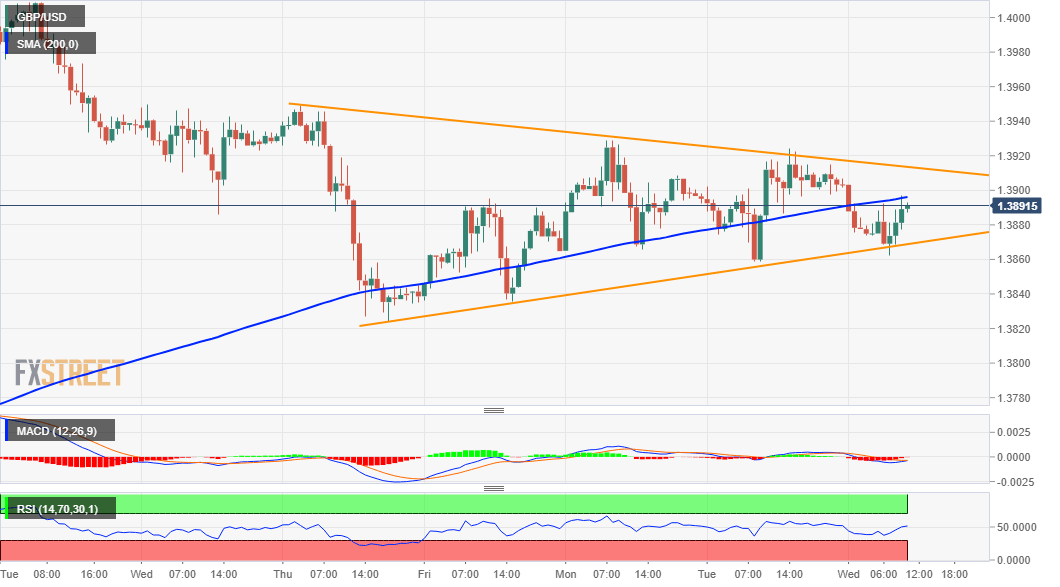

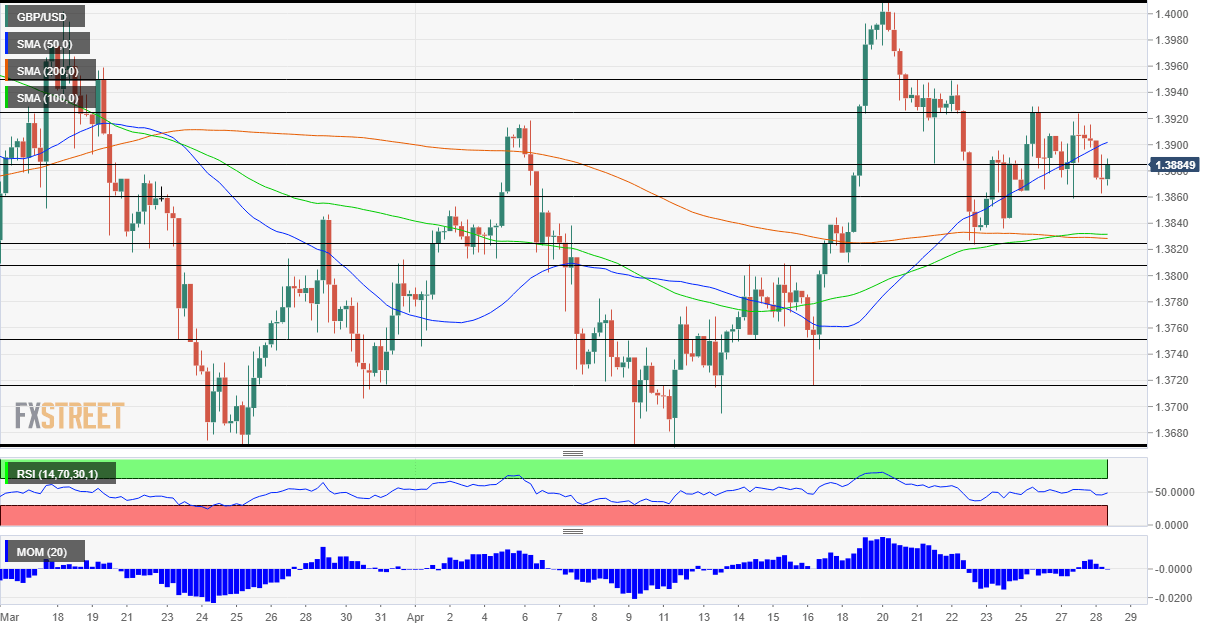

The GBP/USD pair has managed to recover around 25-30 pips from the early European session swing lows and was last seen trading with modest losses, just below the 1.3900 mark.

The US dollar found some support from some strong follow-through uptick in the US Treasury bond yields. On the other hand, the British pound was weighed down by the UK political turmoil amid the controversy on funding arrangement for Prime Minister Boris Johnson’s official apartment. That said, the optimism over the gradual reopening of the UK economy helped limit any deeper losses for the GBP/USD pair. Read more…

Brexit, vaccinations, spending plans even Prime Minister Boris Johnson’s scandals are all put on the sidelines – it is Fed Day. The US Federal Reserve is set to leave its policy unchanged but will have to acknowledge the improving economic environment in the US.

Since the bank’s March meeting, vaccines and a massive $1.9 trillion stimulus plan have triggered a boom that is reflected in robust hiring, a pickup in inflation, a near 10% increase in retail sales and steaming hot business surveys. Read more…

GBP/USD has been retreating from the highs as tension mounts ahead of the Fed decision. Will Powell propel the pound higher or pummel it? Taper talk is the key, Yohay Elam, an Analyst at FXStreet, reports. “The US Federal Reserve is set to leave its policy unchanged but will have to acknowledge the improving economic environment in the US.”

“Every month, the Fed creates $120 billion to purchase bonds on markets. Before raising short-term rates, the Washington-based institution would gradually reduce its purchases. Powell and his colleagues can kick off such a process by signaling they would lay out a plan for tapering in June. If the Fed unleashes such a hint, GBP/USD would fall sharply. Read more…