fresh negative momentum and moving averages back to a bearish setup that supports a negative scenario, which requires close below the triangle, to signal an end of a corrective phase. Read more…

Pinging hell – Hundreds of thousands of Brits have received notifications saying “You need to self-isolate” due to exposure to someone tested positive for COVID-19. While some of these warnings may have been caused by Bluetooth signals passing through neighbors’ walls, the increase in pings serves as additional evidence that the coronavirus spreading rapidly. Under such conditions, it is hard to justify further gains for GBP/USD.

The Delta variant’s spread has resulted in over 48,000 confirmed cases in the UK on Thursday, days before the grand “Freedom Day” reopening on July 19. Hospitalizations and deaths are also on the rise, adding to concerns of an economic slowdown resulting from quarantines. Read more…

GBP/USD is trading above 1.38 as investors await Britain’s reopening on Monday. Selling opportunity? Risk-off mood could send sterling back down, according to FXStreet’s Analyst Yohay Elam.

“The Delta variant’s spread has resulted in over 48,000 confirmed cases in the UK on Thursday, days before the grand “Freedom Day” reopening on July 19. Hospitalizations and deaths are also on the rise, adding to concerns of an economic slowdown resulting from quarantines. Under such conditions, it is hard to justify further gains for GBP/USD.” Read more…