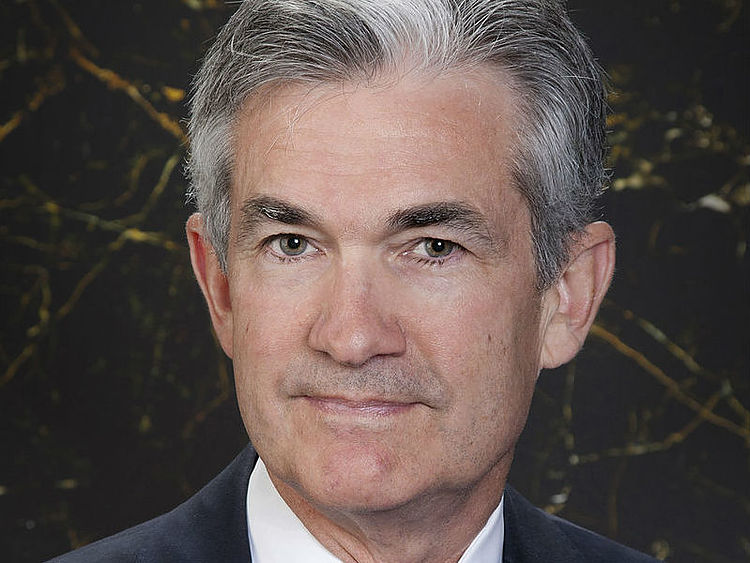

FOMC Chairman Jerome Powell is testifying before the Senate Banking, Housing, & Urban Affairs Committee on “the Semiannual Monetary Policy Report to the Congress.”

“Inflation is well above 2%.”

“Inflation is not tied to usual factors such as a tight labor market or tight economy.”

“This is a shock to the system associated with reopening.”

“Challenge Fed is confronting is how to react to this inflation which is larger than expected.”

“To the extent higher inflation is temporary it would not be appropriate to react to it.”

“Fed will continue to evaluate the risks that affect inflation.”

“Policy will be accommodative for quite a while.”

“This particular inflation is unique in history.”

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System’s principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.